[ad_1]

The largest good contracts token, ETH, is down 0.4% on Tuesday after bulls misplaced the battle round $1,900. Despite the pullback from the weekly excessive of $1,943, Ethereum value nonetheless upholds an 8% acquire in seven days.

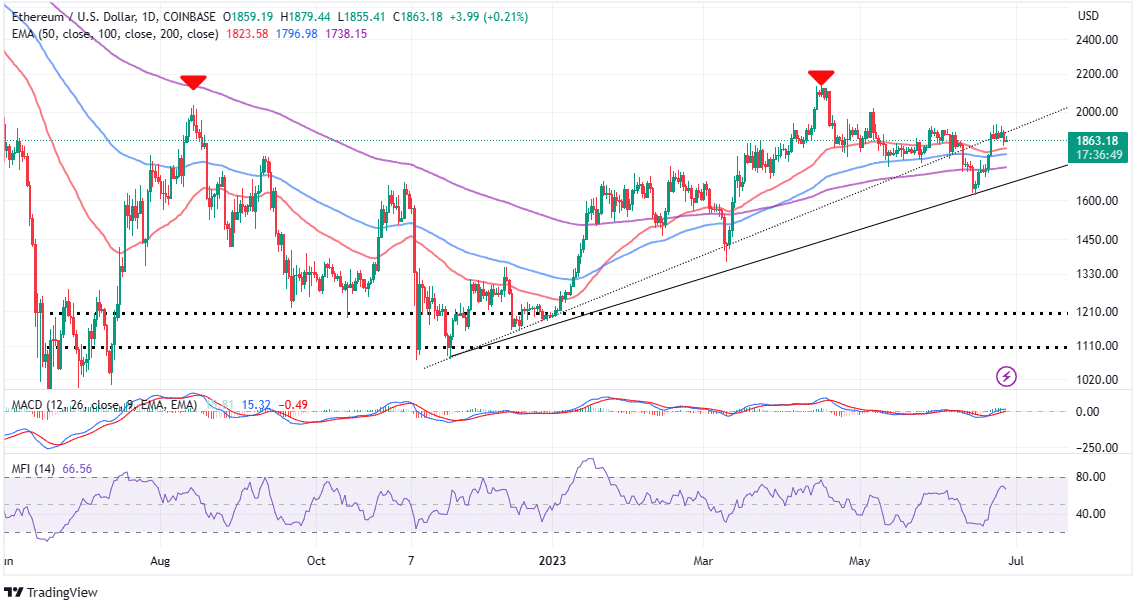

As the value wobbles at $1,865 and merchants usher within the European session, Ethereum price is facing two conflicting scenarios.

Reclaiming resistance above $1,900 might clear the trail to $2,000. On the flip aspect, dropping assist on the 100-day Exponential Moving Average (EMA), which is grounded at $1,800, may go away ETH weak to declines concentrating on decrease likes akin to $1,730 and $1,600.

Ethereum Staking Accelerates Post-Shapella Upgrade

According to blockchain analysis platform Messari, Ethereum staking has been bettering because the Shapella improve, which occurred in April. Before this community replace that allowed traders to freely stake and unstake Ether, “staking growth was slow and perceived as riskier.”

However, market circumstances modified and improved drastically following the implementation of the Shapella improve. Users now have the liberty to “comfortably stake and unstake ETH,” thus accelerating the speed of staking.

On-chain knowledge reveals that May 2023 noticed the best month-to-month influx because the Shapella improve went dwell.

Prior to Shapella-enabled withdrawals, $ETH staking development was gradual and perceived as riskier.

Post Shapella, customers can comfortably stake and unstake $ETH. This freedom has truly accelerated the speed of $ETH staked, with May 2023 seeing the best month-to-month web influx. pic.twitter.com/z3iULVOPL0

— Messari (@MessariCrypto) June 27, 2023

An elevated staking price signifies that traders desire to HODL Ethereum as opposed to storing the tokens on exchanges the place they are often offered simply. Similarly, knowledge from one other analytics platform, Santiment, shows that the largest non-exchange addresses have been rising the extent of provide they maintain.

On the opposite hand, high non-exchange wallets have seen the availability they account for dwindle and is close to genesis ranges. Santiment says that “ETH provide on exchanges is down to 9.2%.

Ethereum Price Slows Pullback As $3,000 Beckons

Ethereum value wobbled above $1,900 over the weekend, which handed the baton to bears, who began exerting extra overhead stress on Monday. This, coupled with resistance emanating from the higher rising and dotted trendline, forced ETH to explore downhill levels, testing assist offered by the 50-day EMA (crimson) at $1,823.

The Relative Strength Index (RSI) affirms the rising bearish grip because it abandons the uptick to the overbought area, settling for retracement throughout the impartial zone. Traders ought to contemplate ETH’s response to assist on the 50-day EMA, and particularly the client congestion on the 100-day EMA (blue) round $1,800.

If push comes to shove and Ethereum slips below those two key levels, traders could begin conditioning themselves for an prolonged pullback. On the intense aspect, these retracements are unlikely to be bigger, contemplating the improved market construction for Ether and the remainder of the crypto market normally.

The Moving Average Convergence Divergence (MACD) upholds the bullish outlook because it settles above the imply line (0.00). With the MACD line in blue above the sign line in crimson, the trail with the least resistance might be to the upside.

In that case, a break above the psychological barrier at $2,000 would pave the way for the next recovery phase to $3,000.

Related Articles

The offered content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link