[ad_1]

Bitcoin value breaks beneath the important thing 50-moving common forward of the US Federal Reserve financial coverage assembly risking a fall to $26k. The Fed is predicted to ship one other 25 bps fee hike and markets await whether or not Fed Chair Jerome Powell is hawkish or dovish amid the banking disaster and debt ceiling disaster risking an “economic catastrophe.”

Ethereum value and altcoins will comply with swimsuit, bringing an total crypto market correction amid the looming Fed rate of interest resolution. Also, there’s no help from whales as they’re constantly promoting.

Bitcoin Price To Break Further Ahead US Fed Rate Decision

As CoinGape Media reported earlier, the market will stay underneath promoting strain and unstable for a number of days from the month-to-month expiry on April 28 to the U.S. Federal Reserve’s fee hike financial coverage resolution on May 3.

In the day by day timeframe, BTC price broke beneath the important thing 50-MA stage at $28.2k after failing to carry above the 20-MA at $29k. BTC value fell to a 24-hour low of $27,680 after breaking the important thing stage. The value is presently buying and selling at $28,011, down 2% within the final 24 hours.

Bitcoin value can also be exhibiting weak spot at 1-hr and 4-hr timeframes, with RSI transferring close to the oversold area.

Bollinger Bands and different technical indicators are additionally portray a bearish image forward of great macro occasions this week. Traders want to look at the important thing help stage at $27.2k. If the BTC value breaks beneath this stage, the value will fall to $26k to convey a market correction.

Also Read: Popular Analyst Predicts Looming Ethereum Price and Altcoins Crash

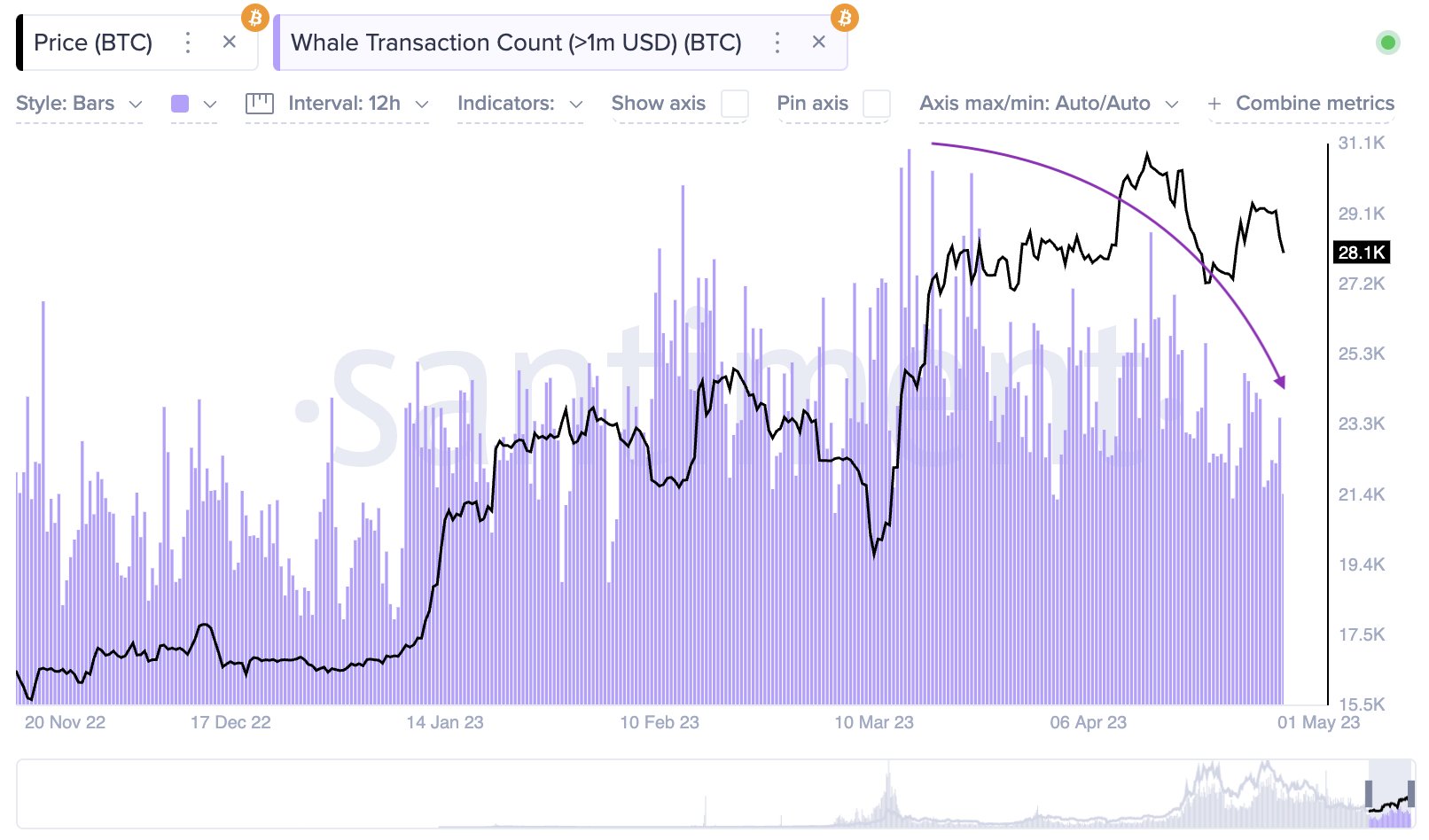

Moreover, analyst Ali Martinez noted that the Bitcoin whale transaction depend of $1 million or extra has been falling since March 22. This development has numerous implications for BTC value similar to declined buying and selling exercise amongst giant holders or a doable shift in market sentiment.

Macro Impacting BTC Price

Bitcoin buying and selling quantity continues to say no as US Dollar Index (DXY) rises above 102 on robust US knowledge and expectations of one other 25 bps fee hike by the US Fed. As per the CME data, the likelihood of a 25 bps fee hike has jumped to nearly 95% amid the current buyout of First Republic Bank by JPMorgan, which is the second-biggest financial institution failure in U.S. historical past.

Meanwhile, US 10-year Treasury yields rose to the three.55% stage amid excessive inflation and eased issues over turmoil within the banking sector.

Also Read: Top Exchange Lists Pepe Coin After 200% Rally, Will It Flip SHIB and DOGE?

The introduced content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.

[ad_2]

Source link