[ad_1]

After recovering its bullish momentum, the most important cryptocurrency out there, Bitcoin (BTC), briefly broke above its key resistance degree of $28,700. However, the cryptocurrency retracted and returned to buying and selling inside its vary shaped within the final week between $27,600 and $28,500.

Despite this uneven worth motion, a latest weblog post by Justin Bennett, dealer and analyst of the crypto market means that BTC has established “strong” horizontal ranges, that are favorable for each scalpers and buyers preferring this era of vary or consolidation out there.

Will These Horizontal Levels Hold A Potential Decline In BTC’s Price?

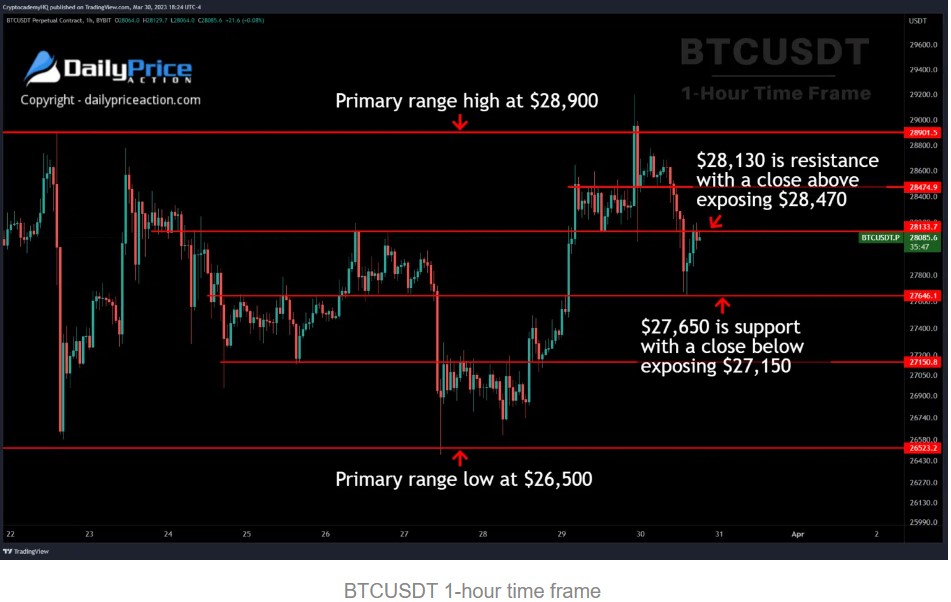

Bennett additional mentions that Bitcoin trades above the $28,130 pivot level on an hourly and 4-hour closing foundation. Any try to retest this degree will doubtless entice sellers, doubtlessly triggering one other run on the $27,650 assist flooring and doubtlessly decrease costs.

Although the horizontal ranges seen within the chart could present alternatives for scalping, Bennett cautions that there’s a potential draw back threat if BTC’s assist ranges are breached.

Bennett means that whereas BTC’s worth has no confirmed route, there are presently extra lengthy liquidations beneath the worth than quick liquidations above. This signifies that the next variety of merchants have taken lengthy positions and could also be liable to liquidation if the worth additional declines over the weekend.

However, with Bitcoin buying and selling above the important thing pivot level, there’s nonetheless potential for additional upside and consolidation above the $29,000 degree. The $28,900 macro resistance degree is the subsequent goal for BTC, and a profitable breach might result in additional good points for the most important cryptocurrency out there.

Bennett additional means that the first vary for Bitcoin is between $26,500 assist and the $28,900 resistance wall, with smaller ranges inside this vary. This may end up in the worth motion could also be comparatively steady inside this vary. Still, there’s a potential for important volatility if the worth breaks out of this vary and experiences a correction towards the assist degree.

A New Cycle Is Just Beginning For Bitcoin

According to Rekt Capital, with the closure of Q1 for Bitcoin and the broader cryptocurrency market, BTC is on the verge of confirming its first bullish quarterly engulfing candle since early 2020. This sample happens when the opening worth of a selected quarter is decrease than the closing worth of the earlier quarter.

According to Rekt, this sample has traditionally preceded a number of quarters of upside for Bitcoin, that means that BTC’s worth tends to extend for a number of quarters after the sample is confirmed, like within the bull market of 2021.

Even if Bitcoin’s worth experiences a pullback within the close to time period, the sentiment of the cryptocurrency market appears to purpose for one factor: BTC is poised for a brand new bull run.

The market is predicted to endure a sustained interval of worth will increase within the coming months, with the primary quarter closing above key ranges. This suggests robust potential for development and investor confidence regardless of short-term fluctuations in Bitcoin’s worth motion.

Featured picture from Unsplash, chart from TradingView.com

[ad_2]

Source link