[ad_1]

Key Takeaways

- Regulators are clamping down onerous on the US crypto business, with current lawsuits introduced in opposition to Binance and Coinbase

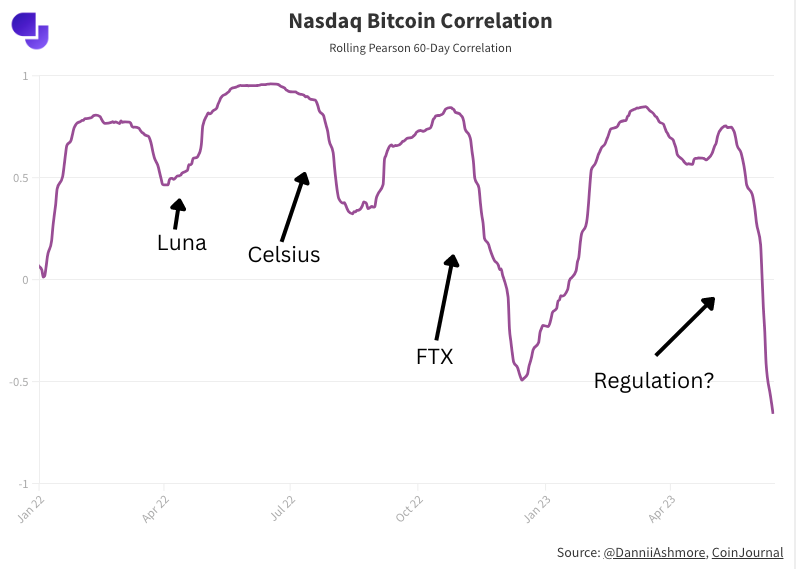

- Bitcoin’s correlation with shares is at a 5-year low, with the latter hovering however Bitcoin’s worth suppressed by issues round future of business in US

- Exchanges have seen net outflows for 33 days in a row, however dimension of withdrawals should not significantly notable

- Binance is seeing the biggest withdrawals, 7.3% of its steadiness heading for the exit doorways

- Allegations in opposition to Binance transcend securities violations which most centralised corporations are going through

Binance’s conflict with the SEC goes on. As does Coinbase’s. As does, effectively, your complete cryptocurrency house, which abruptly faces a regulatory menace that feels existential for the crypto business within the US.

The market has responded, unsurprisingly, by promoting. Bitcoin dipped beneath $25,000 for the primary time in three months final week, earlier than bouncing again to the place it at present trades at $26,500.

More notable, nevertheless, was that this got here amid a time when the inventory market is hovering. As I detailed in depth last week, the correlation between shares and Bitcoin is now at a 5-year low. This is just like the dip in correlation we noticed in November when FTX collapsed whereas the inventory market surged off softer-than-expected inflation numbers.

In such a method, whereas Bitcoin’s worth decline appears minor on the face of issues, it’s underperforming comparatively as the remaining of the market is purple sizzling.

In such a method, whereas Bitcoin’s worth decline appears minor on the face of issues, it’s underperforming comparatively as the remaining of the market is purple sizzling.

Bitcoin on exchanges

But past worth, how are markets reacting? Are folks once more involved about storing their belongings with these centralised exchanges?

Well, wanting on the complete quantity of Bitcoin sitting in these exchanges, there was net outflows for 33 days in a row. That is the longest streak since November 2022 amid the FTX scandal.

The scale of withdrawals just isn’t the identical, nevertheless. Back in November, the final time we noticed a constant stream of net withdrawals, FTX was uncovered as bancrupt (and fraudulent) with $8 billion of buyer belongings gone. Fear was excessive and your complete market panicked, involved that different exchanges may observe. Bitcoin ran for the exit doors, a lot of it despatched straight to chilly storage (or offered for money).

While the present developments are regarding for crypto in their very own method, there seems to be no concern that buyer belongings are in peril. This just isn’t a repeat of FTX, and the market response can also be considerably extra muted.

Indeed, if we take a look at the overall steadiness of Bitcoin throughout exchanges, we are able to see that the current dip doesn’t stand out within the context of the steep downtrend we’ve got seen because the begin of 2020.

Is Binance totally different?

But what about Binance? Accusations levelled on the world’s largest crypto trade are definitely extra sordid than merely securities violations. Binance and CEO Changpeng Zhao have been accused of buying and selling in opposition to clients, manipulating commerce quantity, failing to implement enough cash laundering procedures, encouraging US clients and VIPs to avoid location-based restrictions, and commingling buyer funds.

It is the latter accusation which is the headline one and throws up painful recollections of FTX. While I’ve been crucial of Binance for working in an extremely opaque method (they’ve at all times refused to disclose their liabilities), there was no proof up to now that buyer funds have been misappropriated as they have been within the FTX case. Again, this actually has little in widespread with the FTX scenario.

On Saturday, a US court docket even accredited an settlement between Binance and the SEC that might dismiss a short lived restraining order to freeze all Binance.US belongings.

“We are pleased to inform you that the Court did not grant the SEC’s request for a TRO and freeze of assets on our platform which was clearly unjustified by both the facts and the law,” Binance.US stated on Twitter.

This seems to have assuaged the doomsday state of affairs, no matter probability there was of that to start with. In wanting on the flows on Binance particularly, nevertheless, it has seen extra outflows than some other main trade. 7.3% of its Bitcoin steadiness was withdrawn within the two weeks because the lawsuit was introduced on June fifth. That equates to 52,000 Bitcoin, or about 0.3% of the overall circulating provide.

For context, when Binance got here underneath hearth for its lack of transparency round reserves after FTX collapsed, 13.3% of its Bitcoin steadiness was withdrawn in an analogous two-week interval – evidently larger as seen on the above chart, almost double the flows of what have been seen to this point amid this SEC case.

What does this all imply? Not very a lot, actually. Binance has lengthy operated within the shadows, and as I wrote here upon the SEC’s case being introduced, it was a day that had lengthy been coming. But there shouldn’t be a sudden uptick in concern across the security of buyer funds, and that’s mirrored within the comparatively small move of funds out of the platform.

Nonetheless, the allegations in opposition to Binance are excess of merely promoting unregistered securities, which is the principle sticking level throughout the business (and what Coinbase is being sued for). It is because of this that funds have moved out of Binance at a sooner tempo than different exchanges, even when the dimensions of these is not any cause for alarm.

All in all, the response is no surprise. Nor have been the information of these lawsuits, actually.

[ad_2]

Source link