[ad_1]

Bitcoin worth failed to carry momentum in direction of $30,000 after the US Federal Reserve hiked charges by 25 bps, different central banks adopted go well with and raised rates of interest. On-chain knowledge reveals whales and miners are promoting their BTC holdings as BTC worth fell below the key 200-WMA level and stays vary sure in 26,500-27,500.

Meanwhile, US Fed Chair Jerome Powell’s speech is scheduled immediately on the financial coverage outlook. Recently, different Fed officers stay cautious in regards to the coverage outlook and hinted at hawkish views on rate of interest hikes. CME FedWatch indicates the chance of a 25 bps fee hike in June has risen over 45% from 15% per week in the past.

Whales and Miners Selling Bitcoin Holdings

On May 19, CryptoQuant reported that miners’ reserves are certainly reducing inflicting important promoting stress on Bitcoin from miners.

An on-chain analyst revealed that miner dumped 1750 BTC to crypto change Binance on Thursday. The identical miner deposited 5,791 BTC final month inflicting the BTC worth to fall massively.

Bitcoin Miner Reserve on-chain knowledge signifies the reserves dropped from 1,827,457 to 1,825,618 BTC on Thursday, virtually 1840 BTC dumped to crypto exchanges. Today, miners have once more bought over 350 BTC till now and are anticipated to proceed promoting their BTC holdings.

Moreover, whales are dumping Bitcoin into exchanges. On Thursday, an tackle transferred 10,000 BTC value practically $270 million to Coinbase, when the Bitcoin worth was buying and selling at $27,620.

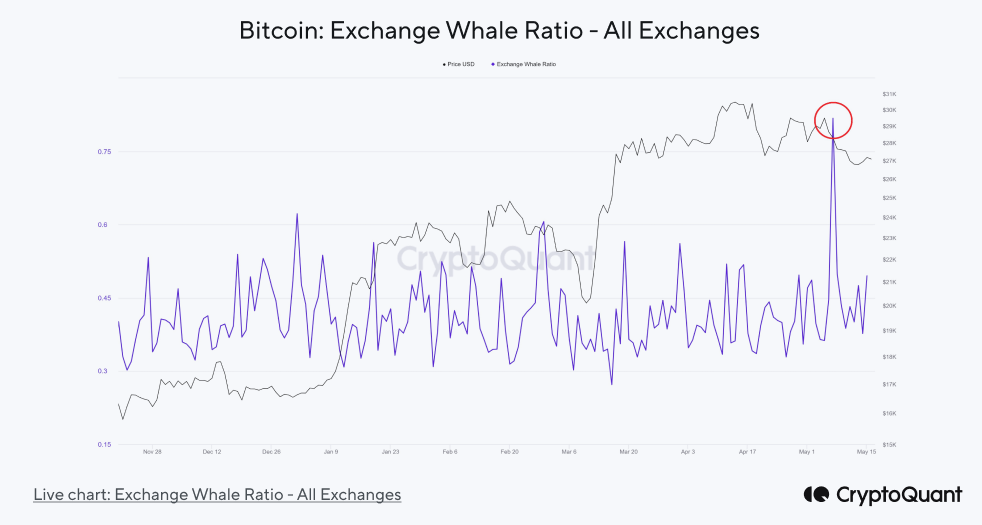

Whales have taken the lead in depositing Bitcoin into exchanges, as evidenced by the early May surge within the Exchange Whale Ratio. Without a doubt, Bitcoin transactions by these whales escalated to excessive ranges, with transfers involving greater than 40% of the cash.

Also Read: Leading Crypto Firm Raising Funds At $1 Billion Valuation

Bitcoin Price To Fall Below 200WMA

BTC price fell 2% within the final 24 hours, with the value at present buying and selling at $26,853. The 24-hour low and excessive are $26,415 and $27,466, respectively. Furthermore, the buying and selling quantity has decreased within the final 24 hours, indicating a decline in curiosity amongst merchants.

Technical indicators equivalent to Bollinger Bands and RSI point out weak point in Bitcoin upside momentum, with a potential fall to $24,600.

Also Read: Bitcoin Going To The Moon In 2023 Summer, Here’s What Elon Musk Says

The introduced content material might embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.

[ad_2]

Source link