[ad_1]

Data from a analysis agency has revealed that almost 80% of the Ethereum staking rewards have been withdrawn because the Shanghai improve.

1.5 Million ETH In Total Has Been Withdrawn Since Ethereum Shanghai Upgrade

In September 2022, Ethereum lastly switched in direction of a Proof-of-Stake (PoS) consensus mechanism. In such a system, a consensus is met on the blockchain via stakers and never miners.

Anyone can change into a staker in the event that they deposit 32 ETH into the staking contract. While the mainnet solely transitioned to the PoS system in September 2022, as talked about earlier, the staking contract had already been dwell on a take a look at blockchain since November 2020.

This means holders have been depositing into the contract and incomes staking rewards since then. However, till the latest Shanghai improve, there was a limitation connected to this contract all these years.

While the deposit performance was in place, the traders couldn’t but withdraw their cash from the contract. Because of this purpose, a lot of rewards had amassed with the validators whereas this restriction remained.

The Shanghai improve launched simply earlier within the month allowed the traders to withdraw their locked ETH and staking rewards. Since the rewards had piled up on the contract all these years, it was anticipated that many withdrawals would happen when the improve was in place.

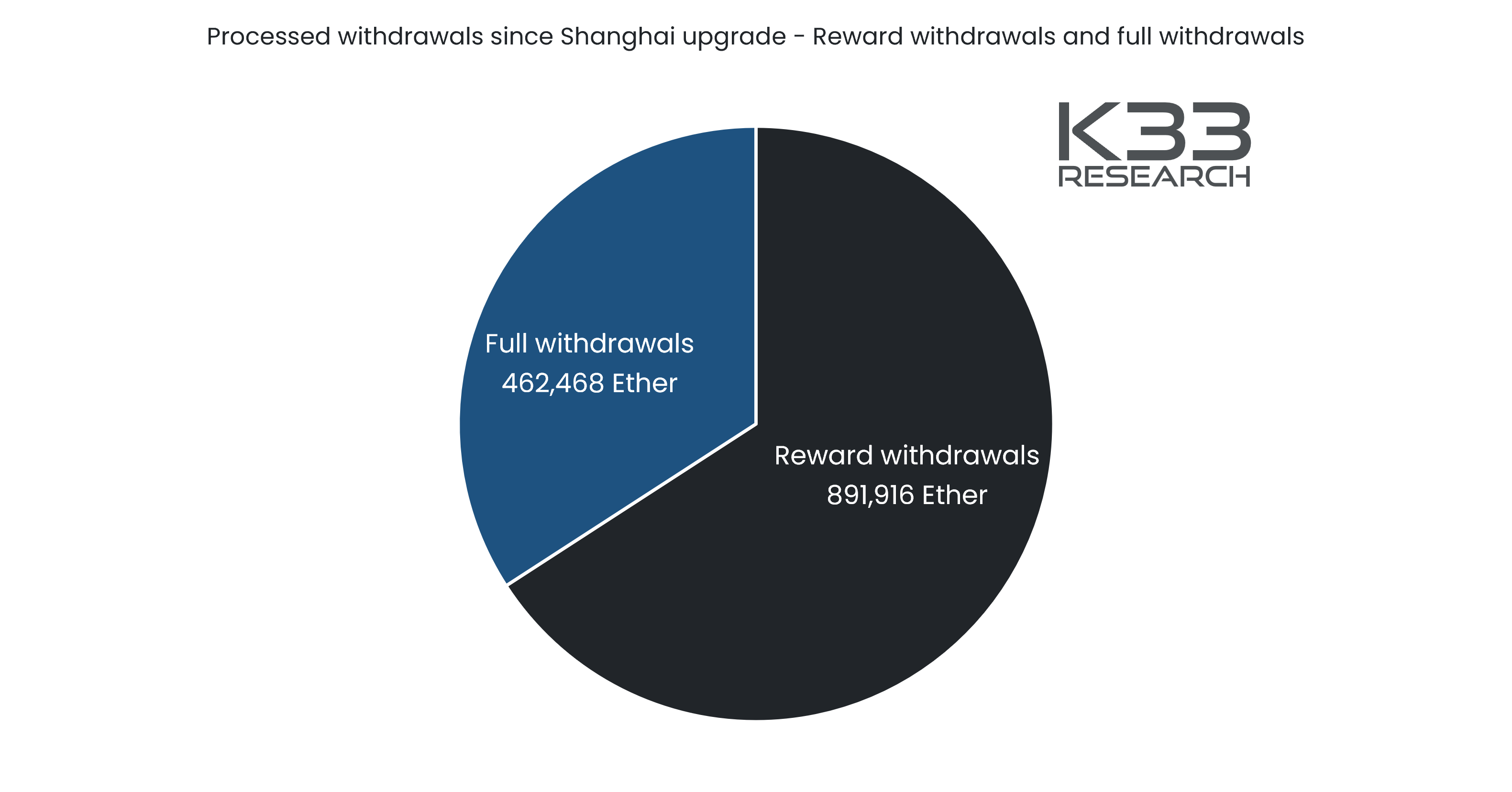

According to a brand new put up from K33 Research (previously Arcane Research), almost 1.5 million ETH ($2.8 billion) has been withdrawn since 12 April 2023, when the onerous fork occurred. The pie chart beneath reveals these withdrawals’ division between full and reward-only ones.

The withdrawals which have taken place because the Shanghai improve | Source: K33 Research

The “full withdrawals” right here discuss with withdrawals involving the whole exit of the 32 ETH stack that the validator needed to put into the staking contract firstly (which means that after this type of withdrawal, the investor not stays a validator).

Only about one-third of the entire withdrawals had been of this kind (round 462,468 ETH); the opposite two-thirds concerned solely the exit of the staking rewards (891,916 ETH).

Now, here’s a chart that breaks down how these reward withdrawals which have taken place since Shanghai evaluate with the gathered rewards but to be touched:

Looks like a majority of the rewards have already been withdrawn | Source: K33 Research

As displayed within the above graph, the Ethereum staking rewards which have been withdrawn because the Shanghai improve has gone dwell far outweigh these which can be nonetheless being taken out. More exactly, round 80% of the entire rewards gathered previous to the onerous fork have already been withdrawn.

From the chart, it’s additionally obvious that the rewards amassed throughout the final seven days have been minuscule in comparison with these beforehand gathered.

This would counsel that any extraordinary selling pressure coming into the market because the begin of those withdrawals ought to already be nearly fully exhausted. The identical stress wouldn’t be saved up sooner or later as a result of gradual tempo of recent rewards being distributed amongst Ethereum validators.

ETH Price

At the time of writing, Ethereum is buying and selling round $1,800, down 8% within the final week.

ETH has plummeted not too long ago | Source: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, K33 Research

[ad_2]

Source link