[ad_1]

A analysis agency has damaged down how the Bitcoin value has reacted to purchases Michael Saylor’s MicroStrategy has made over time.

MicroStrategy’s Bitcoin Purchases Have Been Followed By Negative Price Action

K33 Research, previously Arcane Research, has launched a brand new evaluation piece that appears into how the market has been impacted by every buying spree that MicroStrategy has gone on.

The analysis agency has discovered that Bitcoin has often noticed an upside throughout the durations MicroStrategy has been making its purchases. Note that by throughout, what is supposed right here is the precise dates the purchases occurred and never when the bulletins have been made.

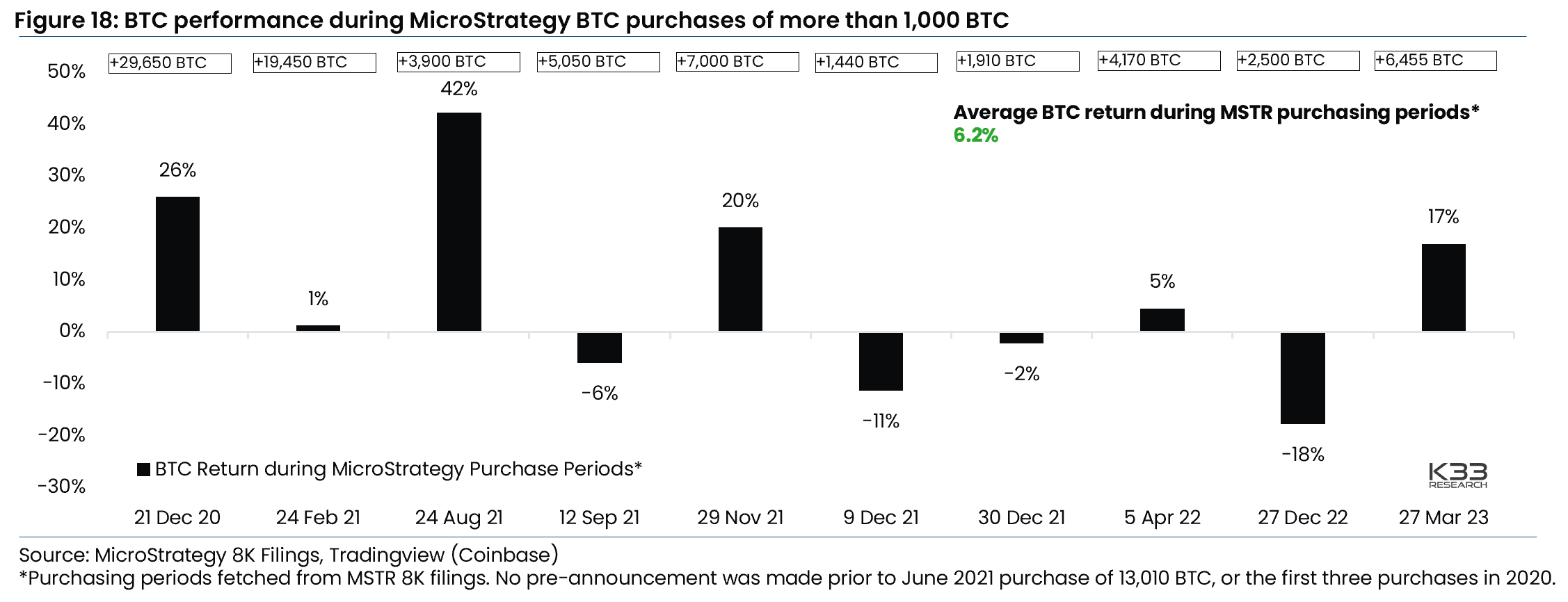

Here is a chart that shows the returns of Bitcoin throughout every of the durations the place MicroStrategy bought at the very least 1,000 BTC over the previous couple of years:

Looks like the best constructive return was registered again in August 2021 | Source: K33 Research

As proven within the above graph, whereas it hasn’t been the case each time, these durations have nonetheless tended in direction of constructive returns for the cryptocurrency. The newest buy, the place the corporate acquired 6,455 BTC (and likewise made a reimbursement of its Silvergate loan in full), noticed the coin surge by 17%.

On common, Bitcoin has seen constructive returns of about 6.2% throughout these shopping for durations. This pattern naturally is sensible, because the analysis agency famous that MicroStrategy’s purchases act as a relentless shopping for presence out there.

Now, the extra attention-grabbing pattern turns into seen when wanting on the returns of the asset that adopted instantly after MicroStrategy made formal bulletins of their purchases. The under chart exhibits how BTC carried out on the identical day as these bulletins, in addition to the way it did every week after them, over the previous couple of years.

BTC has typically seen pink returns after these bulletins | Source: K33 Research

Unlike the buying durations, the bulletins made by MicroStrategy have often seen a detrimental response from the market. On the times the corporate made these bulletins, the worth has taken a 2.2% hit on common. Regarding weekly returns following the bulletins, the typical returns have been detrimental, however solely barely so at -0.2%. Following the information of the most recent buy from the agency, Bitcoin has seen a 3% drop

As for why these pink returns have often been noticed following such bulletins, K33 Research explains, “this market reaction may be caused by market participants absorbing the information that a known large buyer has finished, meaning less buy-side liquidity to support further upside.”

Back in September, MicroStrategy penned a Sales Agreement with Cowen and BITG, which allowed them to challenge and promote shares at an mixture value of as much as $500 million.

So far, the agency has issued and offered $385.8 million price of shares, that means they’ll solely challenge and promote shares price $114.2 million to purchase extra Bitcoin.

“Thus, while MicroStrategy managed to prepay its Silvergate loan at a 25% discount, the market is pricing in that a known large buyer has less short-term gunpowder left to generate upside momentum,” notes the analysis agency.

BTC Price

At the time of writing, Bitcoin is buying and selling round $27,900, up 1% within the final week.

The worth of BTC has seen some drawdown in latest hours | Source: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, K33.com

[ad_2]

Source link