[ad_1]

The crypto market construction has improved immensely over the previous few weeks. Although not explosive, the most important crypto, Bitcoin, boasts a 54.4% progress within the final 30 days, bringing its cumulative yearly acquire to 63.5%.

Bitcoin’s bullish outlook, which firmly steadied in June, has continued into July, and in accordance to market insights, it might propel BTC to $38,000.

Based on dwell knowledge from CoinGape, Bitcoin price is up 1.4% on the day, however of extra significance, bulls have reclaimed resistance at $31,000 and are engaged on closing the hole to the subsequent hurdle at $32,000.

Bitcoin Price Triumphs As Selling Pressure Dwindles

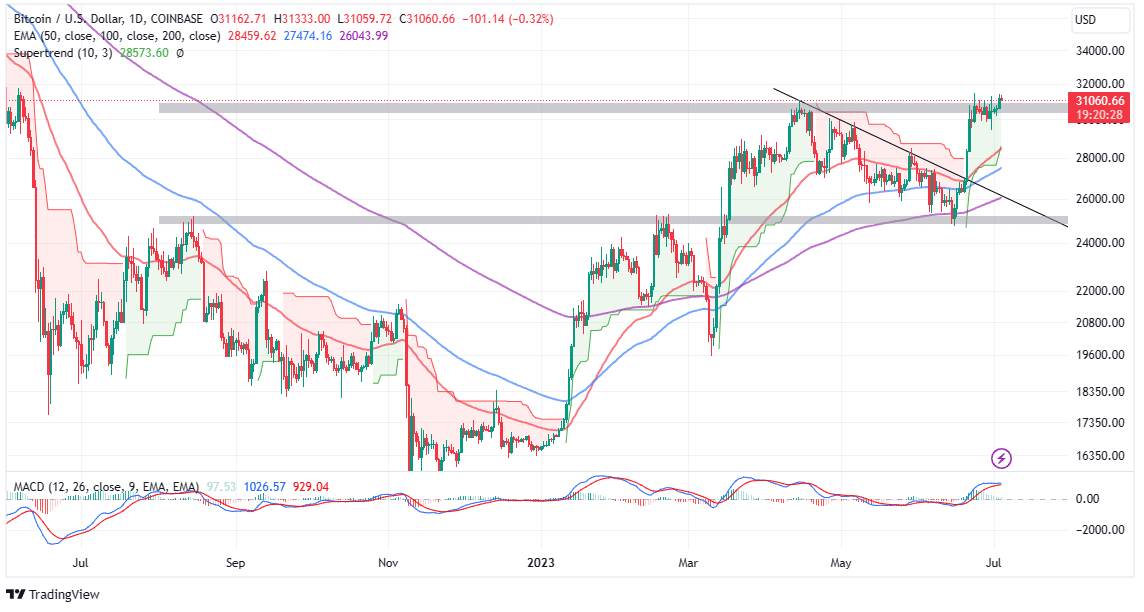

As mentioned in our earlier evaluation, Bitcoin price was riding on a wave of several buy signals, beginning with the Moving Average Convergence Divergence (MACD) indicator. In addition to flashing a purchase sign in June, with the MACD line in blue crossing above the sign line in pink, the momentum indicator crossed above the imply line, reinforcing the bullish outlook.

Subsequently, the SuperTrend indicator additionally flipped under Bitcoin value, thus validating the breakout from $25,000. This indicator overlays the chart like transferring averages however goes a step additional to gauge the volatility out there by incorporating readings from the typical true vary (ATR).

Bitcoin will hold the uptrend intact so long as the SuperTrend indicator maintains its place under the value. Traders would anticipate an reverse response, with BTC cooling off if the volatility index flips above the value.

Notably, a day by day shut above $31,000 will go a good distance to hold Bitcoin’s uptrend grounded. In different phrases, investors are likely to keep buying BTC if the elusive help at $31,000 obliges within the coming periods.

On the opposite hand, a breakout above $32,000 could be one other sign that Bitcoin value is lastly on a trajectory to shut the gap to two key ranges: The cussed vendor congestion at $35,000 and the psychological resistance at $38,000.

On-chain insights from Santiment, a number one analytics platform, present that investor confidence has been growing at a commendable fee, sparking curiosity in BTC accumulation.

However, “trader profits for BTC are a bit on the high end, which implies there could be a cooldown.”

😮 #Bitcoin is making a run at breaking $31.3k as key stakeholders present confidence and extra accumulation indicators. Trader income for $BTC are a bit on the excessive finish, which means there might be a cooldown. #Altcoins like $UNI & $SHIB have super #FUD. https://t.co/1bIwnEMpl2 pic.twitter.com/EjmyE9UG0f

— Santiment (@santimentfeed) July 3, 2023

With that in thoughts, it could be prudent to tread rigorously whereas keenly watching Bitcoin’s response to main value factors just like the just lately reclaimed $31,000 and the next hurdle at $32,000.

A break above $32,000 might be a recreation changer and open the door for positive aspects concentrating on $38,000. On the opposite hand, rolling again below $31,000 would imply that bulls are accepting defeat. This might encourage bears to double down their efforts and ultimately push BTC under $30,000 with $25,000 beckoning.

Blacklock Refiles Spot Bitcoin ETF

According to a Bloomberg report, Blackrock has resubmitted its spot Bitcoin exchange-traded fund (ETF) to the US Securities and Exchange Commission (SEC) proposal through Nasdaq.

The new filings had been made with the SEC on Monday, highlighting that Coinbase Global Inc. will play a pivotal function in market surveillance for the proposed ETF by the world’s most colossal asset supervisor.

This improvement got here in response to the regulatory physique’s earlier assertion that the unique filings lacked complete and required particulars.

Companies all for providing a BTC ETF had final week amended their proposals to present extra particulars, together with VanEck and Fidelity Investments.

If permitted, a spot Bitcoin ETF can be a gateway for institutional traders to take part within the crypto market, which many imagine will gasoline the subsequent bull market.

Related Articles

The offered content material might embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.

[ad_2]

Source link