[ad_1]

Bitcoin worth has written a purple candle within the 1-week chart for the primary time after 5 consecutive weeks. As NewsBTC reported, the value is in a essential zone within the 1-day chart to take care of the long-term uptrend. Therefore, the following few days could possibly be of nice significance to find out the development.

Was $27,000 Already The Local Bottom For Bitcoin?

Co-founders of on-chain analytics resolution Glassnode, Jan Happel and Yann Allemann, agree that the bulls stay in management, however have to slowly flip the tide. “Bitcoin’s long-term uptrend is intact,” they write, however level to weakened momentum attributable to low buying and selling quantity.

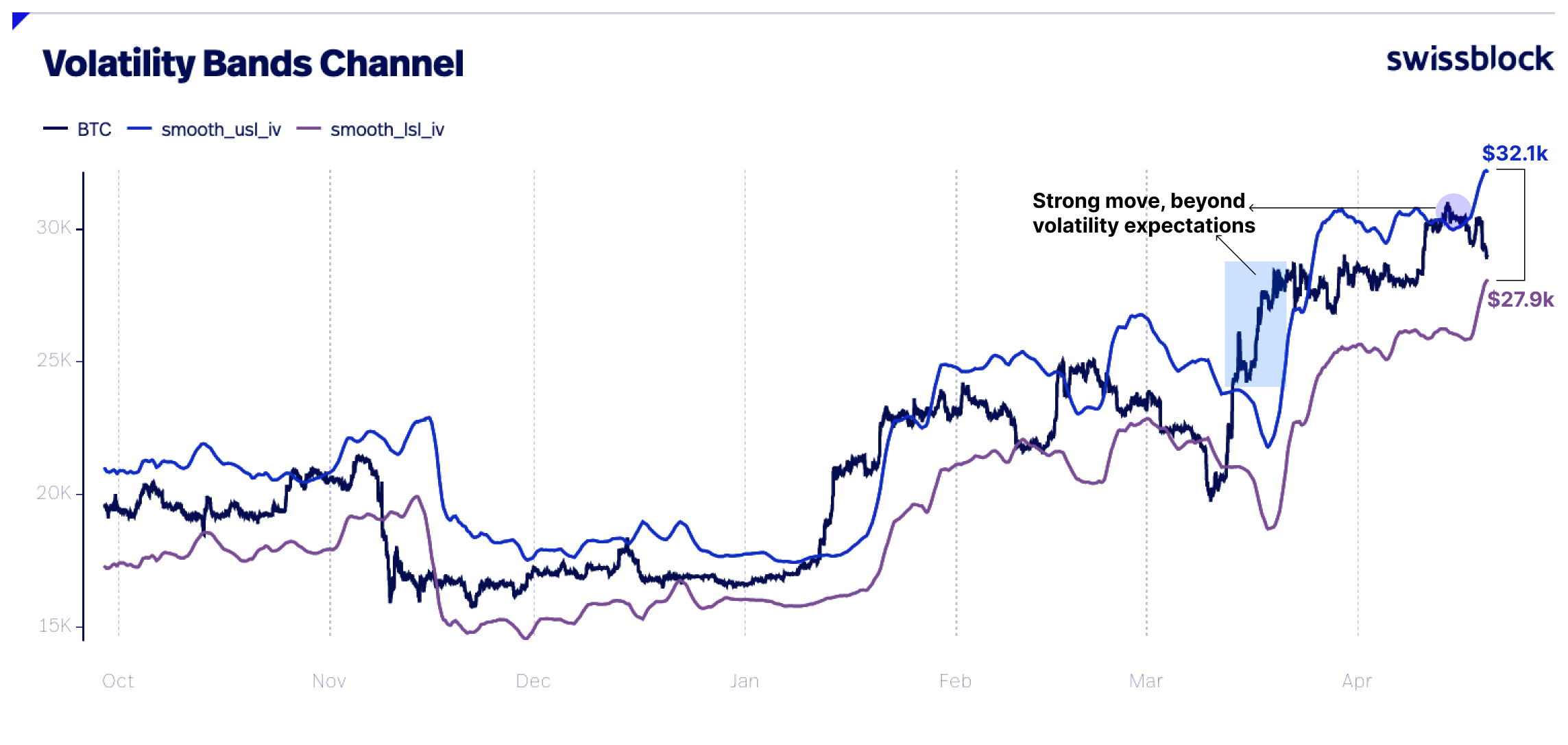

As Bitcoin at the moment hovers close to help ranges, smaller fluctuations of +/- $1k are anticipated, whereas strikes between $27.5k and $32k would nonetheless be throughout the regular vary as proven by the weekly volatility bands.

However, the analysts anticipate some wicks to the draw back. In case of a sustained draw back break, the following help space can be at $25,500 to $26,000 . But in keeping with the analysts, the chance is fairly low.

The Bitcoin danger sign is at 0 and appears a bit shaky within the quick time period regardless of the current volatility, however shouldn’t be indicating any panic promoting. The Fear and Greed Index has pulled again from the greed zone to a impartial place at 52 factors. Moreover, the analysts argue for a wholesome correction out there:

The present market atmosphere, characterised by unrealized earnings outpacing unrealized losses (see NUPL on glassnode), implies optimism within the medium and long run.

Technical analyst Michaël van de Poppe expects that there will probably be a “classic Monday drop” earlier than there’s a reversal. Bullish occasions this week could possibly be the discharge of the U.S. Gross Domestic Product for the primary quarter (Thursday) and the discharge of the Core PCE (Friday).

Crucial for a reversal, in keeping with the analyst, is the value degree at $27,800. “Divs in $26,800 area for longs on Bitcoin,” notes the analyst, who additionally defined:

Correction as CME hole got here in for Bitcoin. Back in direction of the resistance, for the second time. If Bitcoin breaks $27,800-28,000 fully within the coming few days, acceleration in direction of $29,200 appears subsequent. Funding damaging on ETH, so a bounce is getting shut.

The famend dealer @exitpumpBTC takes an identical stance: “Want to see manipulation like Monday dump, consolidation with shorts piling up at the lows around $26K and Tuesday recovery with limit chasing by buyer.”

Analyst Ali Martinez shared the legendary “Wall Street Cheat Sheet” on the standard path of market cycles. Traders ought to ask themselves, how are you feeling immediately?

How are you feeling immediately about #crypto? pic.twitter.com/nnXj9wgyMZ

— Ali (@ali_charts) April 23, 2023

At press time, the BTC worth traded at $27,285.

Featured picture from: iStock, chart from TradinView.com

[ad_2]

Source link