[ad_1]

XRP worth towered throughout the crypto market on Thursday and Friday bolstered by the landmark ruling from Judge Analisa Torres in the Ripple vs. SEC lawsuit, deeming XRP not a safety.

Although the lawsuit didn’t outline what makes up a cryptocurrency and to a big extent, could have sophisticated laws in the US, the fourth-largest cryptocurrency was saved from the dreaded safety standing.

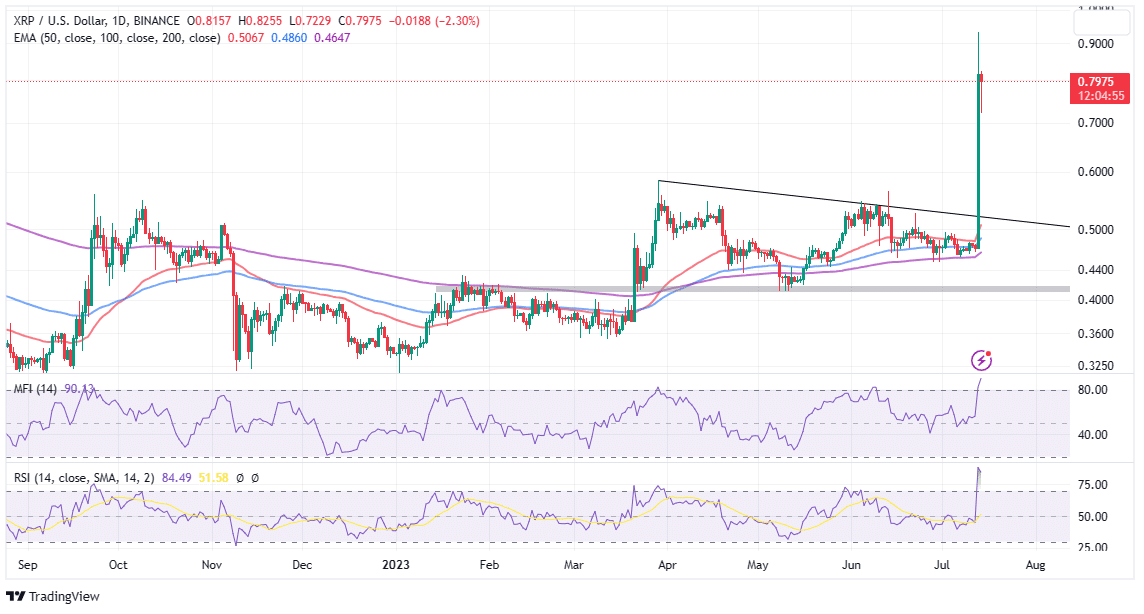

Following the ruling, investor interest in XRP surged, propelling the price to $0.9351. Though, revenue taking paused the rally with XRP retracing to commerce at $0.7932 in the course of the European session on Friday, larger help at $0.8 may mark the resumption of the uptrend.

Coinbase, Kraken Announce XRP Relisting

After going through regulatory stress for greater than two years, XRP holders can now smile after Judge Torres dominated that XRP isn’t a safety in sure situations, notably when bought on third-party protocols like cryptocurrency exchanges.

Analysts at Bernstein, a crypto dealer mentioned that the lawsuit end result will get rid of the “securities overhang on tokens sold exchanges.” In addition, the landmark ruling is a “major relief for all tokens sold on secondary platforms.”

According to the analysts, the well-known Howey take a look at can’t be utilized straightforwardly to crypto belongings buying and selling on exchanges. They argued that “the context of the transaction matters.”

“This weakens the U.S. Securities and Exchange Commission’s (SEC) stance that the securities law is clear and no separate clarity is required for digital assets, given the contextual interpretation required in every case,” the analysts at Bernstein mentioned in an announcement.

Many exchanges and digital asset entities that had delisted XRP citing regulatory scrutiny, together with Coinbase, Kraken, and Bitstamp announced on Thursday that they supposed to renew help for the token issued by Ripple.

“Following today’s court ruling, we have resumed trading of XRP in the United States effective immediately,” Bobby Zagotta Bitstamp USA CEO mentioned in a written assertion. “Bitstamp was one of the earliest exchanges to list XRP, and we are a leading liquidity venue for the asset globally.”

Gemini, one other main U.S.-based crypto change run by the Facebook-founding Winklevoss twins, mentioned it was additionally weighing the potential of bringing again XRP.

Coinbase will re-enable buying and selling for XRP (XRP) on the XRP community. Do not ship this asset over different networks or your funds could also be misplaced. Transfers for this asset stay out there on @Coinbase & @CoinbaseExch in the areas the place buying and selling is supported.

— Coinbase Assets 🛡️ (@CoinbaseAssets) July 13, 2023

XRP Overtakes BNB Becoming Fourth-Largest Crypto

The payments-oriented crypto token XRP exploded each in worth and market cap surpassing Binance’s native token BNB to change into the world’s fourth-largest digital token.

With $41 billion in market share, XRP now sits behind the most important stablecoin, Tether (USDT) with $83 billion. Meanwhile, BNB has assumed the fifth place with practically $40 billion in market share.

XRP worth might face a sudden correction primarily based on the overbought circumstances exhibited by the Relative Strength Index (RSI).

That mentioned merchants can be watching the XRP worth response to resistance at $0.8. If defended, traders can be inspired to keep buying XRP with the hope of a break above the psychological $1 resistance.

The Money Flow Index (MFI) motion into the overbought space above 80 implies that extra funds are flowing into XRP markets in comparison with the outflow quantity. What this implies is that XRP worth is most certainly to maintain trending north than reverse the pattern to retest help at $0.06 and $0.5, respectively.

Related Articles

The introduced content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link