[ad_1]

Data exhibits Bitcoin funding charges have turned damaging not too long ago, suggesting that shorts are accumulating available on the market. Will a squeeze observe?

Bitcoin Funding Rates Are At Their Most Negative Since December 2022

As an analyst in a CryptoQuant post identified, the market sentiment is at present turning bearish. The related indicator right here is the “funding rate,” which measures the periodic charge that lengthy and quick merchants on the futures market are at present exchanging with one another.

When the worth of this metric is constructive, it means lengthy holders are at present paying a premium to the quick holders to maintain their positions. Such a development suggests nearly all of merchants are bullish proper now.

On the opposite hand, the indicator’s damaging worth implies the shorts pay the charge. Naturally, it is a signal that traders are at present bearish.

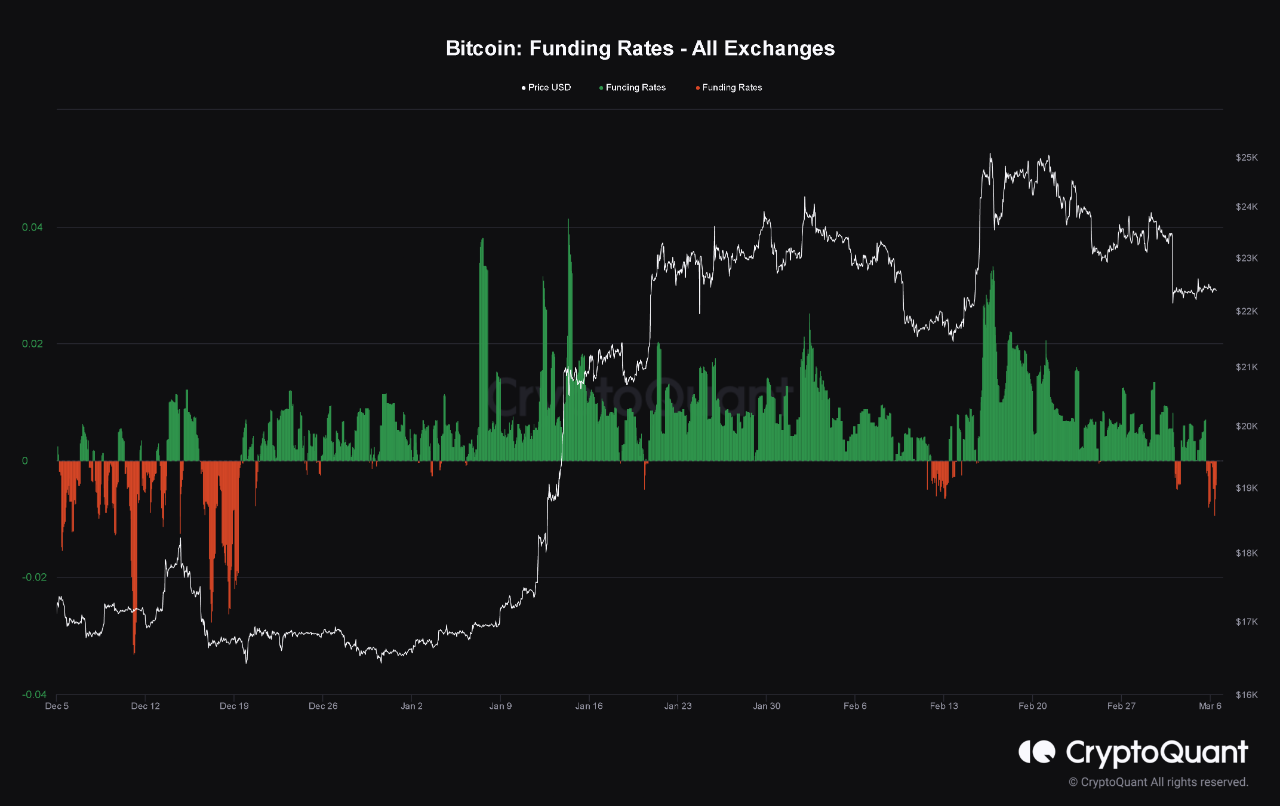

Now, here’s a chart that shows the development within the Bitcoin funding charges over the previous few months:

Looks like the worth of the metric has been fairly damaging in current days | Source: CryptoQuant

The above graph exhibits that the Bitcoin funding fee has normally had a constructive worth throughout the previous few months. This means that because the rally within the asset value has taken place, traders within the futures market have turned bullish as they’re betting on larger and better costs.

However, there have been a couple of situations the place the indicator’s worth turned crimson. A notable instance was in the course of the first half of February when the rally stopped, and the worth plunged.

In these native lows in the midst of the rally, the funding charges had turn into damaging, implying that holders had began believing that the worth rise had ended and can be all downhill.

The lower, nevertheless, turned out to solely be non permanent, and the worth shot again up. As a results of this sudden motion within the value, the shorts that had amassed available in the market have been worn out in a liquidation squeeze fueling the worth larger.

A “liquidation squeeze” is when a sudden value swing flushes many positions concurrently. These liquidations, in flip, solely gas additional the worth transfer that precipitated them, which then causes much more liquidations, and so forth. In this manner, mass liquidations can cascade collectively throughout a squeeze.

In this case, because the squeeze concerned quick holders, it was an instance of a “short squeeze.” There have been two different situations of the funding fee turning damaging throughout this rally, and each coincided with native flooring within the value, suggesting that the liquidations could have helped the worth in every case.

Recently, the funding charges have turned damaging as soon as once more. This time the values are even deeper than any of the situations above, and the present ranges of the indicator are probably the most damaging since December 2022.

Whether these shorts gathered available in the market will get squeezed this time or if the present funding charges replicate an actual market mindset change for Bitcoin stays to be seen.

BTC Price

At the time of writing, Bitcoin is buying and selling round $22,500, down 4% within the final week.

BTC strikes sideways | Source: BTCUSD on TradingView

Featured picture from Dmitry Demidko on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link