[ad_1]

Ethereum worth knee-jerk response to Tuesday’s better-than-expected Consumer Price Index (CPI) knowledge was not sturdy sufficient to weaken the vendor congestion at $1,800. However, ETH’s temporary rebound touched highs of $1,760 adopted by a minor however sharp dip which confirmed the viability of assist at $1,730.

The token powering the biggest good contracts ecosystem is at the moment buying and selling at $1,738 whereas bulls battle a seemingly strengthening bearish grip.

With assist at $1,700 staying intact coupled with constructing optimism forward of the United States Federal Open Market Committee (FOMC) assembly in a while Wednesday, Ethereum price might embark on an upward trajectory focusing on $1,800 and $2,000 worth factors, respectively.

Can US Fed Rate Decision Trigger Ethereum Price Rally?

According to this analysis of Bitcoin Price, investor confidence obtained a lift following the discharge of the CPI report, which revealed a year-on-year inflation deceleration to 4.9% in April, modestly undercutting the predictions made by market watchers interviewed by Dow Jones survey.

Later right now, the FOMC assembly will resolve whether or not to pause rate of interest hikes, which have been maintained since Q1 2022. There is a better chance of a pause following earlier communication by the Fed. About 76% of market members, in accordance to CoinDesk, consider the regulator will discontinue the historic rate of interest hikes.

“Inflation is coming down, just as the Fed intended, and that’s easing fears about the economy’s future,” Callie Cox, an analyst buying and selling agency eToro advised CNBC. “Lower inflation also supports the case for the end of rate hikes, and higher rates are what started the crypto winter over a year ago.”

As the Fed ponders ending price hikes, optimism is anticipated to construct amongst buyers. Risky asset courses like Bitcoin and Ethereum are anticipated to profit essentially the most from the “easing of tight liquidity conditions,” Cox added.

Ethereum Price Settles For Consolidation

Ethereum worth has been caught between a rock and a tough place for the reason that SEC-triggered sell-off final week. On the draw back, assist at $1,730 seems strong sufficient to maintain bears in examine.

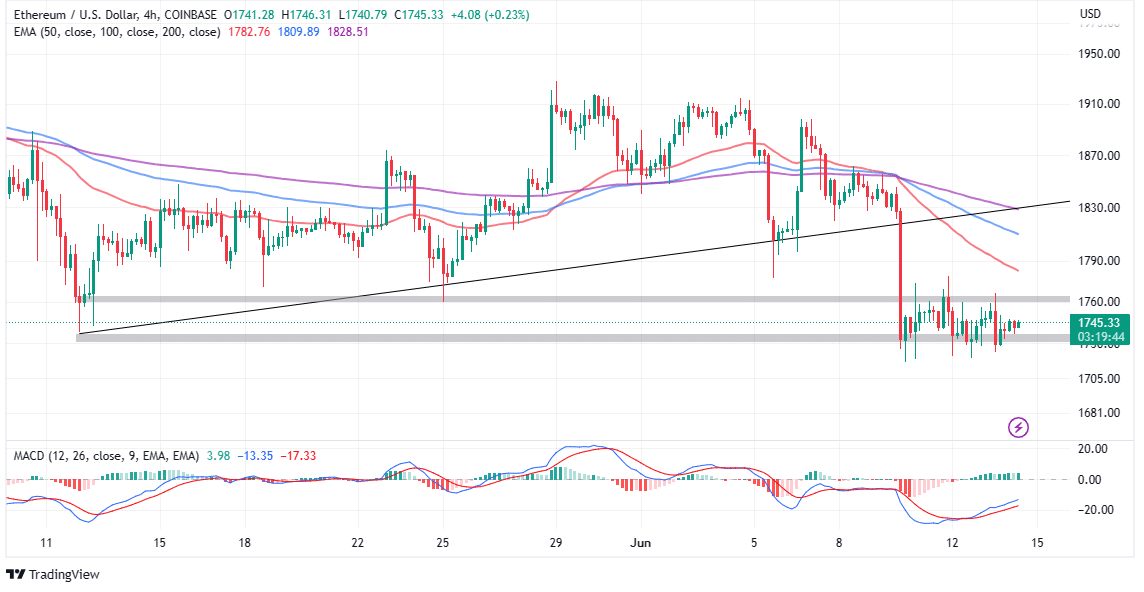

However, it has develop into a frightening activity for bulls to take care of resistance at $1,760. If the purchase sign from the Moving Average Convergence Divergence (MACD) indicator stays placed on the four-hour timeframe chart, the chance for a breakout above $1,800 would stay excessive.

Remember, bulls are at an obstacle now that ETH is buying and selling beneath all the foremost utilized transferring averages, together with the 200-day EMA (purple), the 100-day EMA (blue), and the 50-day EMA (pink).

If push comes to shove and declines lengthen beneath $1,730, buyers can begin acclimatizing to elevated overhead stress and subsequent losses to $1,700 and $1,600, respectively.

Ethereum On-chain Activity Steadies

Intriguingly, some key on-chain metrics have remained regular regardless of final week’s capitulation. Having achieved a document peak in May, the momentum of staking actions throughout the Ethereum community has prolonged its upward trajectory into June 2023.

Glassnode’s ‘Supply in Smart Contracts’ metric presents insights into staking dynamics by gauging the share of the general circulating ETH at the moment dedicated to varied protocols.

In the interval spanning from June 1 to June 12, cryptocurrency lovers have additional dedicated an extra 360,000 ETH to the Ethereum Beacon chain and DeFi good contracts.

The spike in Ether held in staking contracts shrinks obtainable provide on exchanges, thus decreasing promoting stress. If this basic issue holds, Ethereum worth could ignite an uptrend within the brief time period.

Related Articles

The offered content material could embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link