[ad_1]

Crypto Market News: Amid concern and uncertainty round US regional banking disaster, Jamie Dimon, the chief govt officer of JP Morgan, clarified concerning the Wall Street financial institution’s plan of motion within the occasion of additional financial institution collapses within the United States. The clarification comes at a time when the US financial system faces the hazard of additional financial institution collapses amid inflation issues. Meanwhile, a scarcity of consumers for struggling regional banks would imply the US administration stepping as much as mitigate the monetary state of affairs with emergency funding.

Also Read: Here’s Why Memorial Day Could Mark Change In Bitcoin Trader Sentiment

Recent crypto market tendencies, nonetheless, confirmed that uncertainty within the banking sector was truly bullish for Bitcoin worth as the highest cryptocurrency’s existence is centered round avoiding dependence on centralized entities just like the banks whereas performing transactions.

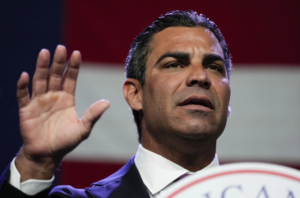

No Further Bank Purchases: JP Morgan CEO

When requested whether or not JPMorgan would purchase any extra struggling banks, Dimon said it was unlikely, talking throughout the JP Morgan’s annual shareholder assembly earlier on Tuesday. Recently, JP Morgan acquired First Republic Bank, within the backdrop of the failure of Silicon Valley Bank and Signature Bank.

Also Read: OpenAI CEO Altman Testifies Before US Congress, What It Means For Crypto

The introduced content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.

[ad_2]

Source link