[ad_1]

The present Bitcoin cycle could be its “most challenging” one but if the drawdown on this on-chain metric is something to go by.

Total Amount Held By 1k-10k BTC Value Band Has Sharply Gone Down Recently

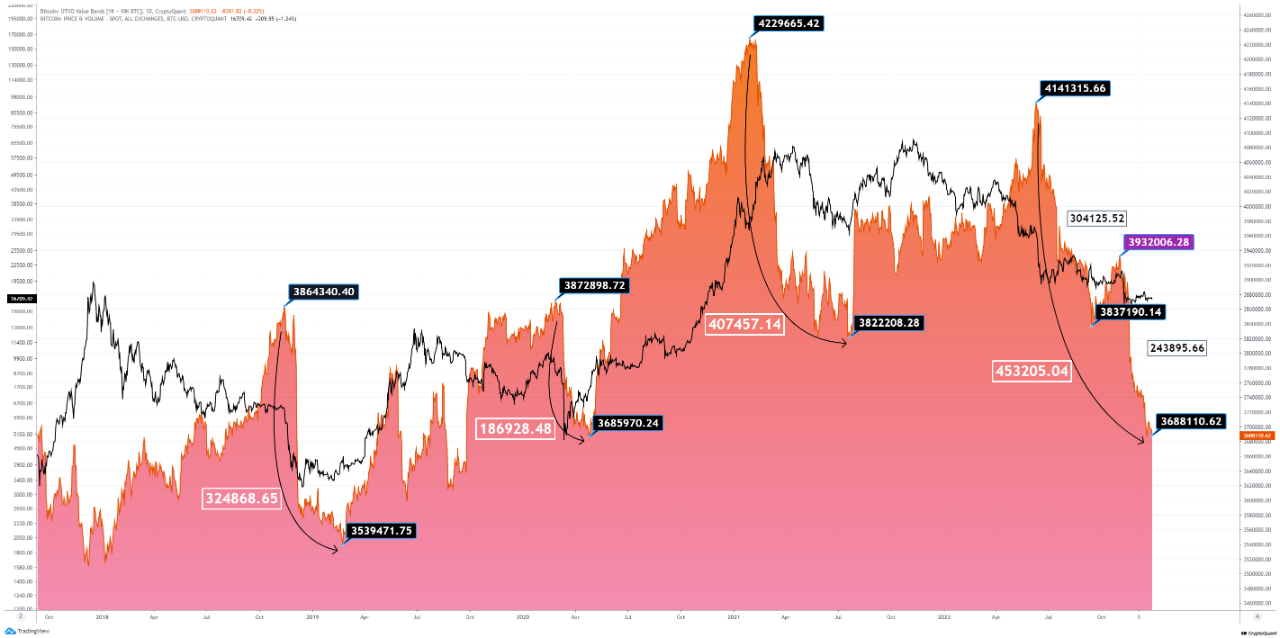

As identified by an analyst in a CryptoQuant post, the most recent drawdown within the holdings of the 1k-10k BTC worth band is probably the most drastic within the historical past of the crypto. The related indicator right here is the “UTXO Value Bands,” which tells us the whole quantity of cash every worth band is holding out there.

UTXOs are divided into these “value bands” or teams primarily based on their present worth. For occasion, the 100-1k BTC worth band consists of all UTXOs carrying between 100 and 1,000 cash. Here, the related UTXO worth band is the 1k-10k BTC vary, a traditionally essential cohort as often solely the whales have wallets with UTXO quantities so giant.

Now, the under chart shows the development within the complete holdings of this worth band over the past 5 years:

Looks like the worth of the metric has quickly declined in latest months | Source: CryptoQuant

The graph exhibits that the whole variety of cash held by this Bitcoin UTXO worth band has seen a pointy drop this yr. In all, the drawdown has amounted to 453,205.04 BTC being dumped by this cohort for the reason that peak noticed in June 2022.

For comparability, within the 2018/19 bear market, the 1k-10k BTC worth band noticed a complete drawdown of 324,868.65 BTC from the excessive. During the COVID black swan crash of 2020, the group additionally distributed a big quantity, shedding 186,928.48 from its holdings.

And within the bull run in the course of the first half of final yr, these whales decreased their holdings by 407,457.14 BTC between the height in February and the July backside. The newest drawdown within the metric’s worth is the sharpest that Bitcoin has seen but. Because of this truth, the quant exclaims the present cycle to be the “most challenging” one within the historical past of the asset up to now.

An fascinating sample can be seen within the chart; each time the 1k-10k BTC has completed with the distribution and began accumulating once more, Bitcoin has felt a bullish affect. “Generally, the market can only recover when this cohort has enough confidence to accumulate again,” explains the analyst. “And at the moment, we still not get any positive signals from this cohort.”

BTC Price

At the time of writing, Bitcoin’s price floats round $16,600, down 1% within the final week.

BTC appears to have gone down in the course of the previous day | Source: BTCUSD on TradingView

Featured picture from mana5280 on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link