[ad_1]

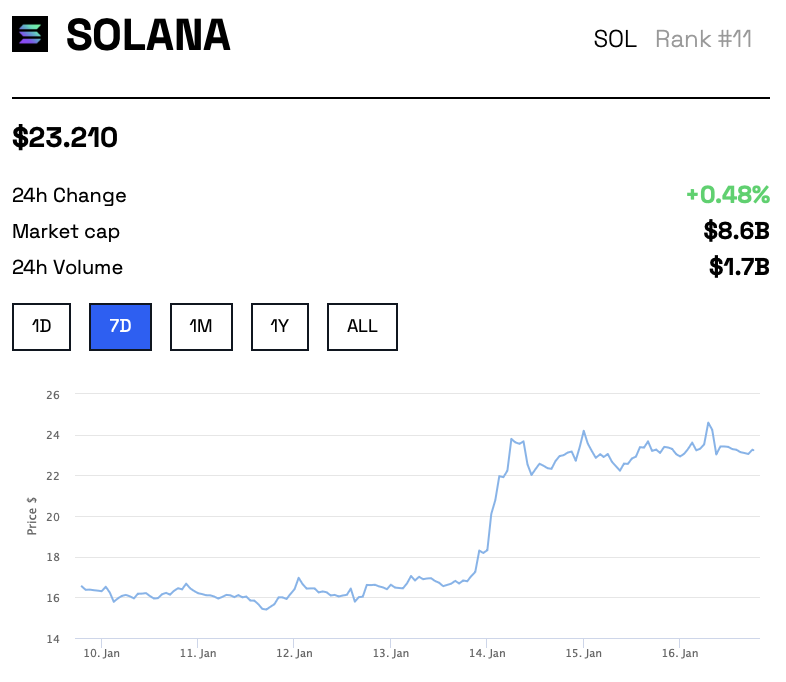

(*10*) flipped Polygon on January 15 to be the tenth largest crypto asset by market cap, following a seven-day rally that noticed it rise by over 70%, in keeping with CoinMarketCap information.

Following FTX’s collapse in November, SOL’s value efficiency was negatively impacted due to its relationship with Sam Bankman-Fried. However, constructive sentiments appeared to have returned to the digital asset, because it has gained roughly 135% since the begin of this 12 months -making it certainly one of the best-performing cryptocurrencies in 2023.

SOL Re-Enters Top 10 Assets

At the peak of the FUD, Solana traded for as little as $9, and two of its prime NFT tasks ditched it for different blockchain networks.

But its huge value efficiency over the final two weeks has greater than doubled its worth to $23.34 as of press time. The spectacular run additionally noticed it re-enter the prime 10 digital belongings by market cap.

According to CoinMarketcap information, Solana’s market cap rose to over $9 billion in the final seven days from $5 billion.

The co-founder of a gaming challenge on Solana, Mamba, said the religion of the community believers had been repaid as SOL gained 165% in 15 days. According to Mamba, SBF leaving was good for the blockchain, and the community’s know-how is bettering.

Solana Active Wallets Rises 3x

Solana’s energetic wallet has risen by greater than thrice since FTX collapsed in November, in keeping with Messari data. Delphi Digital data additionally reveals that decentralized exchanges on Solana DEXs have seen an 83% enhance in complete energetic wallets since the starting of 2023.

According to Delphi Digital, the complete variety of energetic wallets on Solana elevated to 83,000 from nearly 45,000 per day.

As BeinCrypto beforehand reported, Solana’s elevated energetic pockets numbers coincided with the rise of a brand new memecoin, Bonk Inu, inside its ecosystem. The memecoin rallied by over 130%, bringing again curiosity into the ecosystem. However, it has since crashed by over 38% in the final seven days.

Disclaimer

BeInCrypto has reached out to firm or particular person concerned in the story to get an official assertion about the latest developments, however it has but to listen to again.

[ad_2]

Source link