[ad_1]

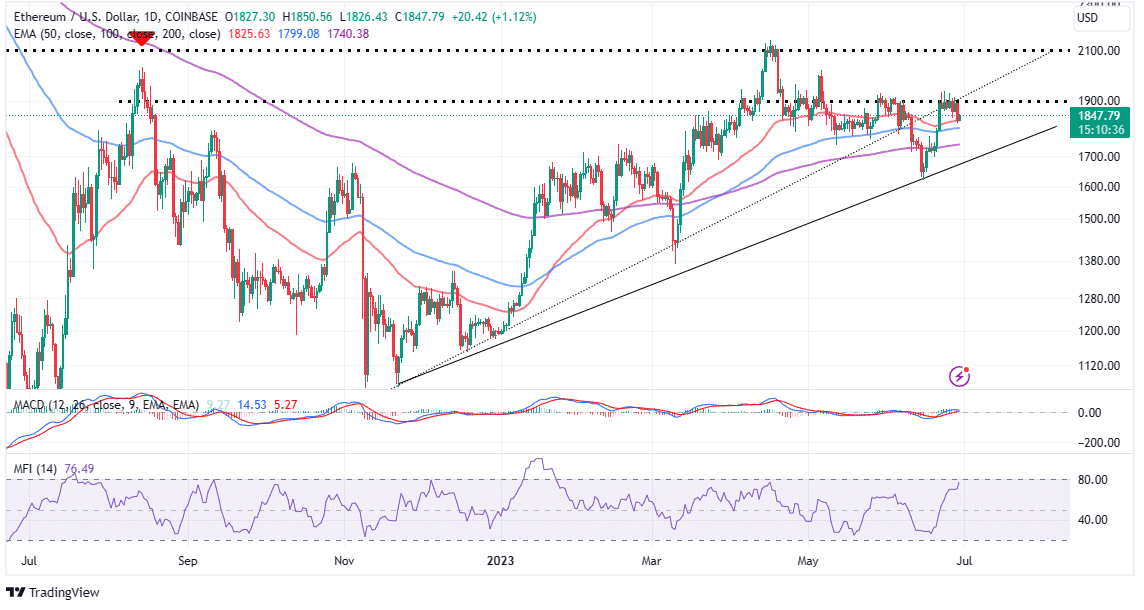

The token native to the biggest sensible contacts ecosystem and the second-largest crypto, ETH, is buying and selling barely unchanged from Wednesday’s ranges round $1,845. A rejection from highs round $1,900 noticed Ethereum worth check assist at $1,825.

However, with the crypto market typically steady throughout the board, these declines had been arrested rapidly therefore the climb to $1,845.

Ethereum price has not been capable of maintain an uptrend above $1,900 since early May, not to mention reclaim resistance at $2,000. With this evaluation, merchants and traders are probably to determine tips on how to keep away from losses and keep worthwhile towards a weekend that additionally marks the start of a brand new month.

Mastercard Announces Ethereum-Powered Blockchain App Store

As Mastercard and different world funds suppliers discover crypto-based monetary providers, the latter says it is able to develop an Ethereum-backed app retailer. In an announcement made on June 28, the worldwide bank card firm unveiled the “Multi Token Network.”

The new app retailer will initially launch in beta model within the United Kingdom over the approaching months.

According to Raj Dhamodharan, Mastercard’s govt vp and head of crypto and blockchain, the Multi Token Network (MTN) is an “app store powered by blockchain technologies for building regulated financial applications.”

The modern platform will give builders entry to instruments Mastercard has been constructing for the reason that starting of the yr. These instruments are supported on a non-public model of the Ethereum blockchain.

“A lot of the things people cover and talk about these days in crypto are the regulatory aspects of it and all the technology and investment as an asset and so forth,” Dhamodharan instructed Fortune.

Mastercard’s earlier incursions into the realm of digital belongings span a various vary, encompassing non-fungible tokens (NFTs), credit score and debit playing cards tied to cryptocurrency, digital asset infrastructure, and instruments designed for builders.

“Our goal is to support the wider digital asset industry and interested parties to help fortify confidence in its future,” the pinnacle of crypto and blockchain added.

Ethereum Price Stays Grounded Above $1,800

Ethereum’s rebound above $1,800 was a much-needed transfer because it eliminated stress off the decrease assist areas at $1,700 and $1,600. It additionally pushed ETH above all the applied moving averages, beginning with the 200-day EMA (purple), the 100-day EMA (blue), and the 50-day EMA (purple).

Holding on prime of the 50-day EMA at $1,825, bulls appear prepared to shut the hole to $1,900, which might pave the way in which for the last word homerun to the $2,000 milestone. Many alerts, together with the one from the Money Flow Index (MFI), present that the trail with the least resistance is presently to the upside.

Traders might need to fireplace up their purchase orders with Ethereum lifting above $1,850. However, they need to accomplish that cautiously, guaranteeing that assist on the 50-day EMA holds. Otherwise, a drop to $1,800 and $1,700 can’t be dominated out at the moment.

Adding credence to the bullish outlook is one other purchase sign from the Moving Average Convergence Divergence (MACD) indicator. In addition to the MACD line in blue holding above the sign line in purple, the momentum index is within the optimistic area on prime of the imply line.

In different phrases, Ethereum price is likely to rally to $1,900 and $2,000 versus dropping to $1,700 and $1,600, respectively, based mostly on the prevailing market construction.

Related Articles

The offered content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link