[ad_1]

Bitcoin worth and the crypto market normally reacted positively to the discharge of the Consumer Price Index (CPI) knowledge within the United States on Tuesday. Although the response was temporary, it emphasised BTC’s place available in the market as a riskier asset class such that at one level, it stepped above $26,430.

The second largest crypto, Ethereum (ETH) additionally gained momentum and climbed to highs above $1,850. Ether has since retraced to commerce at $1,745 on Wednesday whereas Bitcoin price dodders at $26,000.

Easing Inflation Triggers Investor Optimism as Bitcoin Price Flips Green

The CPI knowledge carries important significance within the realm of financial indicators. It supplies a gauge for the common directional change in costs that buyers are anticipated to pay for a basket of products and providers over time.

Investor sentiment noticed a lift when the CPI report revealed a softening within the annual inflation charge to 4.9% in April, a determine modestly beneath the projections put forth by economists surveyed by Dow Jones.

A lower within the CPI, or a “dropping CPI,” signifies that the common worth of those items and providers is declining.

A persistent or important drop within the CPI can sign deflation, a interval of falling costs that encourages traders to spend the excess earnings on belongings thought-about to have a better risk-reward ratio like Bitcoin and crypto.

“When it comes to inflation data, bitcoin embraces its identity as a riskier asset,” Callie Cox, an analyst crypto trade platform eToro stated. “Bitcoin has outperformed the S&P 500 on five out of the last six CPI days – and it’s on track to make it six out of seven with today’s gains.”

This newest CPI knowledge got here only a day earlier than the much-awaited Federal Reserve financial assembly. Over 76% of market watchers, in accordance to a report by CoinDesk, anticipate the Fed to pause rate of interest hikes for the primary time since March 2022.

Bitcoin Price on The Move – Whales Stay Put

Bitcoin price confronted a short sell-off final week after the US Securities and Exchange Commission (SEC) sued two of essentially the most outstanding crypto exchanges, Binance and Coinbase.

As reported, altcoins like Cardano, Solana, and Polygon have been most affected, with the SEC labeling them as securities. Despite BTC dropping to check help at $25,400, it has remained comparatively steady implying its maturity as an asset class.

Santiment, a notable cryptocurrency analytics firm, lately disclosed knowledge suggesting that Bitcoin’s main holders, usually referred to as ‘whales’—those that personal between 100 and 10,000 BTC—are amplifying their positions.

They’ve been buying roughly $26 million value of Bitcoin, or roughly 1,000 Bitcoins, day by day since April 9.

🐳 As #altcoin insanity has ensued, there quietly is a #bullish divergence between #Bitcoin‘s accumulating whales and falling worth. With whale holdings shifting up by ~1K $BTC per day whereas costs fall, there may be purpose to imagine a powerful rebound can happen. https://t.co/Ol0cK5VhPE pic.twitter.com/FeHPqqJx7o

— Santiment (@santimentfeed) June 11, 2023

This sample began when Bitcoin hovered around the $28,000 price point, hinting that these important gamers are capitalizing on the value drop. Such conduct might predict a potential bullish flip within the close to time period.

Insights from Glassnode, one other main on-chain analytics platform, affirm Santiment’s bullish outlook for BTC. Its knowledge reveals that whales are sitting tight, unbothered by the continuing crypto crackdown.

The firm’s knowledge highlights that the quantity of Bitcoin moved to exchanges by long-standing traders is remarkably minimal, at simply 0.004%. In different phrases, this reveals the unflappable inaction of this group of traders, regardless of the continuing market fluctuations and regulatory challenges confronted by outstanding exchanges.

The proportion of #Bitcoin Long-Term Holder Supply despatched to Exchanges stays extraordinarily quiet at 0.004%.

This highlights the profound inactivity of the cohort amidst elevated market misery, remaining detached to the #Binance and #Coinbase regulatory fees. pic.twitter.com/yWfdQHu4Ca

— glassnode (@glassnode) June 11, 2023

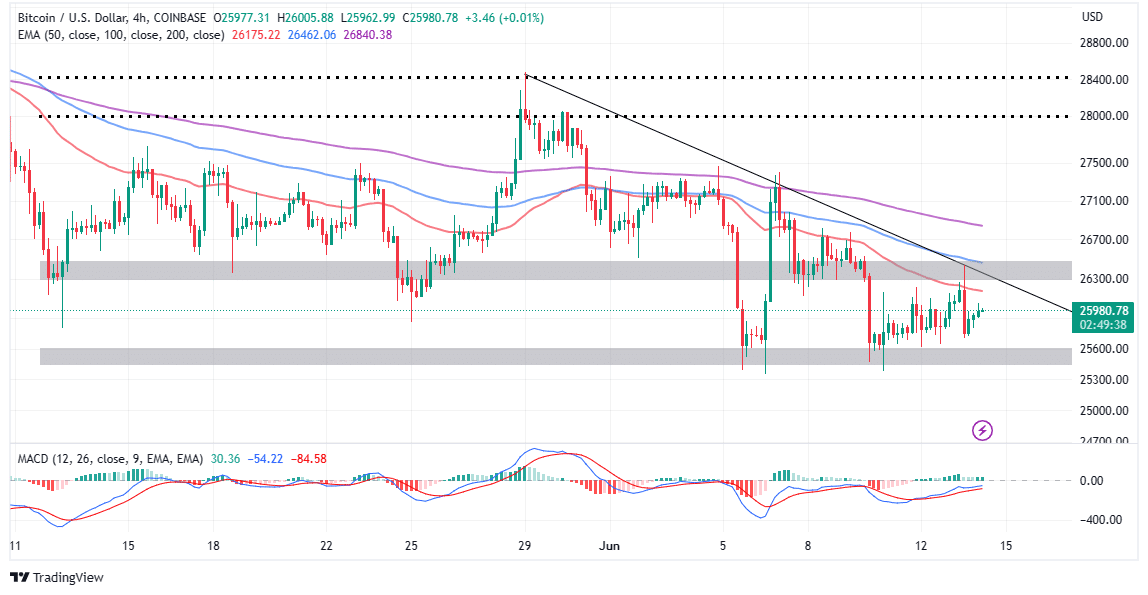

Meanwhile, the day by day chart confirms the constructing uptrend with a purchase sign from the Moving Average Convergence Divergence (MACD) indicator.

A break and a day by day shut above $26,000, the short-term resistance, would name extra retail traders into the market. Retail merchants are sometimes the weaker arms available in the market and endure essentially the most losses throughout market downturns.

Bitcoin worth should maintain the development above the 50-day EMA (in purple) for bulls to have a combating likelihood at breaking the descending trendline hurdle for a renewed transfer to $28,000 and $26,000, respectively.

On the draw back, failure to uphold help at $26,000 might invalidate the anticipated bullish transfer to $30,000 and permit for a retracement with help at $25,400 and $24,000 in thoughts.

Related Articles

The offered content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.

[ad_2]

Source link