[ad_1]

On-chain information reveals Bitcoin long-term holders now maintain 78% of the full circulating provide, the best worth the metric has ever seen.

Bitcoin Long-Term Holders Are Sitting On 78% Of The Total Supply

As identified by an analyst on Twitter, the divergence between the long-term holders and the short-term holders is at its biggest proper now. The long-term holders (LTHs) and the short-term holders (STHs) are the 2 primary holder teams that the complete Bitcoin market may be divided into.

The STHs embody all buyers that purchased their cash inside the final six months, whereas the LTHs embody those that acquired their BTC sooner than this threshold quantity.

Statistically, the longer buyers maintain onto their coin, the much less doubtless they turn out to be to promote at any level. Thus, the LTHs tend to maintain their cash dormant for longer intervals than the STHs. Because of this motive, the LTHs are additionally also known as the “diamond hands” of the Bitcoin market.

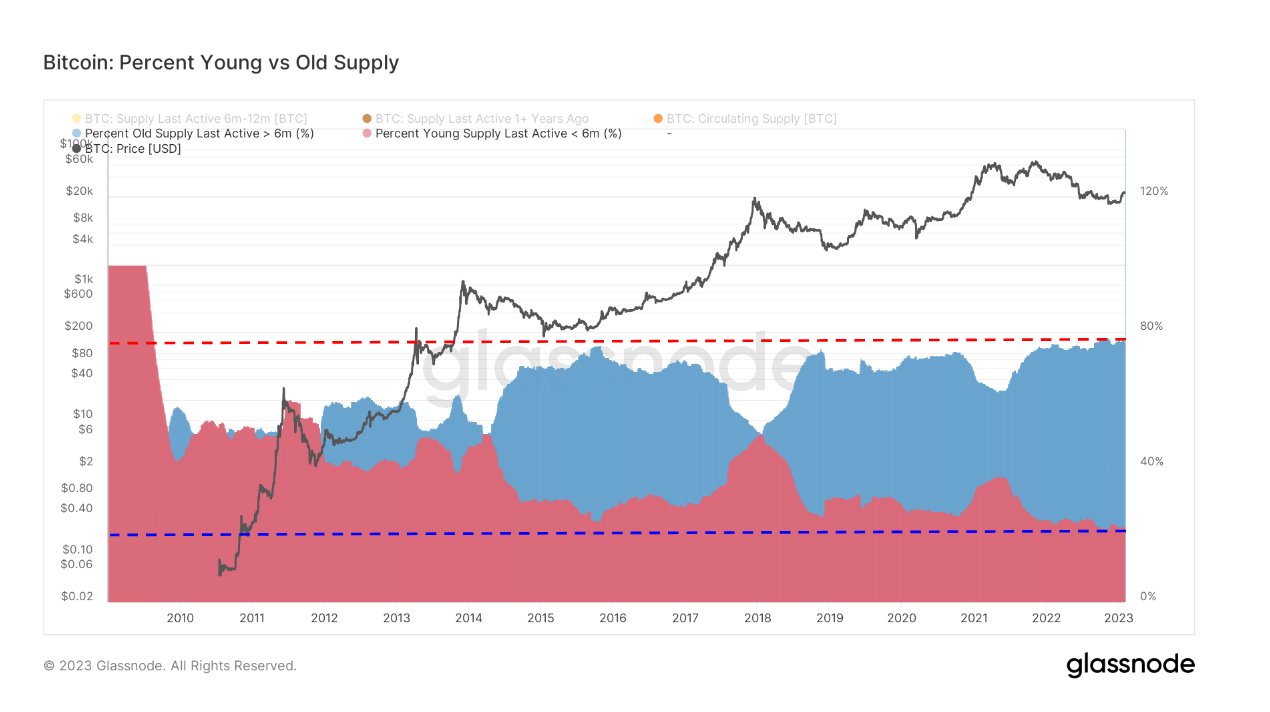

Now, the related indicator right here is the “percent young vs old supply,” which measures what proportion of the full circulating BTC provide is presently being held by the STHs (the “young” provide) and what’s being held by the LTHs (the “old” provide).

Here is a chart that reveals the pattern on this Bitcoin metric over the complete historical past of the cryptocurrency:

The two provides appear to have diverged away from one another in latest months | Source: Glassnode on Twitter

As proven within the above graph, the proportion of the full Bitcoin provide held by the LTHs has solely continued to go up for a few years now, suggesting that there was a rising shift in the direction of a HODLing mentality amongst the buyers available in the market.

While this has occurred, the proportion contributed by the STH provide has naturally shrunk, as its worth is solely calculated by subtracting the LTH p.c provide from 100.

One latest temporary decline was noticed following the collapse of the crypto exchange FTX, which suggests the crash was capable of shake even the strongest fingers available in the market. However, it wasn’t lengthy till holders regained focus and the availability as soon as once more began climbing up.

After this newest accumulation by the cohort, the proportion of the availability held by them has reached a worth of 78%. The STHs make up for the remaining 22% of the availability.

From the chart, it’s obvious that this divergence between the 2 Bitcoin provides is on the greatest-ever degree in the meanwhile. This implies that promoting stress from a lot of the provide must be the least ever now, as it’s prone to stay dormant for prolonged intervals with the LTHs.

Such a provide shock available in the market may be bullish for the worth of Bitcoin in the long run.

BTC Price

At the time of writing, Bitcoin is buying and selling round $23,500, up 2% within the final week.

Looks like BTC has continued to consolidate in the previous couple of days | Source: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link