[ad_1]

Bitcoin worth continues to hover above $30,000 as consolidation heats up throughout the crypto market. On the opposite hand, buyers are anxiously ready for the discharge of the US Consumer Price Index (CPI) – the revered inflation indicator. This index will information the Federal Reserve on the following plan of action, particularly after halting rate of interest hikes in early June.

Analysts are considerably conflicted on how Bitcoin price will react to the CPI data expected on Wednesday. Market expectations are within the 3% vary, which can recommend additional easing of inflation within the US and probably a continued pause on rate of interest hikes.

Risk property like Bitcoin benefit a lot from easing inflation which inspires buyers to hunt extra publicity to Bitcoin, crypto, and shares. Meanwhile, assist at $30,000 places Bitcoin in a fragile scenario the place declines to $28,000 and $25,000 can’t be dominated out.

On the opposite hand, BTC may nonetheless be poised for an upswing, particularly with accumulation on the rise.

A Bitcoin Price Bull Market Or Doldrums

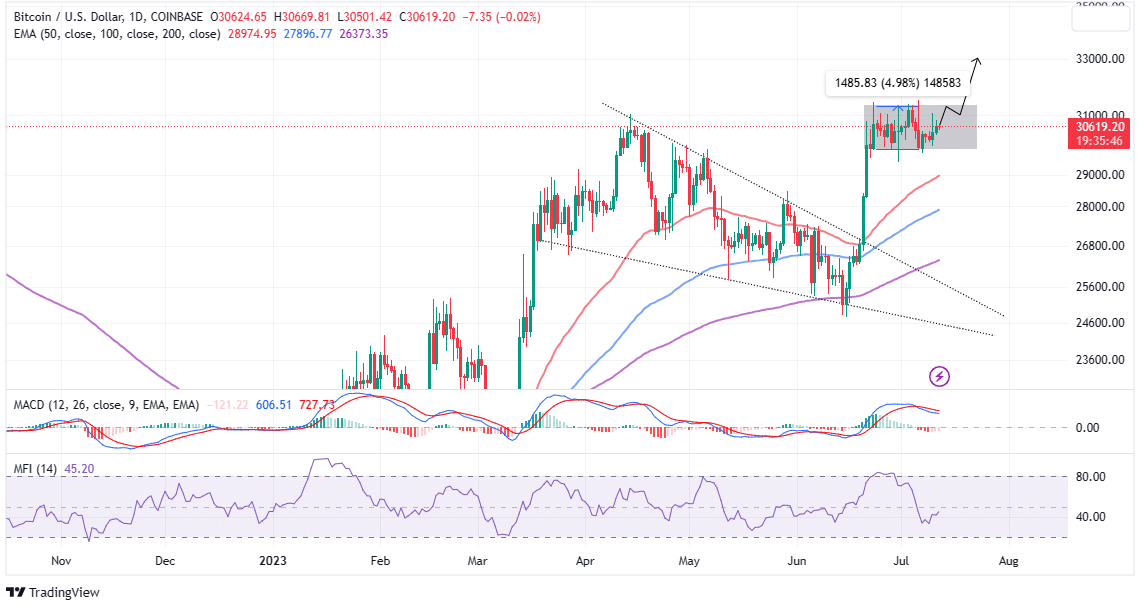

From a micro perspective, Bitcoin price is buying and selling inside a bullish rectangle sample. This chart formation implies a pause within the uptrend and permits for consolidation forward of the following bullish breakout.

A break above the rectangle resistance (higher boundary) at $31,374 would mark the start of the breakout. Traders validate this with a sudden spike in quantity and sustained actions above the resistance.

Here, buyers look out for a breakout goal equal to the width of the sample and extrapolate above the higher boundary. In this case, merchants with lengthy positions in BTC can be eyeing a 5% transfer to $33,000.

The rectangle sample, coupled with a bullish sign from the Money Flow Index (MFI), provides credibility to the potential breakout to $33,000. The MFI is climbing once more after dropping from the overbought area above 80 to 35. This indicator exhibits the energy of each the influx and outflow of cash in BTC markets.

Bitcoin Bull Cycle Incoming?

The crypto market has vastly improved from 2022 doldrums with the following bull market, in keeping with Tim Frost, the CEO of Yield App, a digital wealth administration platform prone to kickoff “in 2024 following a period of continued consolidation this year and, behind close doors, huge innovation is paving the way for the next wave of crypto adoption.”

Glassnode, in a current report on bull market corrections, stated that “the peak drawdown in 2023 has been just -18%, which is remarkably shallow compared to all prior cycles.” The on-chain analytics platform attributed this technical outlook to “a relatively strong degree of demand which underlies the asset (BTC).”

A deep examination of the market information indicated that regardless of the unpredictability and modifications noticed to this point, Bitcoin continues to be exhibiting vivid indicators of restoration and stays robust within the ongoing cycle.

Crypto analyst JD advised his 28k followers on Twitter {that a} Bitcoin bull market confirmation is coming and will set off an altcoin season. He anticipates the affirmation sign over the following month “when the MACD has the confirmed bullish cross & stochastic RSI crosses above the 80 level.”

$BTC – When MACD has the confirmed bullish cross & Stochastic RSI crosses above 80 degree, this has marked the beginning of the following bull cycle! ALTCOINS follows!!

Will the following month give us the affirmation crosses to start out the following bull cycle?! #BTC https://t.co/JhXbL3irhK

— JD 🇵🇭 (@jaydee_757) July 12, 2023

For now, assist at $30,000 stays essential to Bitcoin price, with the potential for a spike first to $33,000. On the opposite hand, declines under the instant assist might lead to losses to $28,000 earlier than one other bullish breakout.

Related Articles

The offered content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link