[ad_1]

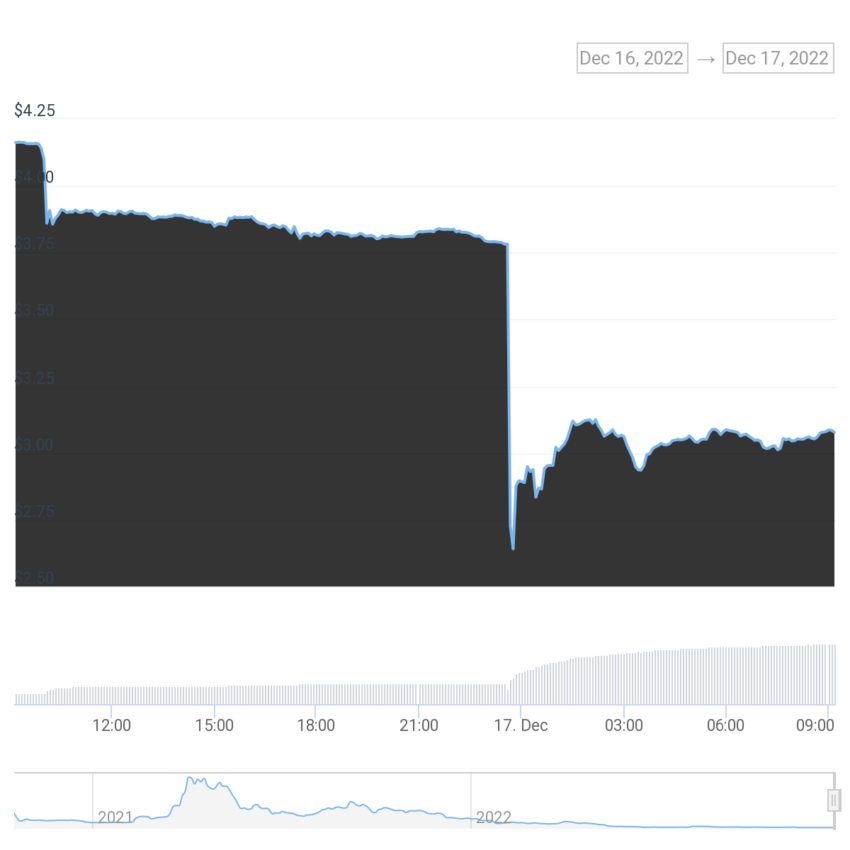

The crypto market skilled an enormous sell-off within the final 24 hours. Several belongings associated to Digital Currency Group (DCG) Grayscale’s funding merchandise, like NEAR, Filecoin, Ethereum Classic, and many others., shed a mean of over 10%, prompting fears that the agency was promoting.

According to Coingecko, the crypto market fell by 5.4% over the reporting to $838 billion. Data from Coinglass confirmed that $237.86 million was liquidated from the business. Bitcoin declined by 4.3% to $16,710, whereas Ethereum noticed 7.6% losses to commerce at $1,180 as of press time.

Altcoin’s Value Falter

In the final 24 hours, a number of DCG-related belongings, like Filecoin, Near, Ethereum Classic, Litecoin, Bitcoin Cash, and many others., all noticed losses. Binance-backed cash like BNB, Trust Wallet Token, and many others., additionally noticed substantial crimson candles. Other altcoins like Algorand, Cardano, Chainlink, Avalanche, and Solana noticed their values plummet quickly in the course of the sell-off.

While it was unclear why the belongings skilled a sudden sell-off in the course of the interval, the crypto market simply skilled one among its most turbulent weeks in latest recollections.

FTX founder Sam Bankman-Fried was arrested within the Bahamas on the orders of the United States authorities. SBF was later denied bail as a result of he was thought-about a flight danger.

The largest crypto change within the area, Binance, additionally skilled a surge in withdrawals following elevated fears over its reserves. BeinCrypto reported that the change skilled round $5 billion in withdrawals in the course of the top of the run.

Crypto Community Speculates DCG is Selling

Meanwhile, a number of crypto analysts have speculated that the present sell-off may very well be from Grayscale’s mum or dad firm, Digital Currency Group (DCG).

The co-founder of Reflexivity Research, Will Clemente, tweeted that many speculators ponder whether the promoting was derived from DCG itself. He added photos of the value efficiency of a few of these altcoins to buttress his level.

Crypto analyst Miles Deutscher opined that there was a robust chance that DCG was dumping. According to him, “bad news likely to come.”

Another analyst, Karl, said he “would not be surprised if this sell-off is a desperate attempt to liquidate what else they can before announcing bankruptcy soon.”

Community issues over DCG’s monetary standing have grown following latest occasions within the area. Its crypto lending agency Genesis not too long ago halted customer withdrawals following FTX’s collapse.

Meanwhile, the funding agency additionally revealed that it has a $2 billion legal responsibility, most of which is owed to Genesis. The fears have been additional heightened over the rising low cost Grayscale’s Bitcoin Trust (GBTC) shares have been buying and selling.

Disclaimer

BeInCrypto has reached out to firm or particular person concerned within the story to get an official assertion in regards to the latest developments, but it surely has but to listen to again.

[ad_2]

Source link