[ad_1]

On-chain information exhibits the Bitcoin energetic addresses have damaged above the degrees seen in Nov. 2021, suggesting that demand for BTC is surging.

Bitcoin Active Addresses Have Observed Constant Growth Recently

As an analyst in a CryptoQuant post identified, there have been issues in February that the metric hadn’t been displaying any important development. The “active addresses” is an indicator that measures the day by day complete variety of Bitcoin addresses taking part in some transaction exercise on the blockchain.

Naturally, this metric accounts for each senders and receivers on this measurement. It additionally solely contains distinctive addresses, which means that any addresses making repeat transactions are counted solely as soon as. Because of this, the metric can provide an thought in regards to the variety of customers utilizing the blockchain day by day.

When the worth of this indicator is excessive, it means many addresses are making transfers on the community proper now. Such a pattern means that the blockchain is at the moment observing a excessive quantity of utilization.

On the opposite hand, low values indicate that community exercise is low. This pattern can point out that the overall curiosity within the cryptocurrency is low amongst traders.

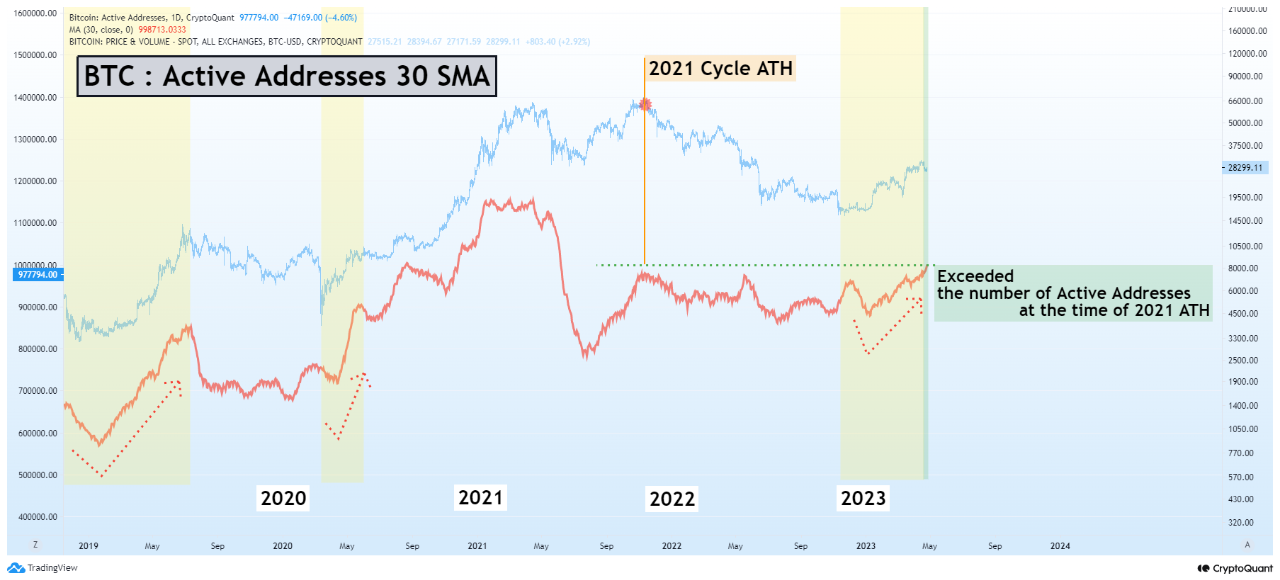

Now, here’s a chart that exhibits the pattern within the 30-day easy shifting common (SMA) of Bitcoin energetic addresses over the previous couple of years:

Looks just like the 30-day SMA worth of the metric has been observing an uptrend in current months | Source: CryptoQuant

As proven within the above graph, the 30-day SMA Bitcoin energetic addresses metric had principally moved sideways throughout the 2022 bear market. This is often the sample seen in bearish intervals, as traders discover the countless consolidation sometimes related to such intervals boring, so only some members on the blockchain.

However, extremely unstable occasions like crashes do see many customers changing into energetic. They rush to promote their cash to chop their losses or try to catch the underside. An instance of this taking place could be seen within the chart throughout the November 2022 FTX collapse.

An analogous impact is often seen with rallies, however the worth surge that began this 12 months initially noticed little development within the energetic addresses. This raised issues in regards to the sustainability of the rally, as all prolonged worth strikes have traditionally required massive quantities of day by day site visitors to maintain going.

Recently, nevertheless, it has grow to be clear that the indicator has been seeing some fixed, gradual development, suggesting that buying and selling curiosity within the asset is slowly however certainly going up.

Recently, the 30-day SMA Bitcoin energetic addresses metric has damaged above the degrees noticed throughout the November 2021 worth all-time excessive, exhibiting that there’s now a major quantity of demand for the cryptocurrency out there.

BTC Price

At the time of writing, Bitcoin is buying and selling round $29,700, up 1% within the final week.

BTC has sharply surged | Source: BTCUSD on TradingView

Featured picture from Aleksi Räisä on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link