[ad_1]

Binance, the world’s largest crypto trade, dominates the crypto market as a result of huge buying and selling volumes it data on the trade. However, Bitcoin spot and derivatives buying and selling volumes on Binance are declining in the previous couple of months.

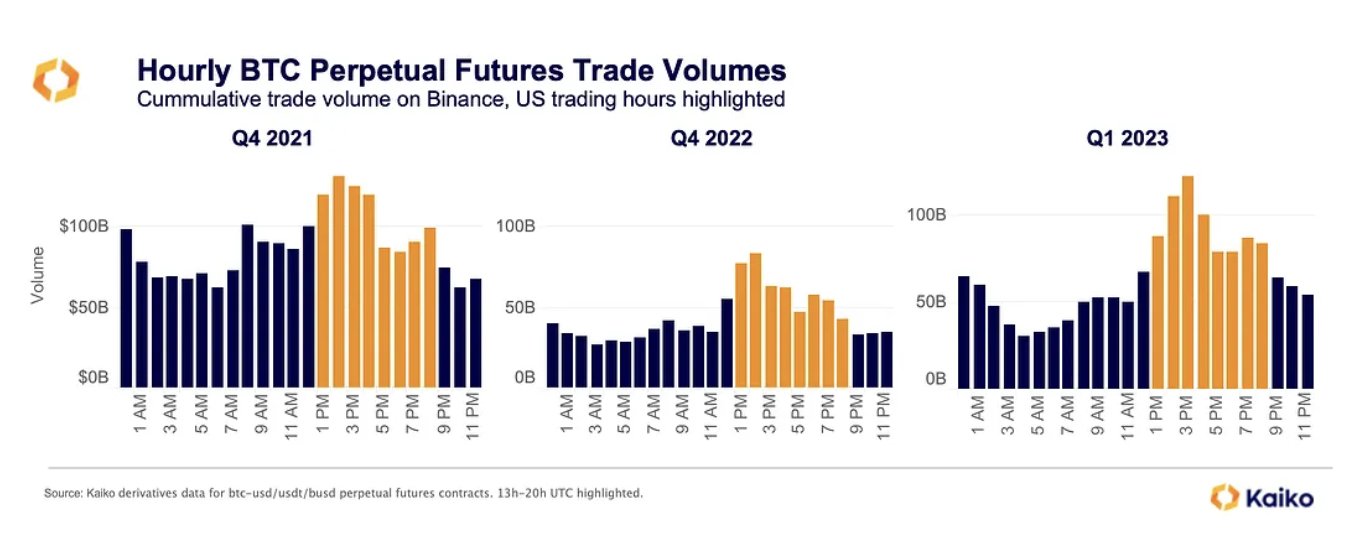

Over the previous few years, Binance recorded greater derivatives buying and selling quantity within the U.S. hours compared to different hours. However, the volumes are dropping through the U.S. hours because the CFTC lawsuit in March, reported Kaiko on April 13.

Bitcoin derivatives buying and selling quantity information for BTC-USD, BTC-USDT, and BTC-BUSD perpetual futures contracts indicated buying and selling quantity normally rises between 13:00 and 20:00 UTC. The Q1 2023 information was in contrast with This fall 2021 and This fall 2022 figures, with Binance’s Bitcoin buying and selling volumes nearly doubled in U.S. hours.

“However, not charted, we noticed a drop in volumes during U.S. hours since the CFTC lawsuit,” noted Kaiko.

Will Binance’s Trading Volume Drop Impact Bitcoin Price?

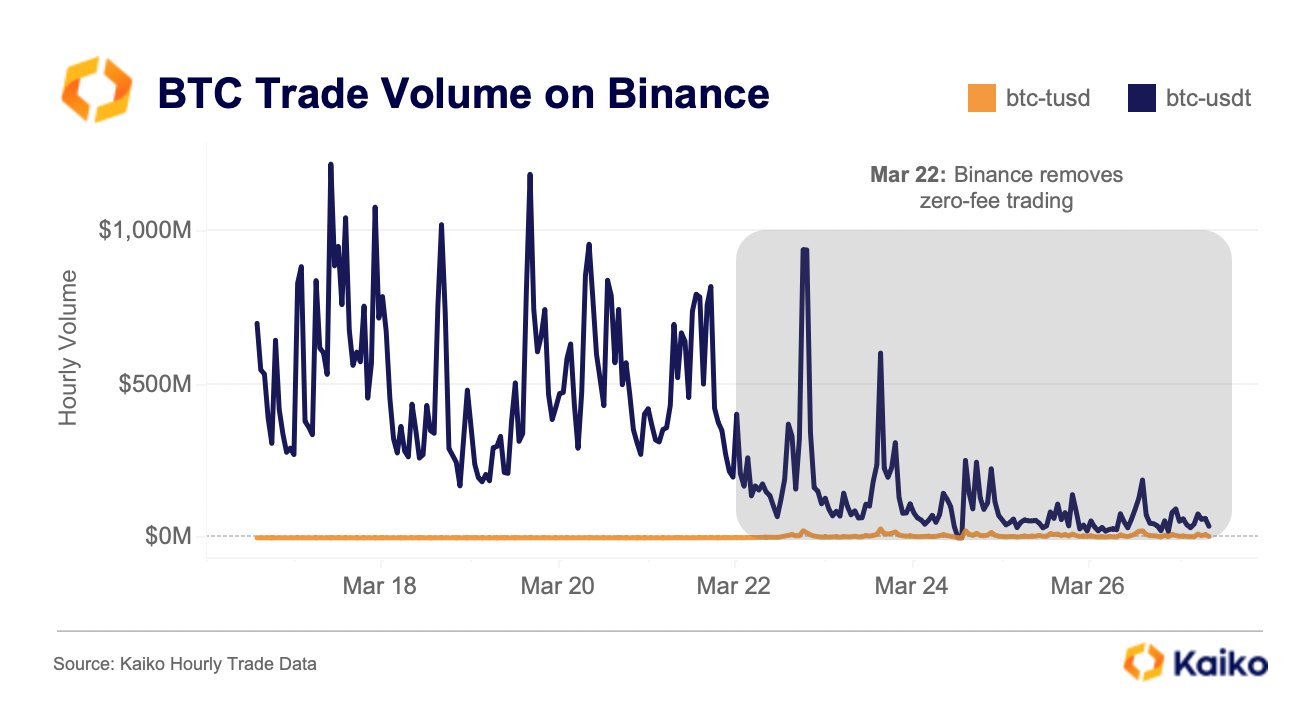

Bitcoin buying and selling quantity for the BTC-USDT pair fell 90% on crypto trade Binance after it ended the zero-fee Bitcoin trading for all buying and selling pairs besides TrueUSD (TUSD). While the each day buying and selling quantity on BTC-TUSD pair has elevated to $170 million, it’s nonetheless comparatively decrease.

Binance made main modifications to its zero-fee Bitcoin buying and selling program and BUSD zero-maker charge promotion as a part of eradicating Binance USD (BUSD) after the crackdown by U.S. regulators.

Binance‘s market share dropped to 54% from 70% two weeks ago, the lowest level since November 5, after the CFTC lawsuit and ending some zero-fee trading. Kaiko earlier clarified that CFTC had no impact on Binance’s buying and selling volumes, however right this moment it agreed that it does have some impression.

While Bitcoin has jumped over $30,000, the upcoming value rally is more likely to be restrictive. The BTC value is at present buying and selling at $30,255, up 1% within the final 24 hours. Meanwhile, the ETH price has hit $2,000 after the Shanghai improve attributable to huge shorts liquidation.

Also Read: London Stock Exchange To Offer Bitcoin Futures And Options Trading

The offered content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link