[ad_1]

On-chain knowledge reveals the Bitcoin profit-taking quantity has shot up after the cryptocurrency’s value briefly broke above the $27,000 stage.

Bitcoin Observes 2.4 Times As Many Profit Transfers As Loss Ones

According to knowledge from the on-chain analytics agency Santiment, this profit-taking stage has not been seen since December 2020. The related indicator right here is the “ratio of daily on-chain transaction volume in profit to loss,” As its title already suggests, it measures the ratio between the Bitcoin quantity of profit-taking transactions and that of loss-taking ones.

This metric tells us whether or not there’s extra revenue harvesting available in the market than loss realization or not proper now. The indicator has a constructive worth if the revenue quantity is increased. Otherwise, it’s destructive.

The indicator works by going via the on-chain historical past of every coin being offered/transferred to see the worth at which it was final moved. If this earlier promoting value for any coin was lower than the BTC worth proper now, then this explicit coin moved at a revenue, and thus, its transaction is counted below the revenue quantity. Similarly, if the final value exceeds the newest worth, the coin’s sale contributes to the misplaced quantity.

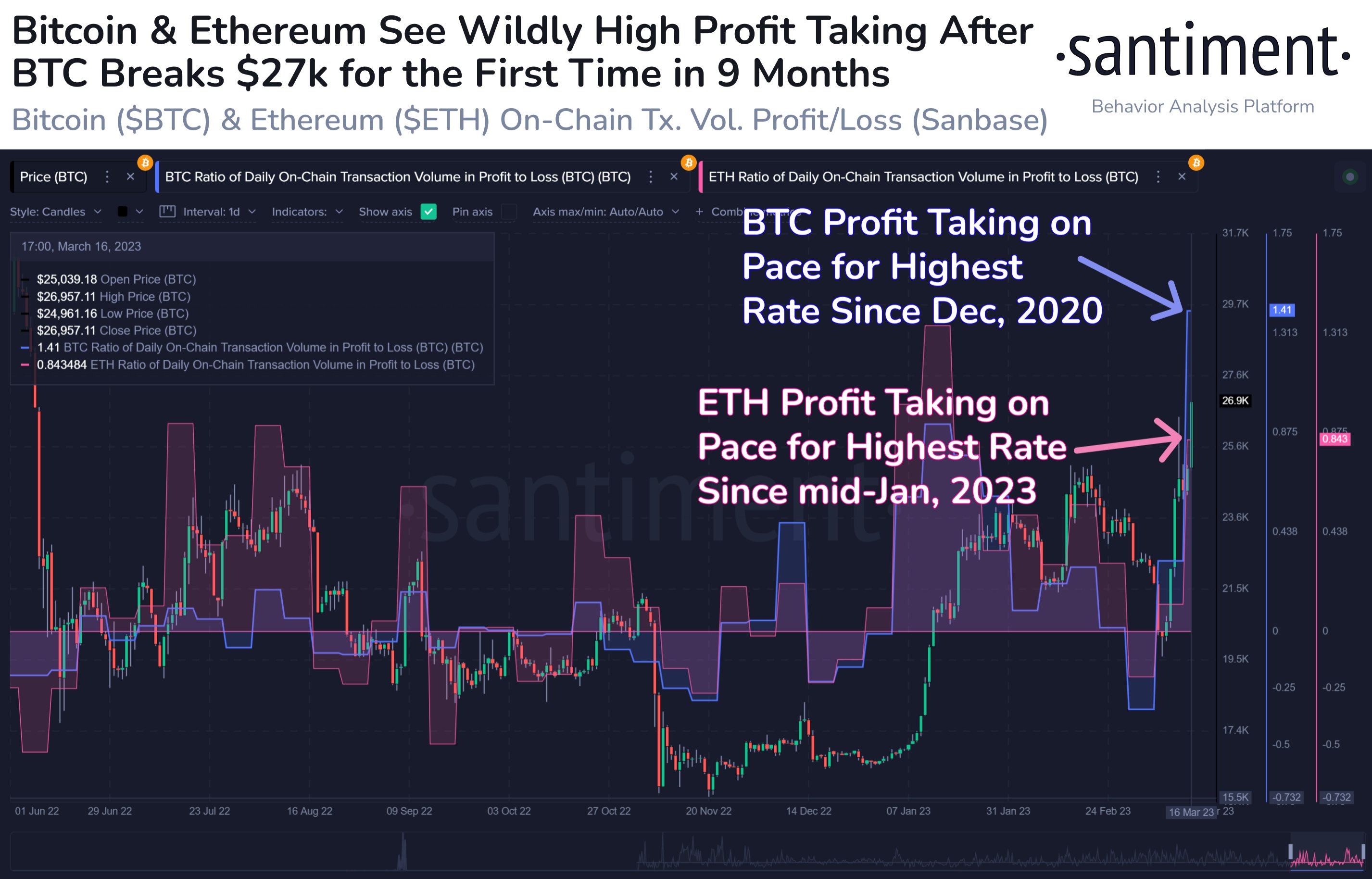

Now, here’s a chart that reveals the pattern within the ratio of day by day on-chain transaction quantity in revenue to a loss for Bitcoin, in addition to for Ethereum, over the previous 12 months:

The values of the 2 metrics appear to have been comparatively excessive in current days | Source: Santiment on Twitter

The above graph reveals that the Bitcoin profit-to-loss quantity ratio has been totally elevated in the previous few days. With the latest surge within the value above the $27,000 stage (which solely lasted briefly earlier than the coin fell again below the mark), the indicator has seen an excellent sharper spike.

In this surge, the metric has attained a price of about 1.4, suggesting that the profit-taking transaction quantity is round 2.4 occasions greater than the loss-taking one. This indicator stage is the very best since December 2020, when the 2021 bull run was in its preliminary phases.

This high-profit quantity would counsel that buyers concern drops proper now, and therefore, they rushed to reap some income as quickly as the worth broke above the $27,000 stage. The promoting strain from these profit-takers was doubtless behind the pullback to the $26,000 stage.

The chart reveals that Ethereum’s profit-taking quantity has additionally risen considerably in the previous few days. Still, the cryptocurrency is barely observing the very best worth of the indicator because the center of 2023, and solely a bit additional again than is the case for Bitcoin.

BTC Price

At the time of writing, Bitcoin is buying and selling round $26,800, up 34% within the final week.

It appears to be like like the worth of the asset has shot up over the previous 24 hours | Source: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.web

[ad_2]

Source link