[ad_1]

The main cryptocurrency, Bitcoin (BTC) price continues to tiptoe above $30,000, with many market watchers believing brighter days lie forward, bolstered by an encouraging marginal decline in the United States inflation indicator – the Consumer Price Index (CPI).

Bitcoin Price Stable Above $30k Post CPI Data Release

Bitcoin price is trading 1.1% as much as $30,363 on Thursday following the discharge of the CPI information, which inspired buyers with inflation falling to its lowest annual degree over two years in June.

The CPI rose 3% from the earlier 12 months, marking the bottom it has gone since March 2021—and a drop from 4% a month in the past.

In comparability, items and companies elevated by 0.2% month-over-month. The outcomes, which the Fed will use in addition to a different financial indicator to make the subsequent choice on rates of interest, triumphed Dow Jones’ estimates that the CPI would rise by 3.1% and 0.3%, respectively.

In June, the regulator paused rate of interest hikes however remarked that additional will increase can be necessitated later in the 12 months based mostly on how the economic system reacts.

Although the CPI got here in higher than anticipated, it stays to be seen how the Fed will react, particularly with some officers leaning towards a 25 foundation factors improve.

On the opposite hand, whereas buyers stay unmotivated by the CPI because of the hawkishness portrayed by the Fed in early June, projections for a Bitcoin price surge to $120,000 by the end of 2024 are surfacing.

Bitcoin Price Bullish Outlook Plus Investor Activity

As Bitcoin price upholds help above $30,000 for the third week in a row, community information reveals buyers are adamant about offloading their wallets. According to the top of information and analytics at FRNT Financial, Strahinja Savic, idle Bitcoin provide in the final two years has jumped to an all-time excessive, nearly hitting 70%.

“This data suggests that the dominant bitcoin investor right now is the long-term ‘holder,’” Savic acknowledged in a written assertion to CoinDesk. “This cohort is less likely to be sensitive to macro considerations.”

Meanwhile, on-chain information and insights from Santiment, a well-liked analytics platform, discovered that “whales and sharks are watching the $30k and $31k Bitcoin price ranging, just like the rest of traders.”

One attention-grabbing revelation is that shark and whale addresses are gobbling stablecoins comparable to USDP and DAI at a excessive charge. This uptake of stablecoins implies doable “future big crypto buys” and will increase the chance of value pumps.

🐳🦈 Sharks and whales are watching the $30k to $31k #Bitcoin value ranging, identical to the remainder of merchants. And it seems that they’re accumulating #stablecoins like $USDP & $DAI fairly quickly, which will increase the chance of future large #crypto buys. https://t.co/IsW0xJFsd9 pic.twitter.com/wkrr0bDQGL

— Santiment (@santimentfeed) July 12, 2023

Bitcoin Price Calm Before Breakout?

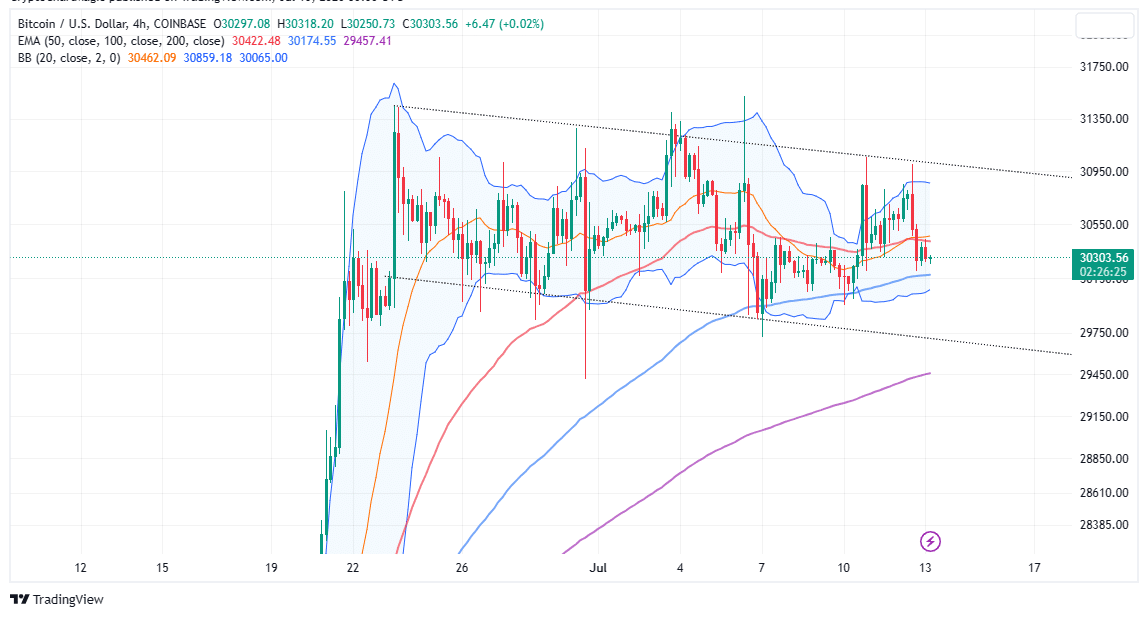

The 100-day Exponential Moving Average (EMA) (in blue) reinforces Bitcoin’s position above $30,000 on the four-hour chart. A breakout can be in the offing based mostly on the Bollinger Bands.

When the bands are slender, the market is consolidating, that means that costs are shifting sideways with low volatility.

Traders can use Bollinger Bands to establish potential breakouts or reversals by in search of value patterns comparable to squeezes, double tops or bottoms, or candlestick formations.

If Bitcoin continues to uphold help, a bullish breakout to $35,000 and probably $38,000 can be imminent – bolstered by the rising demand for BTC and the willingness exhibited by buyers to HODL.

Traders can be looking out for a break above the quick help at $31,000 and the next vendor congestion at $32,000. On the draw back, failure to maintain help at $30,000 intact may validate a sell-off to $28,000 and $25,000, respectively.

Related Articles

The offered content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

[ad_2]

Source link