[ad_1]

Key Takeaways

- Coinbase has introduced it is slicing 20% of its workforce, having lower 18% again in June

- The firm is buying and selling at a market cap of beneath $10 billion, down over 90% from the worth at which it went public at in April 2021

- CEO Brian Armstrong had offered 2% of his stake final October when the inventory traded at $63. Today, it is $38

- Armstrong warned of “more shoes to drop” within the crypto market

- Prices to this point this 12 months have headed upward off optimism that inflation is softening

Un oh. Coinbase at this time introduced that it is once more slicing out a considerable interval of its workforce. A weblog publish introduced the cuts Tuesday morning, which comprise one other 950 jobs. The firm had beforehand laid off 18% of its workforce in June. This implies that within the final six months, 35% of its employees have been made redundant.

“With perfect hindsight, looking back, we should have done more. The best you can do is react quickly once information becomes available, and that’s what we’re doing in this case” – CEO Brian Armstrong in an interview with CNBC.

Why are Coinbase enacting layoffs once more?

I wrote a deep dive on the state of the change in October, after it was revealed that CEO Armstong was promoting 2% of his stake. Coinbase was buying and selling at $63 that day. Today, it is at $38. If you thought Bitcoin was unhealthy, Coinbase has been worse. It is now down over 90% from the worth it went public at.

Its market cap is at present beneath $10 billion, having briefly been value $86 billion on its first day of buying and selling.

Coinbase has mentioned that the layoffs will cut back working prices by 25%, when thought of at the side of different restructuring. There might be a rise in working bills of between $149 million and $163 million for the primary quarter consequently of the cuts, nevertheless.

“It became clear that we would need to reduce expenses to increase our chances of doing well in every scenario”, Armstrong added, earlier than affirming that there was “no way” of doing this with out laying employees off, and including that a number of initiatives with a “lower probability of success” might be shut down.

Could issues worsen in crypto?

While crypto markets have gotten off to a hot start this 12 months due to optimistic macro and inflation information, Armstrong ominously warned that there is “still a lot of market fear” in crypto following the FTX collapse, and that there are possible “more shoes to drop” in terms of contagion spiralling by means of the business.

Of course, layoffs haven’t been restricted to the crypto market. Tech firms comparable to Amazon, Salesforce and Meta have lower 1000’s of employees over the previous few months. Tech is notoriously risky and with low income the usual, with valuations derived from the discounting again of future promise, high-interest charges have punished the sector.

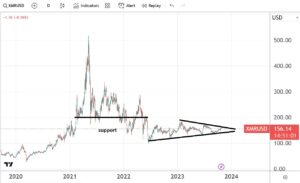

But Coinbase have made errors. An obvious lack of danger administration with regard to the Bitcoin value, given how correlated the corporate’s fortunes are to the crypto market, has price them. A fast look at the above chart reveals that the Bitcoin value and Coinbase inventory very a lot transfer in tandem.

The authentic spherical of layoffs in June got here solely 4 months after the corporate spent $14 million on a Superbowl industrial, which looking back signalled the highest of the crypto market fairly poignantly. FTX and Crypto.com additionally spent hundreds of thousands for infamous adverts within the huge sport. Armstrong additionally admitted at the primary spherical of layoffs that the corporate had expanded too shortly.

What subsequent for crypto?

For crypto, this information in isolation doesn’t imply a lot. It is merely an anecdote which underlines the size of the injury this previous 12 months. Coinbase was the bellwether for the business, the primary excessive profile crypto firm to go public, at a time when most anticipated a slew of firms to observe.

But the market has remodeled fully. And for it to bounce again, there is no different option to put it: the macro local weather must ease up such that the tightening rate of interest local weather may be loosened up. Crypto trades like a excessive danger asset, and therefore the free financial coverage and basement-level rates of interest of the previous decade have propelled it boisterously.

That is now over. But with inflation seeming to melt to open the 12 months, hope is renewed that the Federal Reserve might transfer again to even a “normal” financial local weather ahead of initially anticipated. Then, and solely then, can crypto traders start to consider heading vertically on charts.

For now, it is a wait-and-see strategy, with the following all-important inflation information within the US out Thursday.

[ad_2]

Source link