[ad_1]

Data from Glassnode reveals the Bitcoin switch quantity remains to be 79% decrease than what was noticed in the course of the bull run again in 2021.

Bitcoin Transfer Volume Remains Low Despite The Rally

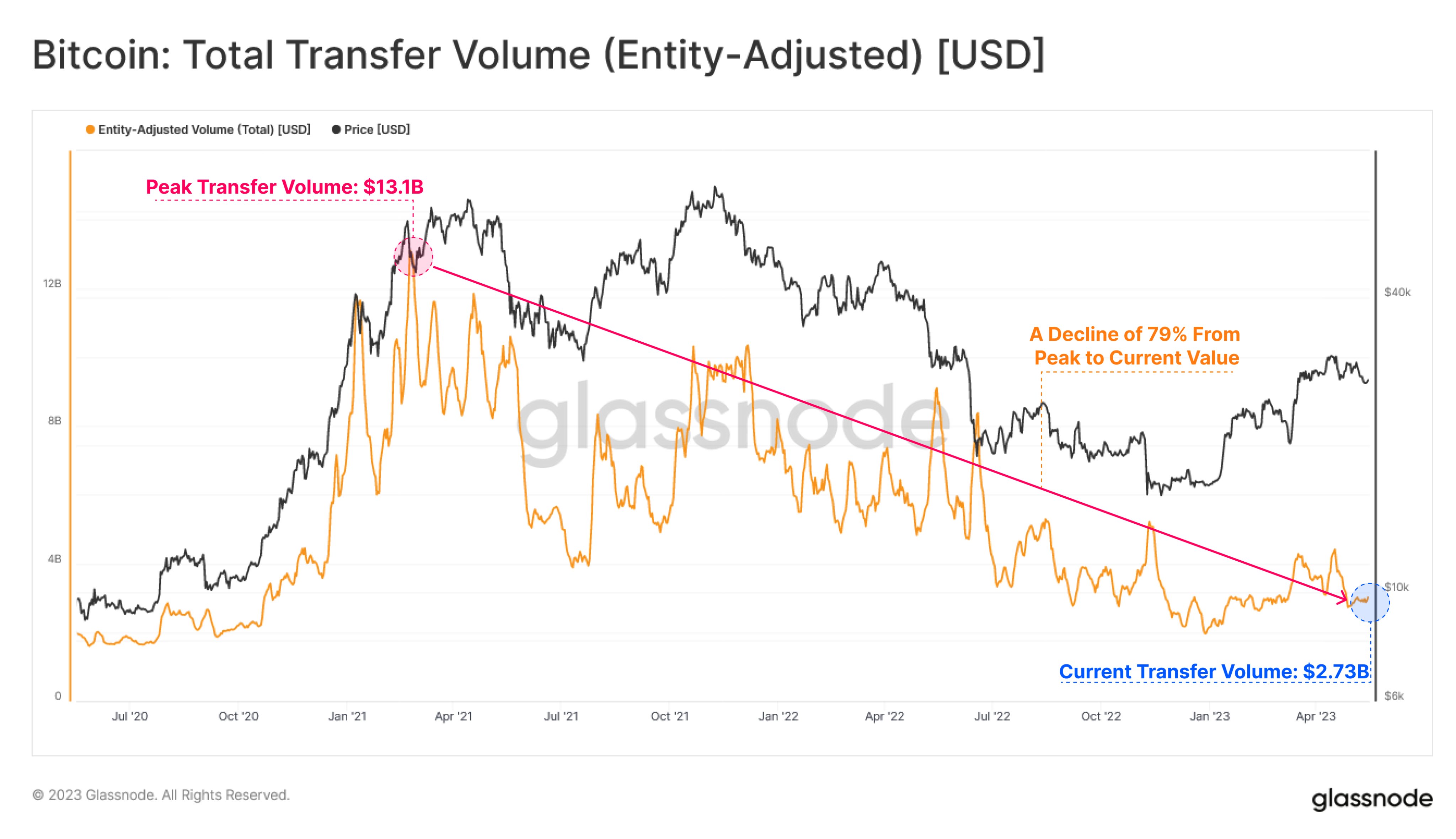

According to information from the on-chain analytics agency Glassnode, the entire switch quantity on the BTC community is simply $2.73 billion per day at the moment. The “total transfer volume” right here is an indicator that measures the entire quantity of Bitcoin (in USD) being transacted on the blockchain each day.

When the worth of this metric is excessive, it means the buyers are shifting numerous cash across the community at the moment. Such a development is usually an indication that merchants are energetic available in the market proper now.

On the opposite hand, low values of the indicator indicate the blockchain is observing low exercise in the intervening time. This sort of development can counsel that the overall curiosity within the coin amongst buyers could also be low at the moment.

Now, here’s a chart that reveals the development within the Bitcoin complete switch quantity over the previous few years:

The worth of the metric appears to have been in an total downtrend since fairly some time now | Source: Glassnode on Twitter

Note that the Bitcoin complete switch quantity indicator used right here is the “entity-adjusted” one, which means that the transactions being counted listed below are those being accomplished between entities, and never particular person wallets.

An “entity” refers to a set of addresses that Glassnode has decided to belong to the identical investor. Making the adjustment for entities has the profit that every one transfers accomplished between the wallets of a single holder are faraway from the equation, thus offering a greater estimation of the exercise on the chain.

From the above graph, it’s seen that the Bitcoin entity-adjusted complete switch quantity had surged to some fairly excessive values when the bull run within the first half of 2021 had taken place.

This development is sensible, as sharp value actions like rallies are thrilling to the overall investor, so quite a lot of customers get drawn to the blockchain throughout such intervals and add to the switch quantity.

At the height throughout this bull run, the indicator had managed to hit a price of round $13.1 billion. Since then, nonetheless, the metric has been in an total state of decline.

The bull run within the second half of 2021 additionally noticed an uplift within the switch quantity, however the metric nonetheless didn’t hit values as excessive as in the course of the rally within the first of that 12 months.

Bear markets have traditionally seen this metric drop to low values (as the worth tends to show boring sideways value motion for big stretches throughout such intervals), so it’s not shocking that the indicator additionally plunged in the course of the current bear market.

What could also be surprising, nonetheless, is that regardless of the beginning of a rally this 12 months, the Bitcoin complete switch quantity has nonetheless not seen any vital uplifts. The indicator’s worth is at the moment round $2.73 billion, which is 79% decrease than the 2021 bull run peak worth.

This lack of quantity would counsel that the cryptocurrency doesn’t have anyplace close to the identical curiosity behind it that it did in 2021, which may probably be worrying for the sustainability of the rally.

BTC Price

At the time of writing, Bitcoin is buying and selling round $26,800, down 2% within the final week.

BTC consolidates sideways | Source: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link