[ad_1]

Bitcoin bulls are doing all that’s potential to uphold their place above $30,000. This comes after a correction from the most important crypto’s not too long ago achieved 12-month excessive, barely above $31,000.

With 0.3% of accrued positive aspects within the final 24 hours, Bitcoin value is buying and selling at $30,380 on Wednesday. Meanwhile, reports in the market show that investors, each retail and institutional, are making ready for a “seasonal surge” in Bitcoin value.

History, according to Matrixport, a supplier of crypto companies, has proven that BTC tends to carry out higher in July.

Bitcoin’s efficiency over the previous ten years demonstrates a powerful common surge of over 11% every July, with seven out of the final ten July months boasting constructive returns, in line with the report.

The examine additional revealed that the earlier three years had yielded substantial returns in July, with respective will increase of round 27%, 20%, and 24%.

“While summer tends to be a period of consolidation for bitcoin, a strong July tends to be followed by a mediocre August and a selloff in September,” Markus Thielen, the pinnacle of analysis, stated within the report.

Bitcoin Price May Rally To $35,000 Before Retracing

The Matrixport report predicts a right away Bitcoin value rally to $35,000. However, the crypto companies supplier cautions of a potential pullback to $30,000 forward of the following spike past $40,000.

Bitcoin value is estimated to be price $45,000 by the tip of 2023.

Recent developments within the crypto market, together with Blackrock’s choice to file with the US Securities and Exchange Commission (SEC) for a spot Bitcoin ETF and the launch of Fidelity-backed EDX Markets, could proceed to provide BTC with the mandatory momentum to climb to $35,000 within the brief time period.

Market members, together with analysts like Bloomberg’s Eric Balchunas, believe Blackrock is likely to get the SEC’s approval to operate the spot BTC ETF. In addition to this, Grayscale, the most important digital asset supervisor on the planet, as per Bloomberg Intelligence’s Elliot Stein, has a 70% likelihood of profitable the case towards the SEC.

Another purpose we give spot bitcoin ETF approval 50% likelihood is our senior authorized analyst @NYCStein offers Grayscale a 70% likelihood of profitable case towards SEC, who might approve BlackRock’s ETF as strategy to save face utilizing trusted ‘adult’ TradFi cos & stick it to Grayscale by way of @JSeyff pic.twitter.com/pHydOcpuQo

— Eric Balchunas (@EricBalchunas) June 27, 2023

Grayscale, because it utilized to transform its Bitcoin Trust shares right into a spot ETF was rejected, has been concerned in a prolonged authorized battle with the SEC.

“Grayscale has a 70% chance of winning its lawsuit against the SEC over the company’s bid to convert the Grayscale Bitcoin Trust (GBTC) to a Bitcoin ETF, we believe,” Stein defined.

Bitcoin Price In Consolidation

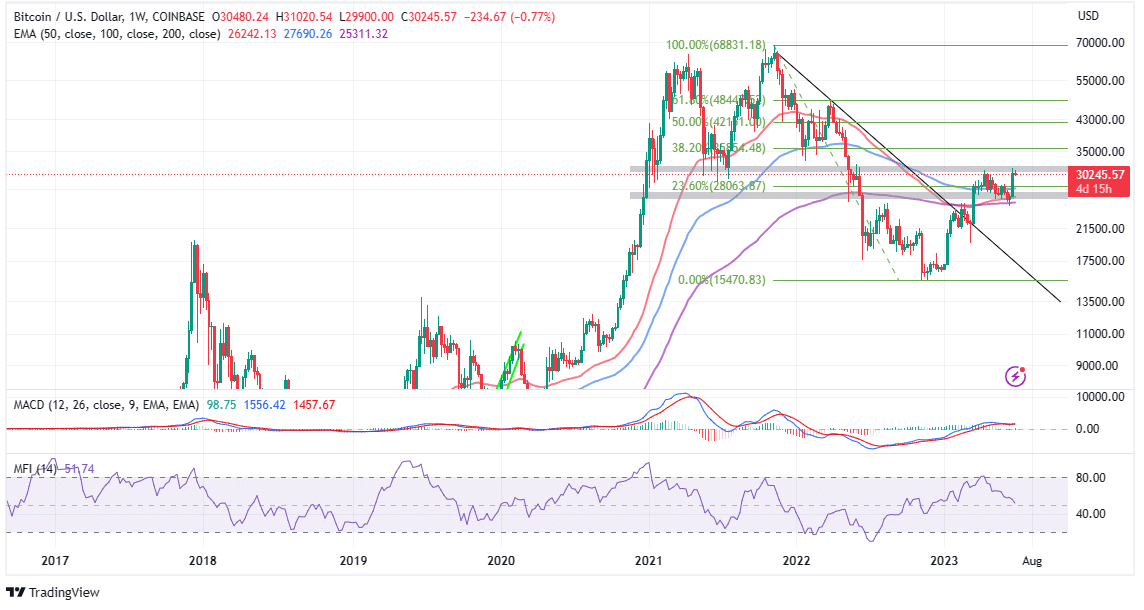

Bitcoin value has been doddering marginally above $30,000 since early this week. The Moving Average Convergence Divergence’s (MACD) place within the constructive area exhibits that patrons have the higher hand.

However, the Relative Strength Index (RSI) retracement from the overbought area right down to the midline exhibits that unfavourable market forces usually are not favorable for a rally for the time being.

Therefore, help at $30,000 stays essential for the resumption of the uptrend. If declines overshoot this key space, the confluence help at $27,690 fashioned by the 100-day Exponential Moving Average (EMA) and 38.2% Fibonacci retracement stage will turn out to be useful.

Traders who could wish to take lengthy positions in Bitcoin value could wish to wait till a pattern reversal is confirmed above $30,000 and particularly the 12-month excessive marginally above $31,000. From right here, buyers could acclimatize to a Bitcoin price rally to $35,000.

Related Articles

The offered content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.

[ad_2]

Source link