[ad_1]

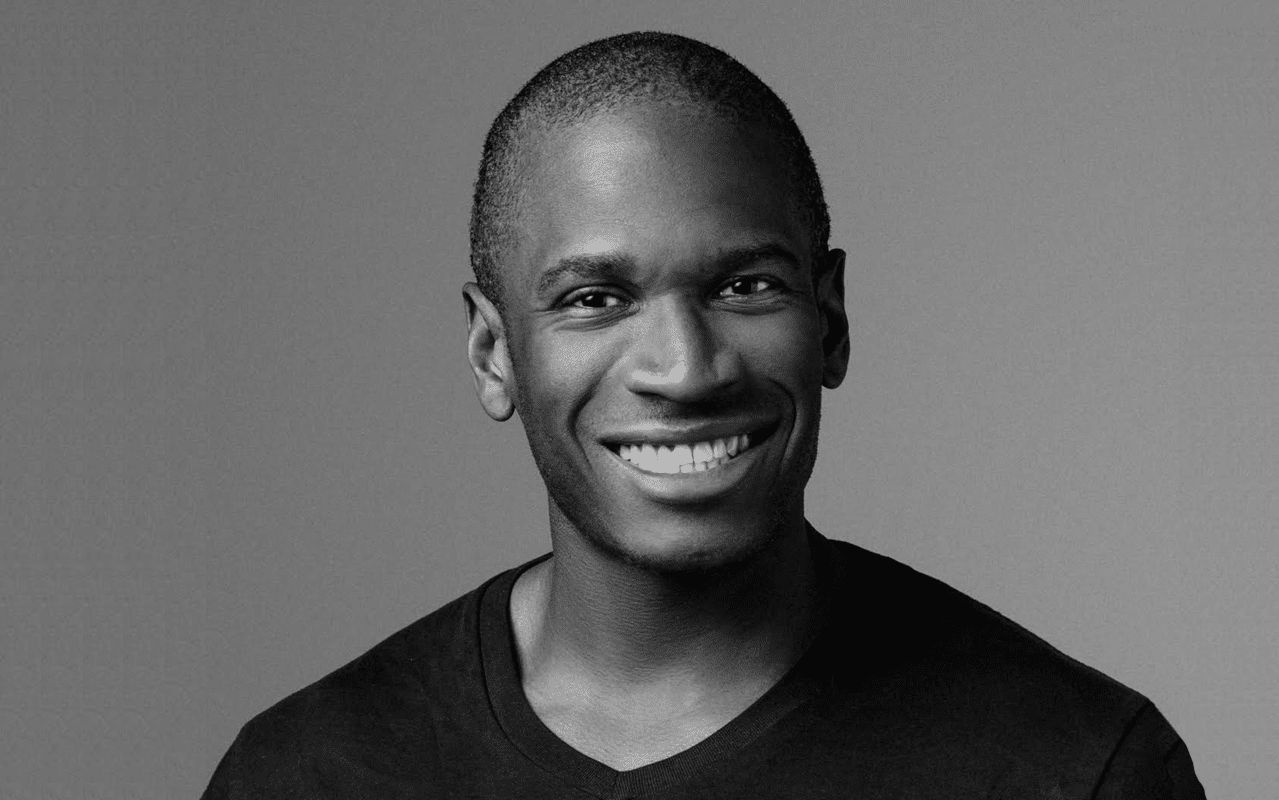

A restraining order has been issued by a courtroom in Singapore towards Arthur Hayes, one of many co-founders of the BitMEX buying and selling platform as a result of repeated focused posts made on Twitter. The order was acquired by Su Zhu, who was a co-founder of the now-defunct cryptocurrency hedge fund Three Arrows Capital (3AC).

$6 Million In Question

After the failure of the fund a yr in the past, the previous CEO of BitMEX has been vehemently tweeting towards Su Zhu and his co-partner Kyle Davies, principally in search of for the 6 million {dollars} that he believes is entitled because of the fund’s collapse following the Terra UST debacle.

Read More: Bitcoin, Ethereum Price Rises As US CPI Inflation Cools To 4.9%

The ruling that was issued by Judge Sandra Looi Ai Lin of the Harassment Court stipulates that Hayes will not be permitted to ascertain contact with Zhu by way of any means, and that he’s prohibited from releasing “any identity information.” According to the injunction, Hayes can have the ruling delivered to him by way of his Twitter account.

Arthur Mocks 3AC Founders

The 38-year-old crypto entrepreneur has publicly criticized about 3AC’s debacle and even mocked their future endeavors. In one in all these tweets, dated May 2, Hayes said that they owed $6 million to him which apparently went ignored.

Awe that is candy, is that your manner of utilizing symbolism to characterize the $6 million you owe me? 1 Oyster = $1 million … https://t.co/ehWJ4wUfXB

— Arthur Hayes (@CryptoHayes) May 2, 2023

According to paperwork filed with the courtroom, 3AC is chargeable for paying particular person claimants in extra of 1 billion {dollars}. In the interim, Zhu and Davies made preparations to develop OPNX, a platform that permits buyers to commerce chapter claims for defunct companies comparable to FTX, Celsius, BlockFi, and so on. Meanwhile, Hayes has established his personal crypto fund known as Maelstrom.

Also Read: Crypto Giant Galaxy Digital Moving Operations Off Shore Citing US Regulatory Headache

The offered content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link