[ad_1]

The correlation between the S&P 500 and Bitcoin is barely rising, inching nearer to reaching ranges the place previously the cryptocurrency strengthened.

Meanwhile, the S&P 500 simply closed its January month-to-month session outdoors of a key pattern line your complete world of finance has been watching. Here is why a attainable breakout within the inventory market may propel BTC increased together with it in an ideal storm state of affairs.

The Stock Market Closes Monthly Candle Above Key Trend Line

The S&P 500 index is usually thought of one of the best measure of the general well being of the US inventory market, and not directly, the economic system. It’s used as a benchmark to match the alpha and beta of different property and particular person shares.

Positive efficiency within the SPX is related to intervals of prosperity and profitability. If the inventory market is doing nicely, it’s a sign for buyers to modify to risk-on methods.

The S&P 500 might be breaking out of a year-long sample | SPX on TradingView.com

The S&P 500 is probably breaking out of the higher boundary of a long-term buying and selling sample: a descending broadening wedge. Price is holding above the sample on the day by day timeframe by the January month-to-month that simply got here to an in depth.

And whereas additional upside would bode well for cryptocurrencies by default, rising correlation between BTCUSD and the SPX is what makes a attainable breakout within the inventory market that rather more bullish for Bitcoin.

Bitcoin Correlation With S&P 500 Index Increases

The chart above exhibits the breakout in motion within the day by day and month-to-month timeframe within the S&P 500. Bitcoin worth is moments away from closing its January month-to-month candle with greater than 40% ROI. Other cryptocurrencies have significantly outperformed during the month.

Both BTCUSD and SPX rising in tandem this month has restored the rising course of the correlation between the 2 vastly completely different funding automobiles.

The correlation with the inventory market is barely rising | BTCUSD on TradingView.com

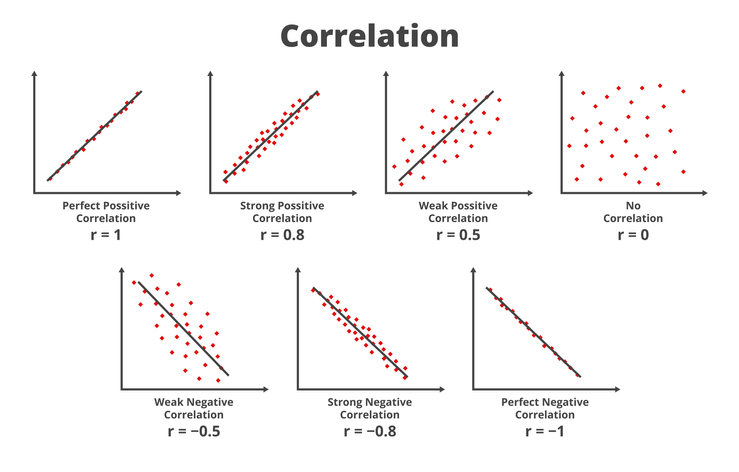

With a correlation coefficient of 0.88, the SPX and BTCUSD are at a number of the strongest constructive correlations traditionally. Past bear markets in crypto have switched Bitcoin into unfavourable correlation territory. This time, nevertheless, has been completely different.

An rising correlation has previously been related to a few of Bitcoin’s most explosive bullish strikes to the upside – particularly after reaching a correlation of 0.93. With the correlation probably rising and a attainable breakout within the SPX, may there be an ideal storm brewing for the highest cryptocurrency by market cap?

[ad_2]

Source link