[ad_1]

Bitcoin has rallied almost 85% this 12 months, however Ethereum (ETH) value to seemingly outperform BTC price within the close to future. The ETH/BTC pair is placing upside stress after declining to this point this 12 months.

After the successful Ethereum Shanghai (Shapella) upgrade on April 12, ETH price jumped 6% to maneuver nearer to the $2,000 stage. Meanwhile, BTC value continues to commerce above the $30,000 stage, up 1% within the final 24 hours. The Ethereum Merge final 12 months turned Ethereum value deflationary and fewer unstable. However, the ETH movement out there has elevated because the improve enabled staked ETH withdrawals.

According to Coinglass, Ethereum witnessed huge liquidation of shorts within the final two days. Over $12.50 million in shorts had been liquidated on April 12 and $23.39 million on April 13. This prevented a fall in ETH costs after the Shanghai improve that most individuals anticipated.

Surprisingly, OKX and Huobi witnessed the biggest ETH liquidations, with 23.19 million and 9.50 million, respectively. Binance is subsequent with 7.89 million in liquidation after the Shanghai improve.

Reasons Why Ethereum May Outperform Bitcoin

Ethereum is anticipated to outperform Bitcoin within the close to future and BTC value to witness much less volatility.

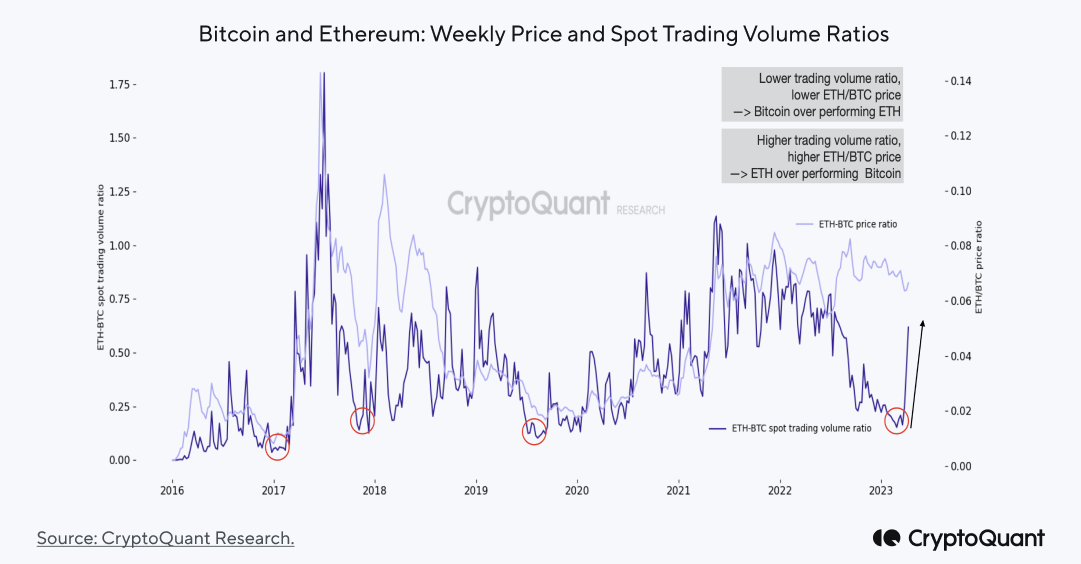

Firstly, the relative spot demand for ETH has elevated throughout the crypto exchanges as a consequence of a lower in BTC spot buying and selling quantity. The principal cause is the suspension of zero-fee trading for many of its BTC buying and selling pairs by high crypto change Binance in March.

Secondly, futures markets are indicating a possible shift in direction of ETH. The open curiosity (OI) and buying and selling quantity are seemingly bottoming out and the ETH value is able to go parabolic.

Furthermore, increased demand for ETH than BTC and ETH-BTC relative quantity reaching decrease within the perpetual futures market assist a rally within the ETH value this 12 months.

Also Read: Ethereum (ETH) Withdrawn After Shanghai (Shapella) Upgrade: Details

The introduced content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link