[ad_1]

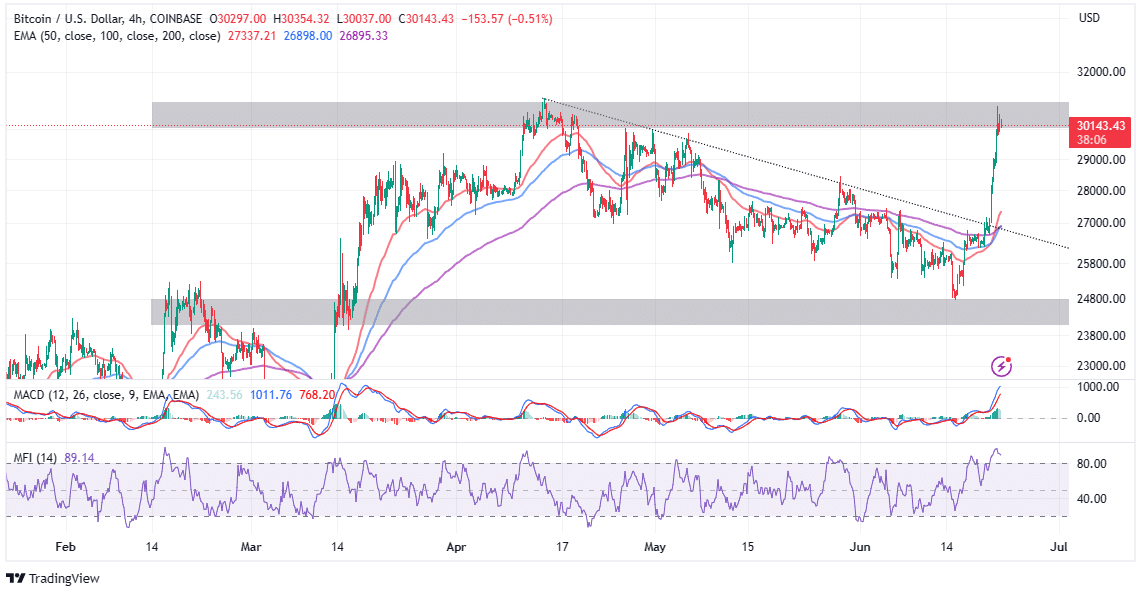

Bitcoin worth is closing in on 2023 highs as market sentiment improves throughout the board. The final couple of weeks have been significantly attention-grabbing with BTC falling under $25,000 and promptly reversing the pattern to $30,820.

Mid-last week’s remarks by Jerome Powell, the US Federal Reserve Chair, didn’t sit effectively with buyers. Beyond pausing the long-standing rate of interest hikes for the primary time since March 2022, Powell mentioned that the financial institution is inclining towards a “watch and see” method.

This implies that we may see extra fee hikes because the battle to deliver inflation all the way down to 2% rages on. Investors in threat property like Bitcoin and crypto had been initially discouraged by the remarks however quickly began to grasp the optimistic short-term sentiments stemming from the pause on fee hikes.

Wall Street’s Love for Crypto Sends Bitcoin Above $30,000

Blackrock, one of many largest corporations on this planet, spanning many industries shocked all the world when it filed for a spot Bitcoin ETF final week. Since then, increasingly more Wall Street corporations have been making strikes within the trade.

Fidelity Investments in collaboration with Charles Schwab, Citadel Securities, Fidelity Digital AssetsSM, Paradigm, Sequoia Capital, and Virtu Financial launched EDX Markets, a brand new crypto trade serving brokers and buyers within the digital asset house.

In the most recent submission on Wednesday to the Securities and Exchange Commission (SEC), Valkyrie Funds – an entity already managing a Bitcoin Strategy ETF and a Bitcoin Miners ETF – revealed its intent to ascertain a spot Bitcoin exchange-traded fund.

The ETF, dubbed the Valkyrie Bitcoin Fund, will harbor bitcoin, mirroring the efficiency of the CME CF Bitcoin Reference Rate, New York Variant. It aspires to make its shares out there on the Nasdaq trade below the ticker BRRR.

However, the SEC hasn’t given its nod to a spot Bitcoin ETF but. In the earlier week, WisdomTree, Invesco, and BlackRock every made filings for their very own spot Bitcoin funds.

As optimism builds for a potential spot Bitcoin ETF within the US, BTC worth has made large progress, breaking above resistance at $28,000 and $30,000. Based on the every day chart, the uptick, which seems to have slowed down as a result of resistance across the $31,000 space, was bolstered by elevated curiosity from each retail and crypto whale buyers.

Bitcoin Price Eyes Consolidation Before Extending Breakout

The largest cryptocurrency’s climb above $30,000 faces mounting resistance at $31,000. This may name for a consolidation interval within the vary between $29,000 and $31,000. An enormous pullback is unlikely primarily based on bettering market sentiment and demand for BTC from both retail and institutional investors.

Michaël van de Poppe, a famend analyst and dealer believes as Bitcoin dominance approaches the purpose of resistance, it might permit the worth to consolidate. At the identical time, it will guarantee altcoins “have some period of relief” the place they “can pick up pace.”

#Bitcoin dominance approaching subsequent level of resistance, whereas #Bitcoin reaches the following level of resistance as effectively.

Probably #Bitcoin will begin to consolidate, so #Altcoins have some interval of reduction approaching and might choose up tempo. pic.twitter.com/5oxf75gorA

— Michaël van de Poppe (@CryptoMichNL) June 22, 2023

That mentioned buyers ought to rigorously be careful for Bitcoin worth motion when testing help at $29,000 and resistance at $31,000. A break above $31,000 may validate the following rally to $38,000. On the flip facet, sliding under $29,000 would pressure the help at $28,000 and threat an even bigger drop to $25,000.

Related Articles

The introduced content material might embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link