[ad_1]

Data reveals that Bitcoin transactions have grown in quantity lately, however change deposit and withdrawal transfers have solely moved sideways.

Bitcoin Transaction Count Has Observed A Sharp Increase Recently

According to information from the on-chain analytics agency Glassnode, the BTC blockchain exercise has considerably gone up lately. The indicator of curiosity right here is the “transaction count,” which measures the entire variety of Bitcoin transactions happening on the community proper now.

When the worth of this metric is excessive, it means the chain is seeing a excessive quantity of utilization from the holders. This sort of pattern suggests merchants are energetic out there proper now.

On the opposite hand, low values of the indicator recommend the BTC blockchain is seeing low exercise at the moment. Such a pattern generally is a signal that the overall curiosity within the asset is low amongst buyers in the intervening time.

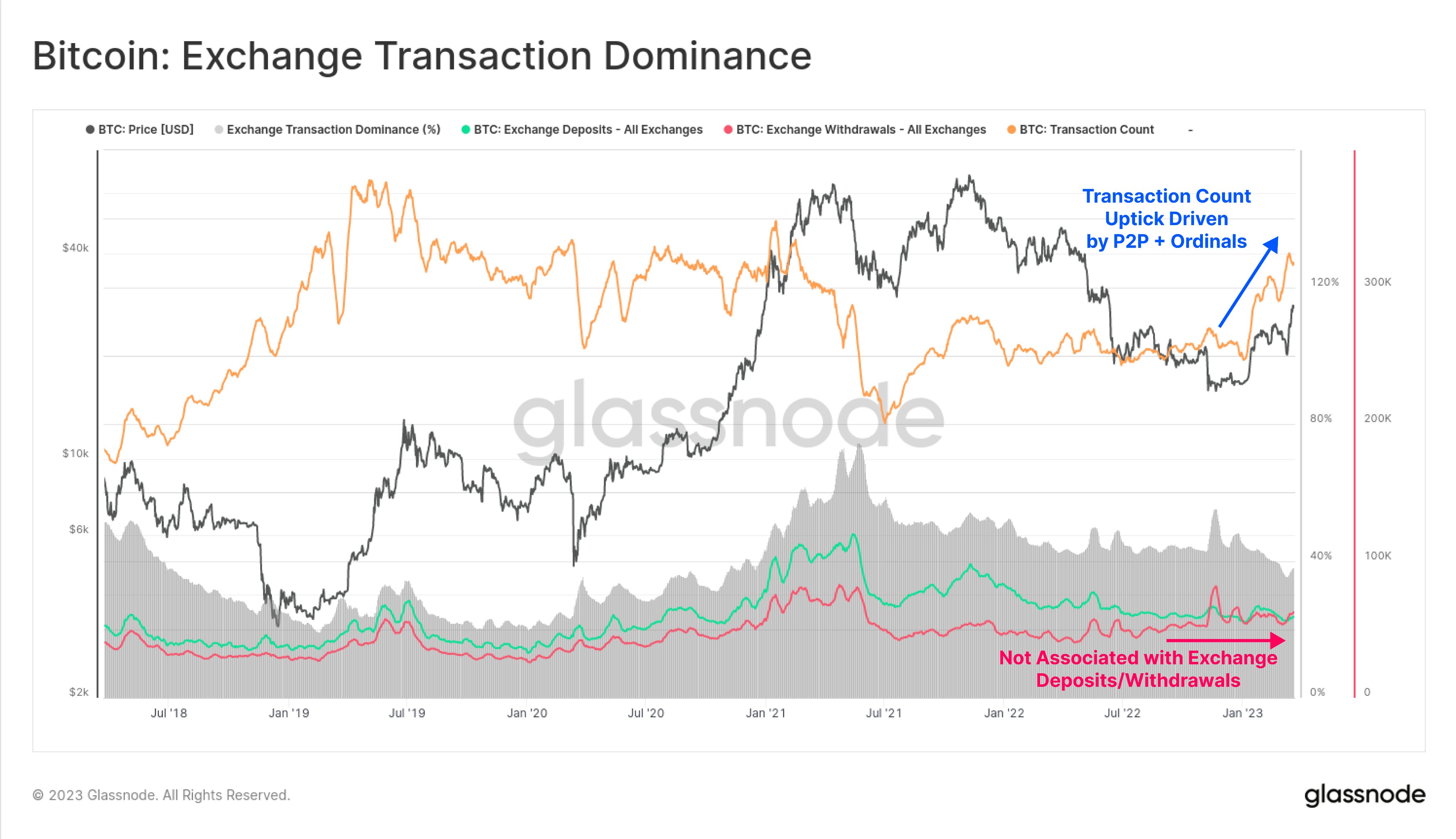

Now, here’s a chart that reveals the pattern within the Bitcoin transaction rely over the previous few years:

The worth of the metric appears to have seen a pointy rise in current weeks | Source: Glassnode on Twitter

As proven within the above graph, the Bitcoin transaction rely had gone stale after the plunge the place the cryptocurrency had descended from the bull rally prime. This pattern remained true all through the bear market till the rally began this yr.

With this contemporary worth surge, the indicator has shot up and has hit ranges that have been solely final seen in the course of the bull run within the first half of 2021. This implies that the variety of transfers happening on the chain proper now’s the very best in about two years.

The chart additionally reveals information for 2 different indicators, the Bitcoin change deposits and change withdrawals. As the names of those metrics already suggest, they inform us concerning the complete quantity of transfers going out and in of exchanges, respectively.

These metrics are to not be confused with the influx and outflow indicators, because the latter ones measure the entire variety of cash flowing into and out of exchanges, reasonably than the transaction rely.

From the graph, it’s seen that regardless of the spike within the Bitcoin transaction rely, these two metrics have continued to maneuver sideways. This implies that the rise in transfers has virtually solely come from the peer-to-peer (P2P) facet and never exchanges.

This is not like what was seen in the course of the April 2019 rally and 2021 bull run, the place the exchange-related transactions additionally noticed at the least some rise together with the worth enhance.

Since the Ordinals protocol, a way of inscribing information instantly into the Bitcoin blockchain (mainly the BTC model NFTs), has additionally seen emergence in the course of the current months, a part of the rise within the transaction rely is probably going pushed by such transfers made utilizing this protocol.

BTC Price

At the time of writing, Bitcoin is buying and selling round $28,200, up 14% within the final week.

BTC hasn't moved a lot lately | Source: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link