[ad_1]

Ethereum has plunged under $1,700 throughout the previous day. Here’s the on-chain indicator that will have signaled this dip prematurely.

Ethereum Age Consumed Metric Saw A Spike Before The Price Decline

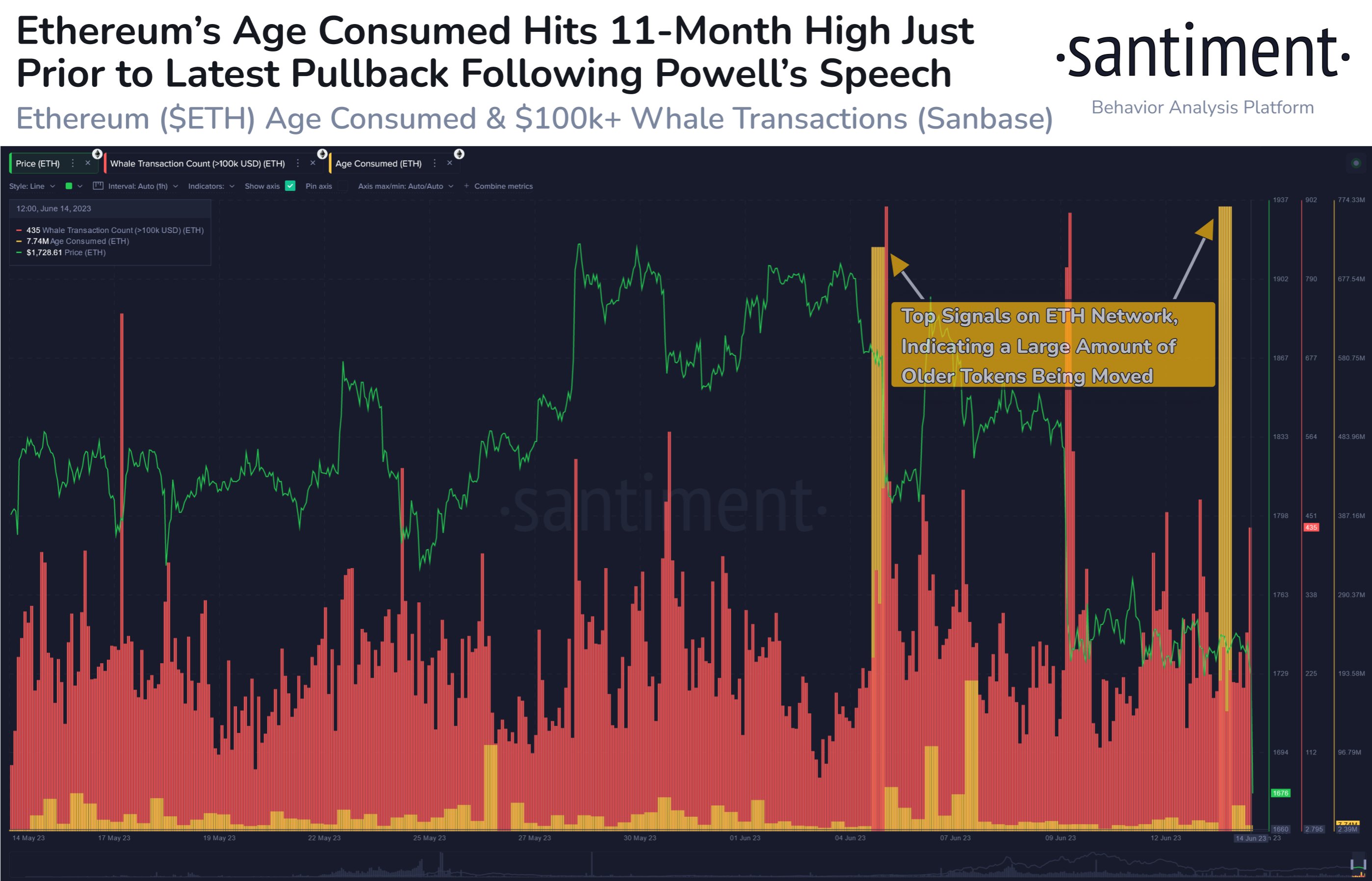

According to knowledge from the on-chain analytics agency Santiment, institutional traders look to have been anticipating the transfer to happen. The indicator of curiosity right here is the “ETH age consumed,” which first finds the whole variety of cash shifting on the Ethereum blockchain. Then it multiplies this worth by the times these cash had been dormant earlier than their motion.

So, on this method, the metric retains observe of what number of cash are being bought/moved every day and makes use of their age as a weighting issue. This implies that many aged cash are moved to the community every time this indicator’s worth is excessive.

Naturally, low values of the metric, then again, would indicate that there aren’t many cash shifting on the chain proper now or some cash with a low common age are being transferred.

Now, here’s a chart that reveals the pattern within the Ethereum age consumed over the previous month:

Looks like the worth of the metric has been fairly excessive in current days | Source: Santiment on Twitter

As displayed within the above graph, the Ethereum age consumed metric had lately registered a really giant spike. This would counsel the potential motion of many dormant cash on the chain throughout this surge.

Generally, when such giant spikes within the indicator are noticed, it’s an indication of promoting from the long-term holders (LTHs). The LTH cohort contains all of the traders holding onto their cash since greater than 155 days in the past.

These holders are the skilled palms available in the market who don’t simply promote even when the market is distressed. Because of this cause, their actions could be one thing to be careful for, as once they do lastly promote, it’s often not a constructive signal for the value.

The chart reveals that the LTHs had additionally proven a big transfer earlier within the month. Shortly after these traders turned energetic, the cryptocurrency worth plunged.

This time, the spike within the Ethereum age consumed additionally appears to have preceded a worth decline, because the cryptocurrency’s worth has now dropped under the $1,700 degree.

This newest worth plunge has come after the information that the US Federal Reserve isn’t raising interest rates this time, however extra hikes could be coming later within the 12 months to battle inflation.

Santiment means that the spike within the age consumed metric earlier than the value decline may indicate that the establishments already anticipated the transfer, therefore why they shifted their cash early.

ETH Price

At the time of writing, Ethereum is buying and selling round $1,600, down 11% within the final week.

ETH has taken a plunge lately | Source: ETHUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Santiment.internet

[ad_2]

Source link