[ad_1]

The U.S. Federal Reserve is anticipated to lift the fed funds price by 25bps to 4.75%-5% in the course of the FOMC assembly on Wednesday. It would be the second consecutive 25bps rate hike, pushing borrowing prices to new highs since 2007. Traders anticipate an additional improve in Bitcoin and Ethereum costs as a result of banking disaster.

Billionaires Elon Musk and Bill Ackman, economists, and buyers imagine the central financial institution ought to pause the financial tightening to deliver monetary stability after the collapse of three US banks and the takeover of Credit Suisse. Investors should preserve an in depth watch on new financial forecasts and dot plot doable additional price hikes this 12 months.

On-Chain Data Indicating Potential Correction in Bitcoin Price

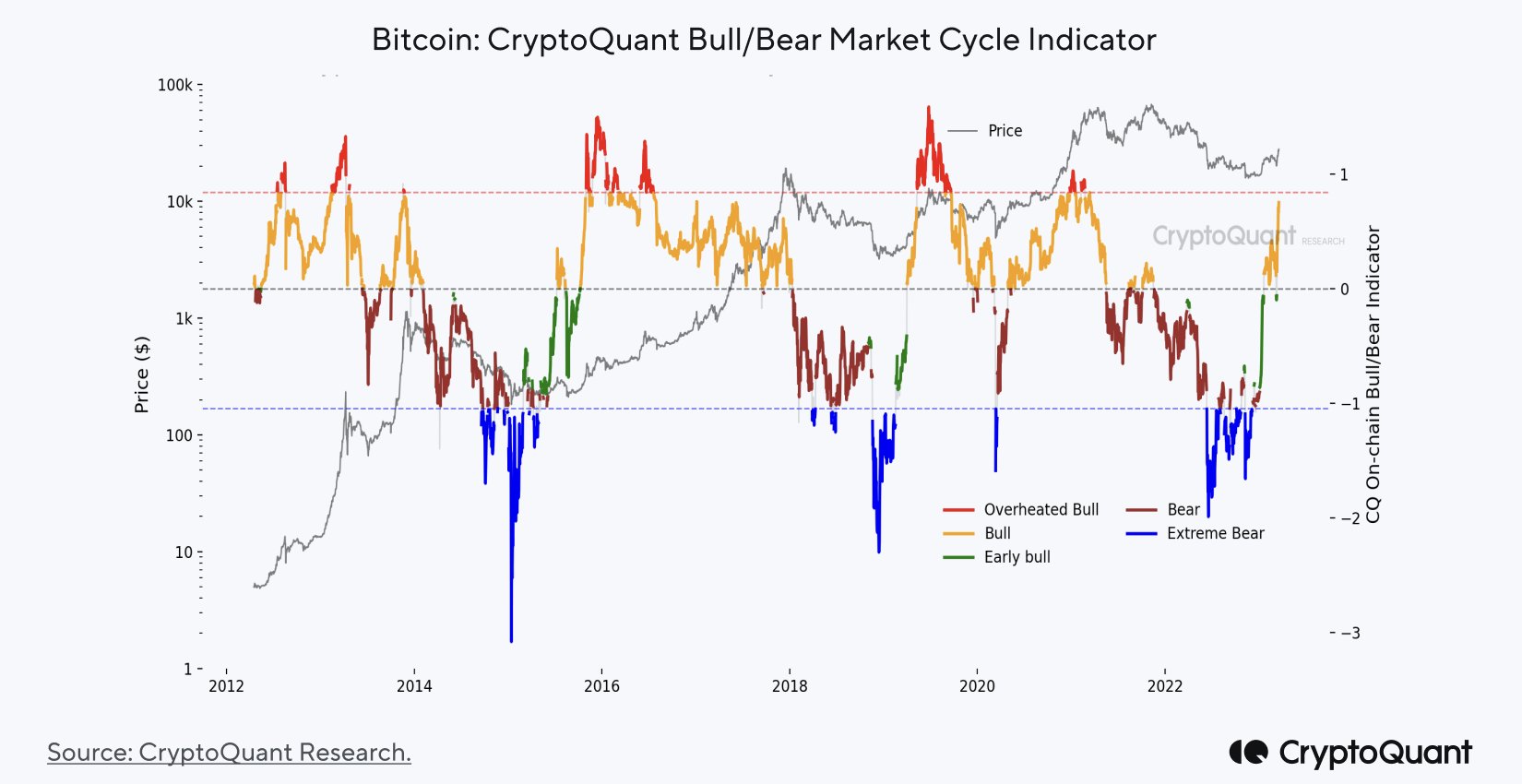

Bitcoin is within the early bull market cycle and the latest rally above $28,000 clearly proves it. Moreover, on-chain indicators akin to CryptoQuant’s On-chain P&L Index and inter-exchange flows indicated a bullish Bitcoin narrative.

The Bitcoin Bull/Bear Market Cycle metric signifies a chance of a value correction because it reaches close to the Overheated Bull space. Thus, buyers should train warning as a result of sudden improve in Bitcoin value in a significantly quick interval.

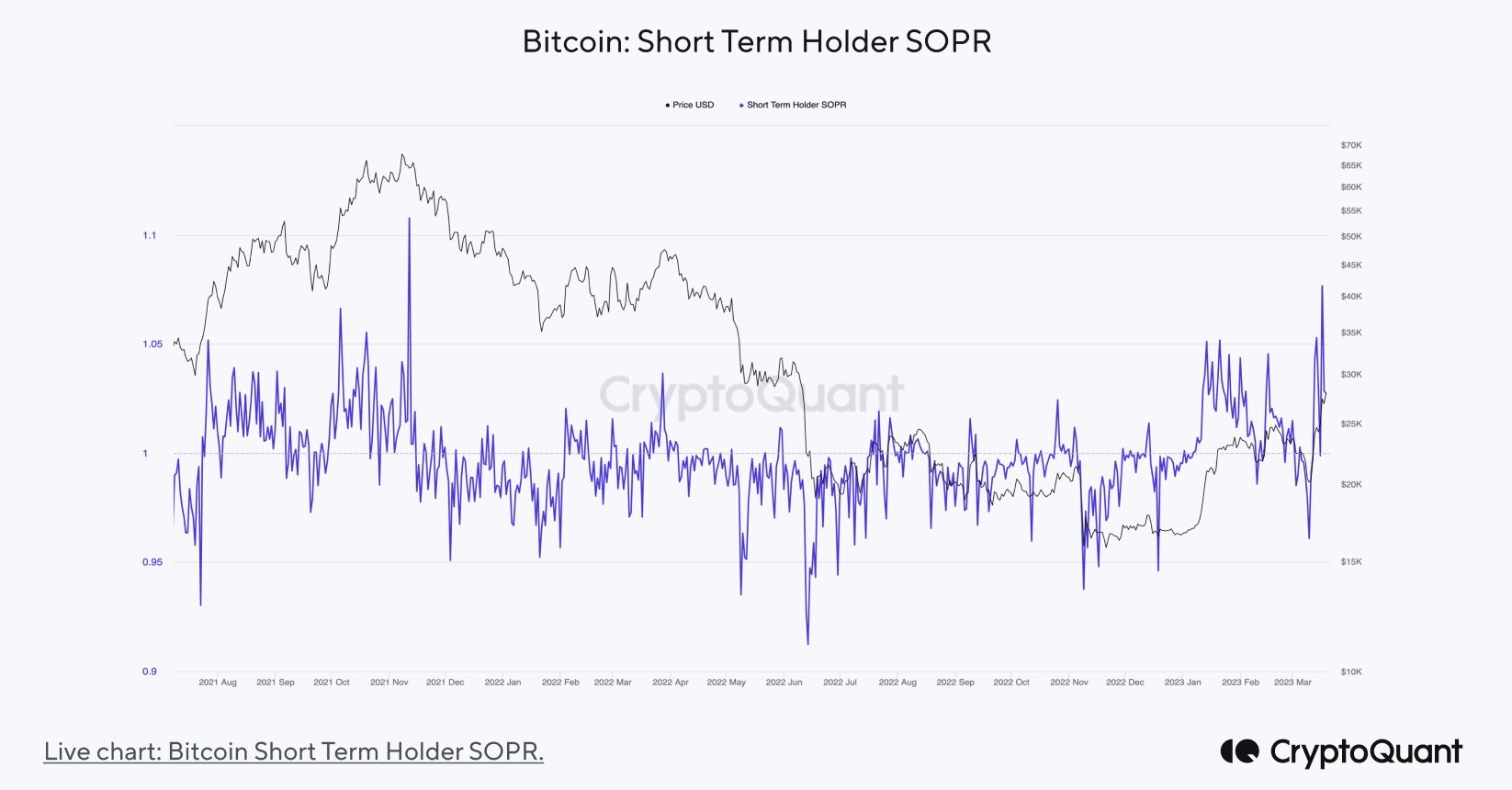

The Bitcoin Short-Term Holders SOPR metric has jumped above 1.5. It signifies buyers are reserving earnings at a exceptional revenue margin of seven.6%. It is the very best since November 2021, when Bitcoin was buying and selling at $64K. Typically, values over ‘1’ point out extra short-term buyers are promoting at a revenue.

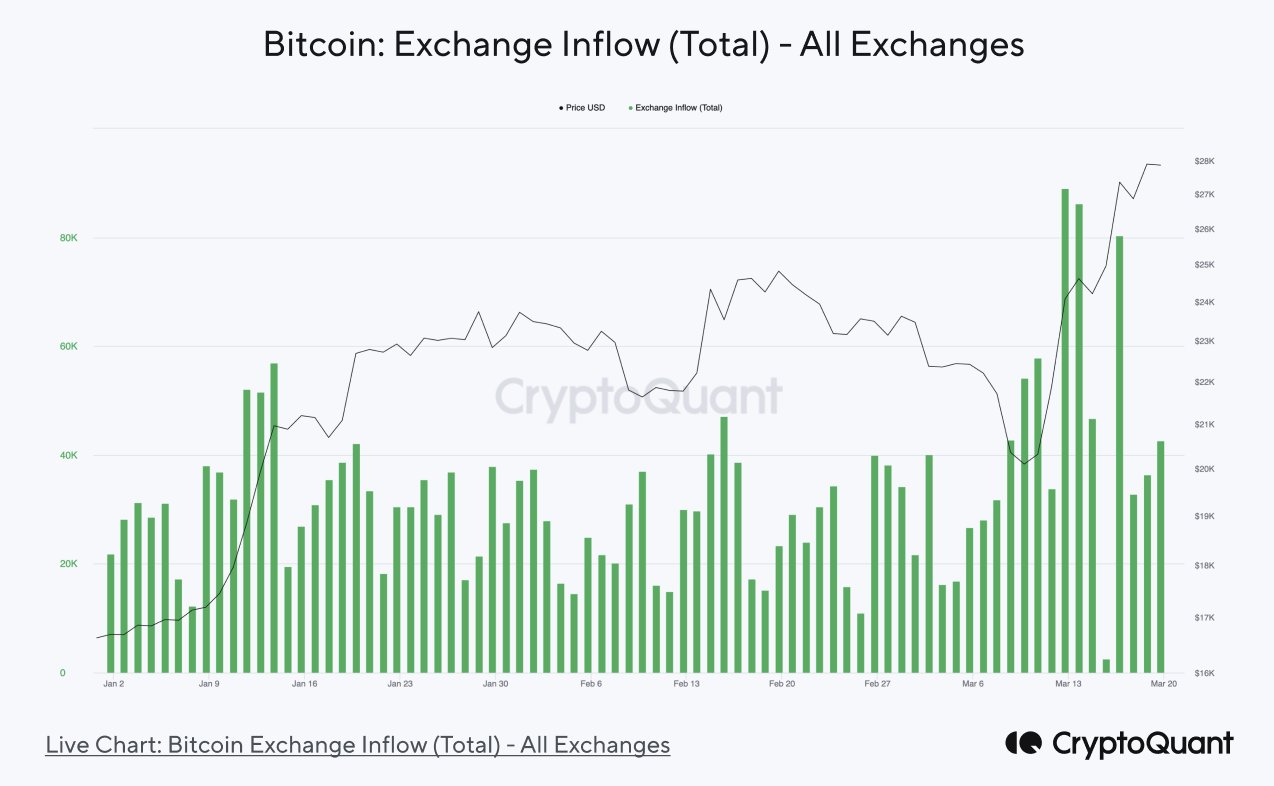

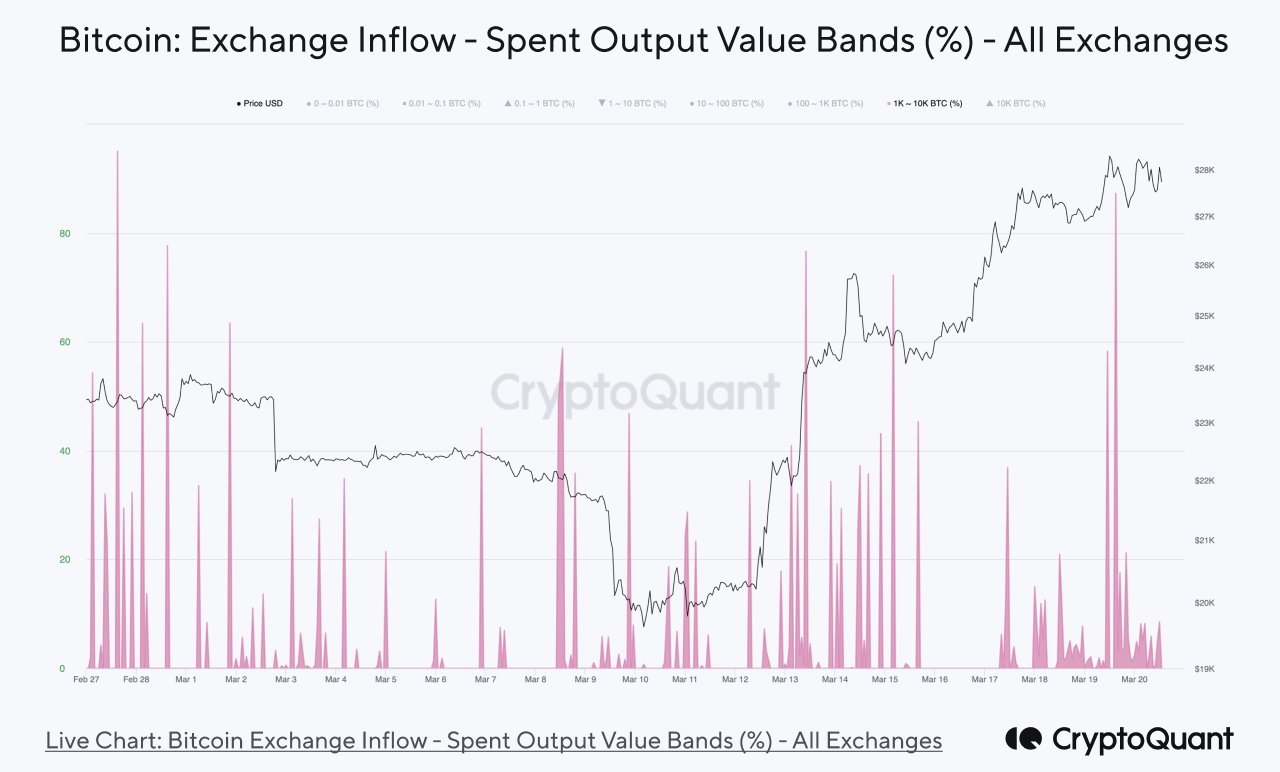

Bitcoin Exchange Inflow metric signifies a big improve in Bitcoin inflows into crypto exchanges because the BTC value rallied above $28,000, reaching the very best ranges in 2023. Generally, a excessive worth signifies larger promoting stress within the spot alternate. Thus, a correction in Bitcoin value is anticipated.

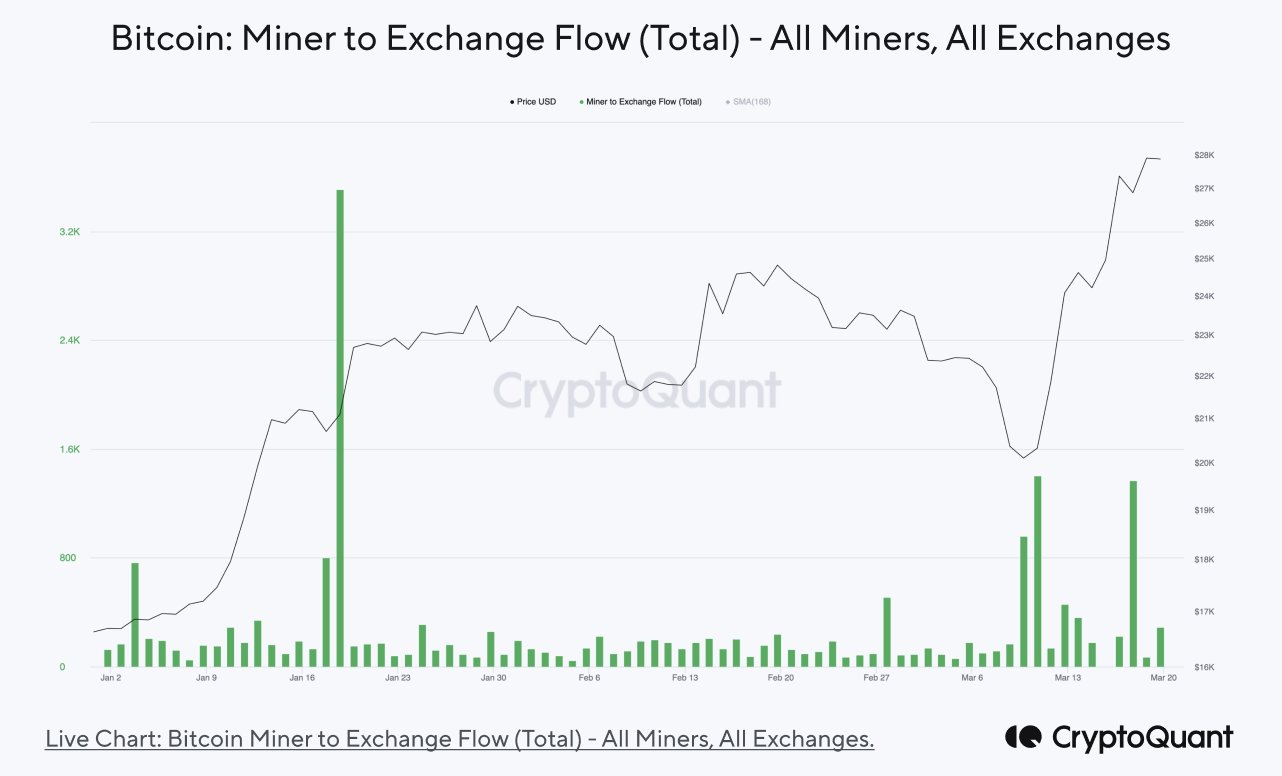

The Bitcoin Miner to Exchange Flow metric exhibits that miners have been contributing to those inflows amid the banking disaster, particularly after the shut down of crypto-friendly Silicon Valley Bank. The miner reserves have fallen once more in March after selloff in January.

Bitcoin Exchange Inflow – Spent Output Value Bands (%) metric signifies large whale exercise. A substantial proportion (33%) of Bitcoin flowing into exchanges has been from whales. This means that whales have been dominating alternate inflows lately.

Ethereum Price Correction

Meanwhile, Ethereum Exchange Inflow signifies doable ETH value correction and different on-chain metrics stay blended. ETH price is anticipated to witness promoting stress amid the Shanghai improve and Bitcoin downfall.

Some analysts predicted a transfer towards $2000 within the short-term, however will proceed to face resistance close to the psychological degree.

Also Read: Bitcoin Price Set For $35,000 After US Fed Rate Hike Decision: Bloomberg

The offered content material might embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link