[ad_1]

Key Takeaways

- Coinbase inventory is down 87% from its IPO price, the corporate now value $11 billion

- Regulators are shifting in on the business in the US, creating an more and more hostile surroundings

- Share price displays these developments, as effectively as plummeting quantity in the crypto house, writes our Head of Research, Dan Ashmore

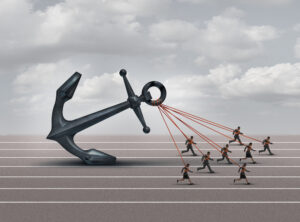

Coinbase is at warfare.

The change is the one publicly traded crypto platform in the US, an attribute that appeared an enormous power on the time of its IPO in April 2021. This was a time when Bitcoin was buying and selling at $63,500, dinner tables have been crammed with questions such as “how high can it go?”, and everyone wished a chunk of the crypto pie.

Things are slightly totally different in the present day. Coinbase’s standing as a public firm could also be serving to it with regard to transparency in an more and more opaque crypto business, however it is usually presenting its troubles for everyone to see. The inventory is down 87% from the price it floated at.

Coinbase faces a combat on a number of fronts

I wrote a deep dive on the prospects of the corporate final October, after it was revealed CEO Brian Armstrong had bought 2% of his stake. Seven months on, crypto costs have rebounded strongly however Coinbase’s future appears murkier than ever.

The firm faces challenges on a number of fronts. The first, clearly, is the state of the crypto business. Prices, volumes and curiosity have evaporated at an alarming fee over the 18 months. The Federal Reserve’s transition to tight financial coverage in the face of rising inflation has sucked liquidity out of the economic system and crushed belongings residing on the far finish of the chance spectrum. And make no mistake, crypto is most positively out there on the risk curve.

Bitcoin has careened down as low as $15,500 this cycle, a drawdown of 77% from its peak. It presently trades at $29,000 following a bumper first quarter of the yr, however the points with Coinbase transcend merely crypto costs.

The business has been underneath siege from regulators this yr, with the SEC in specific clamping down on an area that conceived a number of scandals final yr – most notably the spectacular collapse of not-so-stable stablecoin UST and crypto exchange FTX.

Coinbase is bracing itself for motion after it obtained a Wells discover earlier this yr. A Wells discover is a proper warning from the SEC that proof of proof of lawbreaking has been discovered, and authorized motion will doubtless be really helpful.

The SEC claims Coinbase’s staking service, Prime and Wallet merchandise, as effectively as its basic itemizing course of, might all be in violation of federal securities regulation.

The change is preventing. It has accused the SEC of levelling authorized accusations “on the fly” and contended that authorized motion in opposition to Coinbase would pose “major programmatic risks” and would “fail on the merits”.

The change has repeatedly criticised the dearth of regulatory readability for crypto. SEC chair Gary Gensler has contended that “Crypto markets suffer from a lack of regulatory compliance. It’s not a lack of regulatory clarity”.

But prefer it or detest it, the SEC is asking the photographs, and that is all very dangerous information for Coinbase. The concern may be very actual that the US surroundings is solely turning into too hostile for crypto. Coinbase is aware of this, even when it disagrees with why it’s taking place.

This week, it introduced the launch of the Coinbase International Exchange (CIE), an institutional platform for worldwide derivatives buying and selling. But the concern can actually be seen in the share price. While we talked about the very fact the crypto business has been ravaged, Coinbase has underperformed even Bitcoin considerably over the past yr.

Perhaps the 2 greatest benchmarks for Coinbase’s efficiency are Bitcoin and the Nasdaq. The under chart exhibits how extensive the chasm has been.

Even this yr, as costs have rebounded throughout the crypto business, the change has failed to sustain. Its inventory could also be up 44% year-to-date, however Bitcoin is up 68%.

The backside line is that Coinbase has two large issues. The first is that the business it operates is has melted down in contrast to the lofty highs throughout the pandemic, and the second is that regulators are very a lot threatening its existence as a US firm.

Neither of these issues have straightforward fixes. And the share price displays that.

[ad_2]

Source link