[ad_1]

On-chain information exhibits 13% extra of the Bitcoin provide has gone again into the inexperienced as BTC has damaged previous the $18,200 stage right now.

Bitcoin Percent Supply In Profit Has Grown To 60.5% Now

According to information from the on-chain analytics agency Glassnode, the provision in revenue was under 50% not too way back. The “percent supply in profit” is an indicator that measures the share of the entire circulating Bitcoin provide that’s carrying some quantity of revenue proper now.

The metric works by going by means of the on-chain historical past of every coin in circulation to see what worth it was final traded at. If this earlier worth for any coin was lower than the present worth of BTC, then that exact coin is holding some revenue in the meanwhile, and the indicator accounts for it within the information.

The greater the worth of the provision in revenue, the upper the variety of buyers that turn out to be prone to promote at any level. This is why tops have coincided with very excessive values of the indicator prior to now.

The counterpart metric of the provision in revenue is the “supply in loss,” which naturally measures the alternative sort of provide. Its worth can merely be calculated by subtracting the p.c provide in revenue from 100.

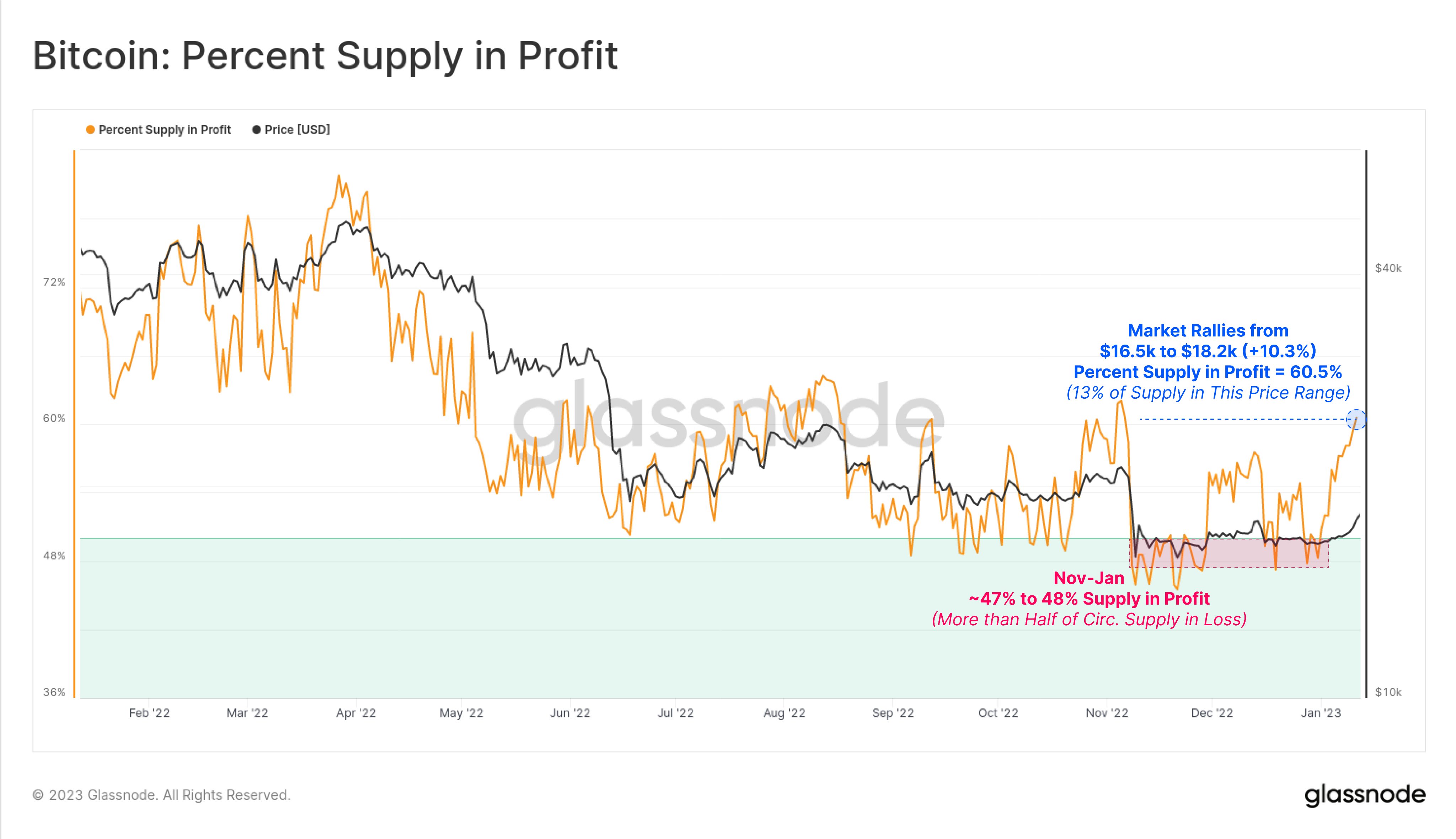

Now, here’s a chart that exhibits the development within the Bitcoin p.c provide in revenue over the previous 12 months:

The worth of the metric appears to have seen a rise in latest days | Source: Glassnode on Twitter

As displayed within the above graph, the Bitcoin p.c provide in revenue had dropped to only 47% between November final 12 months and the beginning of 2023. This implies that a majority of the circulating provide had entered right into a state of loss throughout this era.

Historically, cyclical lows within the worth of the crypto have often fashioned with a majority of buyers going underwater like this (though earlier bear markets noticed even greater provide recording losses than within the final couple of months).

This is as a result of promoting stress begins getting exhausted at these ranges and the ultimate backside is created because the holders within the purple capitulate and switch their cash to stronger arms. A transition in direction of bullish momentum then takes place on the again of accumulation from these stronger arms.

Recently, as Bitcoin has been rallying, the p.c provide in revenue has surged and hit a price of 60.5%. This implies that 13% extra provide has now come again right into a state of revenue as in comparison with the lows within the final two months.

Glassnode notes that this implies recent shopping for certainly came about whereas BTC noticed its latest lows because the solely cash that may probably be in revenue proper now are these acquired within the $16,500-$18,200 vary.

BTC Price

At the time of writing, Bitcoin is buying and selling round $18,200, up 8% within the final week.

Looks like BTC has seen some sharp upwards momentum lately | Source: BTCUSD on TradingView

Featured picture from Traxer on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link