[ad_1]

Cardano (ADA), Solana (Solana), and Polygon (MATIC) dealing with a much-anticipated selloff from Robinhood Markets and Celsius. Robinhood will promote these cryptocurrencies on June 27, whereas Celsius to liquidate its crypto holdings over a time frame beginning July 1. Robinhood can also be shedding round 150 staff, 7% of its workforce, attributable to lowered buying and selling quantity and higher align the workforce constructions.

Cardano, Solana, Polygon (MATIC) Selloff

After the US SEC lawsuits in opposition to Binance and Coinbase, Robinhood introduced to finish of help for Cardano (ADA), Polygon (MATIC), and Solana (SOL) on June 27, 2023 at 6:59 PM ET. The US SEC contemplating high cryptocurrencies Cardano (ADA), Polygon (MATIC), and Solana (SOL) as securities confronted backlash from the crypto neighborhood.

Robinhood customers have withdrawn or bought roughly half of their holdings during the last two weeks. It is estimated that Robinhood to promote $15 million of MATIC, $25 million of $25 million, and ADA price $30 million.

Jump Trading, which manages crypto for Robinhood, will liquidate all remaining holdings instantly after 6:59 PM ET on June twenty seventh. As per specialists, choices embrace promoting it OTC, taking it onto their books, hedging on perps, and depositing to centralized exchanges.

In addition, Celsius will regularly liquidate crypto property beginning July 1. As per their submitting, the agency maintain $2.5 million price of SOL, $26 million of ADA, and $60 million price of MATIC.

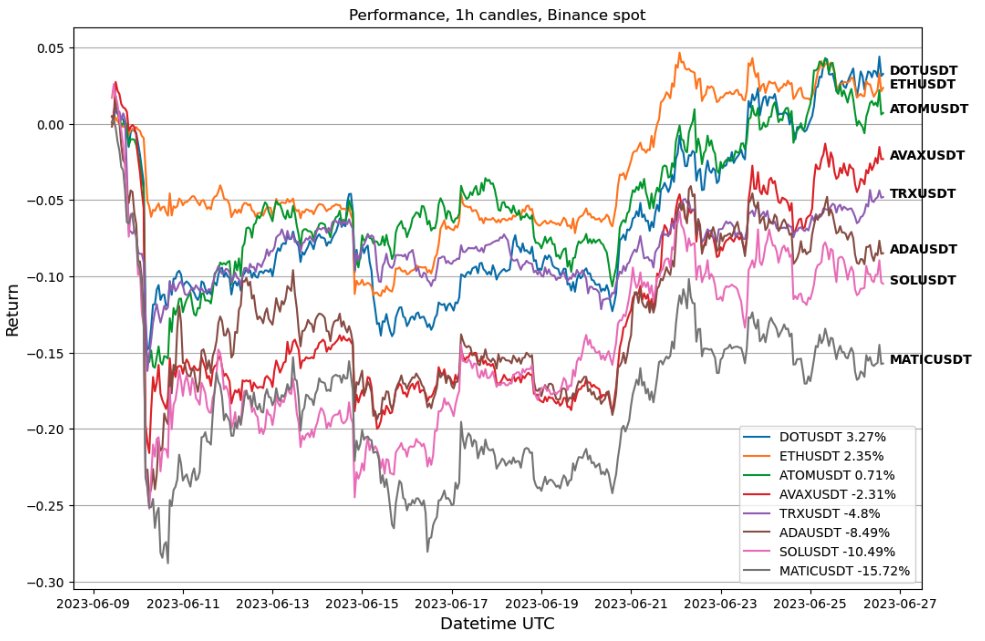

Cardano, Solana, and MATIC are underperforming the market and its friends because the Robinhood and Celsius bulletins earlier this month.

ADA worth presently trades at $0.27, down 3% within the final 24hrs. Solana and Polygon (MATIC) costs commerce at $16.46 and $0.65, dropping 3% and 1% in 24hrs.

Also Read: Why July Is Crucial For Ripple Vs SEC Lawsuit, XRP Price & Overall Crypto Market?

Robinhood Lays Off 7% Of the Workforce

According to a report by Wall Street Journal, Robinhood Markets is slashing 7% of its full-time employees. The layoff is predicted to have an effect on 150 staff — the web brokerage agency’s third spherical of layoffs in a 12 months.

Robinhood continues to face troubles attributable to a decline in month-to-month energetic customers and income. The fall in buying and selling volumes and regulatory stress have prompted new points for the web brokerage agency.

Also Read: Terra Luna Classic (LUNC) Community Supports USTC Repeg And Quant Team Proposal

The offered content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.

[ad_2]

Source link