[ad_1]

On-chain knowledge exhibits round 2.7 million extra cash have entered a state of revenue following Bitcoin’s bounce above the $25,000 degree.

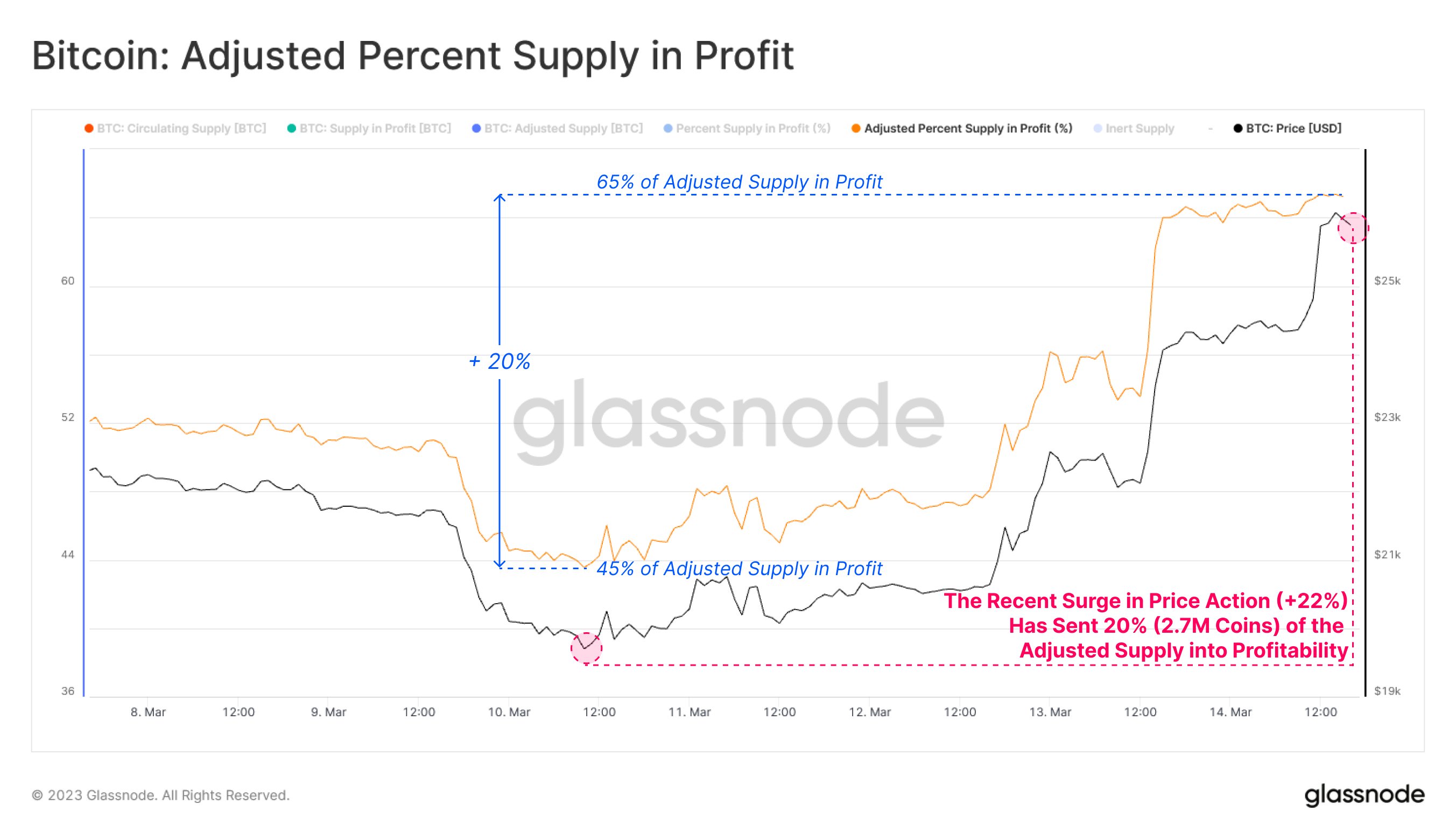

65% Of The Adjusted Bitcoin Supply Is Now In The Green

According to knowledge from the on-chain analytics agency Glassnode, a further 20% of the adjusted provide is now having fun with income. The related indicator right here is the “percent supply in profit.” As its identify already implies, it measures the proportion of the full circulating Bitcoin provide at the moment holding unrealized good points.

The metric works by going by means of the on-chain historical past of every coin within the circulating provide to verify what value it was final moved at. If this earlier worth for any coin was lower than the most recent Bitcoin value, then that coin is counted below the provision in revenue.

There is an issue with this indicator, nevertheless, and it’s that a considerable amount of dormant provide has been misplaced as a result of the wallets that retailer mentioned cash are now not accessible.

This outdated provide was final moved at very low costs in comparison with the BTC worth at present, so it’s technically holding huge unrealized profit. But as these cash are misplaced, they’re primarily out of the circulating provide and will thus not affect the present market.

Because of this motive, the provision in revenue indicator can step by step change into inaccurate in comparison with the precise image. To mitigate this subject, Glassnode has provide you with the “adjusted percent supply in profit” metric, a modified model of the unique indicator that filters out the information of all cash older than 7 years.

Now, here’s a chart that exhibits how the worth of this Bitcoin indicator has modified through the previous week:

Looks like the worth of the metric has noticed some rise in current days | Source: Glassnode on Twitter

As displayed within the above graph, the Bitcoin adjusted p.c provide in revenue was round a price of 45% only a few days in the past when the value was floating across the $20,000 degree. This signifies that 45% of the provision youthful than 7 years had some good points at that time.

Since then, BTC has loved some sharp upwards momentum and has even damaged above the $26,000 mark briefly earlier than seeing a pullback to the present $25,000 degree.

As a results of this fast development, the adjusted provide in revenue has additionally seen a giant bounce to about 65%, which means that 20% of the adjusted provide or 2.7 million cash have entered right into a state of revenue now.

A pure implication is that buyers acquired 20% of the adjusted provide at costs within the $20,000 to $26,000 vary.

BTC Price

At the time of writing, Bitcoin is buying and selling round $25,100, up 13% prior to now week.

The value of the asset appears to have seen some pullback because the excessive earlier at present | Source: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link