[ad_1]

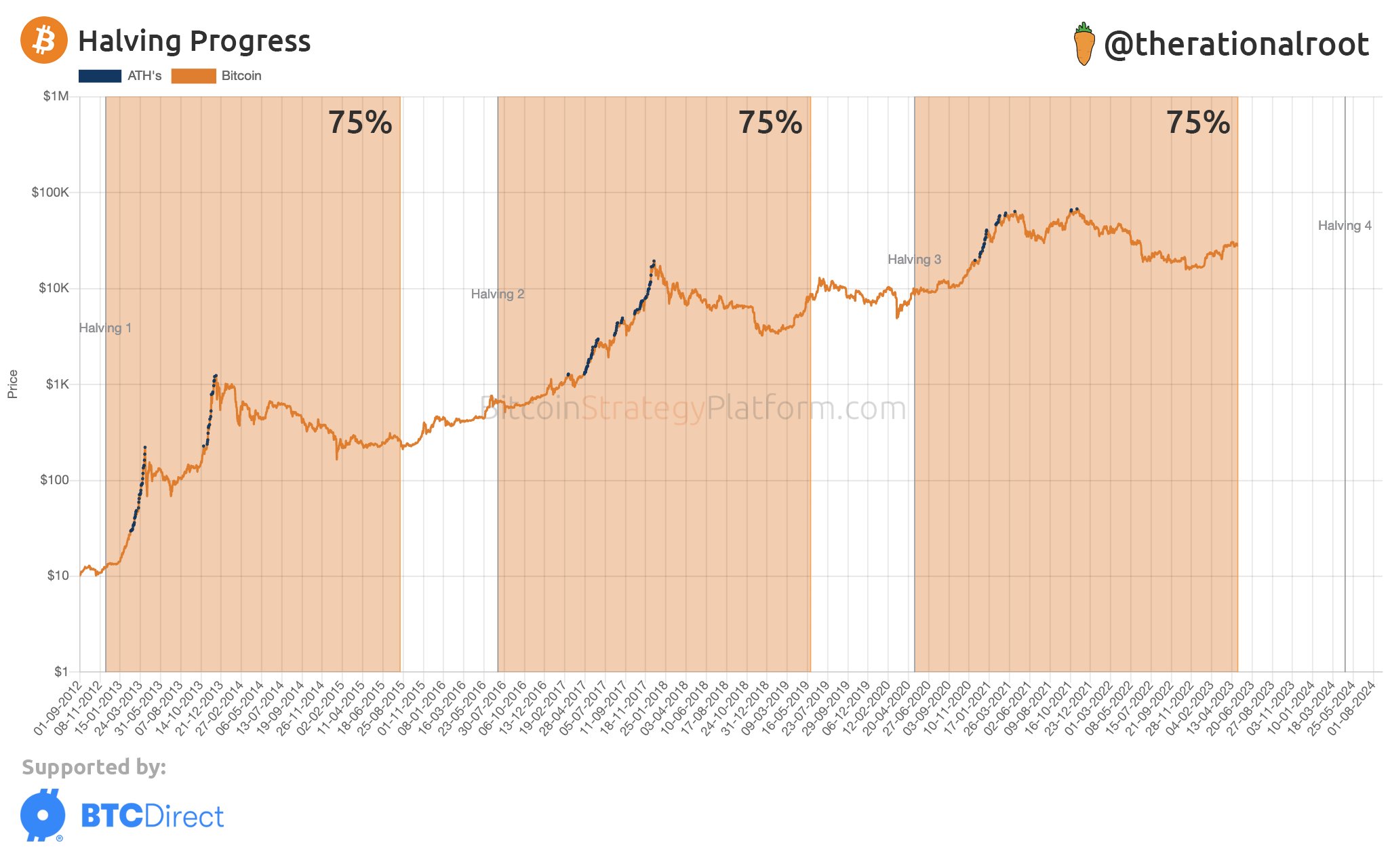

The present Bitcoin cycle is now 75% on the way in which to the subsequent halving. Here’s what earlier cycles seemed like at related levels of their timeline.

Current Bitcoin Halving Cycle Has Hit The 75% Milestone

The “halving” refers to a periodic occasion the place the cryptocurrency’s block rewards are completely reduce in half. The “block rewards” are what miners obtain as compensation for mining blocks on the community.

The BTC that these chain validators obtain in these rewards is the one solution to introduce recent cash into the asset’s circulating provide, that means that the block rewards may be thought-about the equal of BTC’s “production.”

The cause that the halving exists as an idea is to restrain the availability of the cryptocurrency and make it extra scarce with time since fewer and fewer cash are produced with every halving.

Since the halving has these wide-reaching penalties for the supply-demand dynamics of the asset, such an occasion has traditionally had an influence on the cryptocurrency’s value. More particularly, as the availability is tightened following it, the worth of BTC has noticed a bullish development.

Halvings happen after each 210,000 blocks or roughly each 4 years. Because of this periodicity and their essential place available in the market, these occasions function a well-liked means of defining the beginning and finish factors of a BTC “cycle.”

An analyst on Twitter has put collectively a chart that reveals the standing of the present Bitcoin cycle, in addition to the way it compares with the previous ones at related levels.

The completely different halving cycles of the unique cryptocurrency | Source: Santiment on Twitter

As you’ll be able to see within the above graph, the Bitcoin bull runs have traditionally taken place following halving occasions, displaying how highly effective the narrative round them has been.

From the chart, it’s seen that the most recent BTC halving cycle is at the moment round 75% finished, that means that the miners have mined about 157,500 blocks on this cycle thus far.

While the tendencies that the previous two cycles adopted after related milestones had been hit differed between the 2, they nonetheless noticed bullish momentum for no less than a while after this level.

In the case of the 2012 cycle, the asset’s value continued to climb following the 75% mark and constructed as much as the subsequent bull run. The 2016 cycle reached this milestone whereas the value was in the midst of the April 2019 rally.

The value continued to rise for some time after the mark was hit, however ultimately, the rally hit its high and the cryptocurrency declined after that. The correct buildup to the bull run didn’t occur till the 2020 halving occurred (at which level a brand new cycle had began).

The April 2019 rally shares quite a lot of similarities with the present one by way of varied on-chain indicators, so it’s attention-grabbing that their placement within the timelines of the respective cycles can be fairly related.

It now stays to be seen the place the present rally goes from right here, and if the sample of bullish momentum following the 75% halving milestone will maintain true on this cycle as nicely.

BTC Price

At the time of writing, Bitcoin is buying and selling round $29,100, up 1% within the final week.

BTC has surged at this time | Source: BTCUSD on TradingView

Featured picture from Dmitry Demidko on Unsplash.com, charts from TradingView.com, Santiment.internet

[ad_2]

Source link