[ad_1]

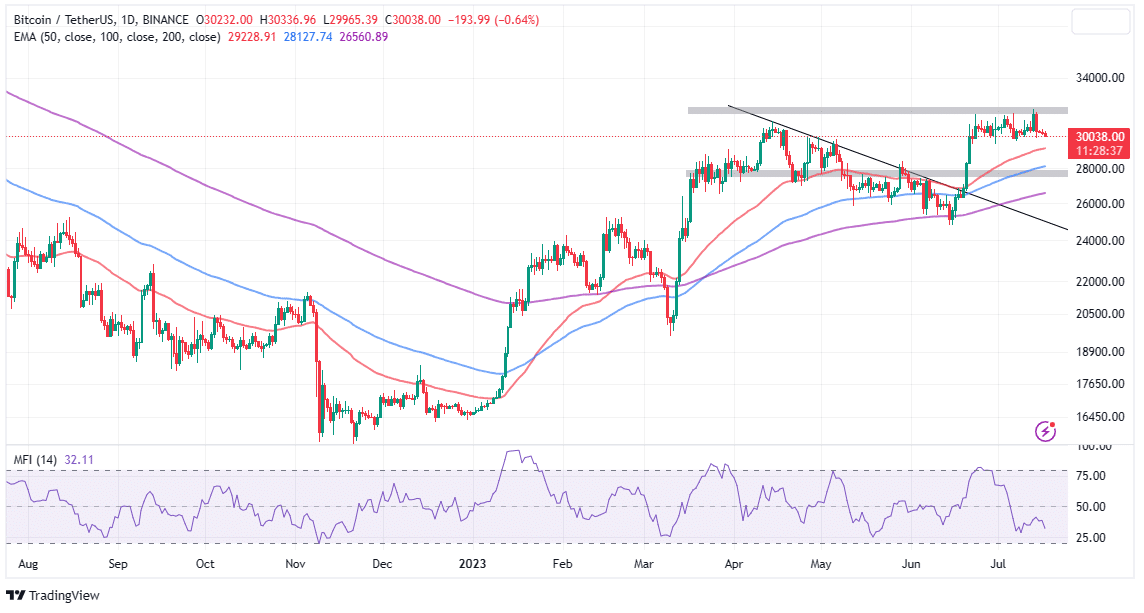

Bitcoin worth made no progress through the weekend session, contemplating the rejection from highs barely above $31,800 to losses at the moment testing the validity of assist at $30,000. Bulls have been woken up final week with constructive inflation knowledge based mostly on the United States Consumer Price Index (CPI).

As reported on Friday, motion to $35,000 and $38,000 would have been confirmed if BTC broke and upheld support above $32,000.

With the pullback to $30,000 obvious, a shift within the technical outlook of the biggest cryptocurrency boasting $586 billion and $7.5 billion in buying and selling quantity, is required to validate the uptrend to $35,000 and $38,000, respectively.

Bitcoin Price Must Reclaim $30,200

Last week’s failure to strengthen a bullish grip on Bitcoin price saw a gradual retracement with coin-sweeping liquidity at $30,000. However, in line with main analysts like Michaël van de Poppe, most liquidity is located within the decrease assist space round $28,000.

The famend dealer and analysts advised over 660k followers on Twitter that Bitcoin should “reclaim $30,200 and we’ll be good for continuation to the upside.

He additional cautioned that “there are such a lot of folks ready for a case the place we’ll drop to $28k, it’s fairly crowded. In different phrases, Poppe signifies that many merchants and buyers might miss out on the anticipated uptrend, inflicting ache, particularly within the derivatives market.

Captain Faibik, one other standard dealer and analyst, says that “early shorts and late longs REKT soon.” This comment adopted a technical perception from the Bollinger Bands, which “are squeezing and volume is decreasing,” implying “silence before the storm” characterised by Bitcoin worth nosediving to $25,000.

$BTC Bollinger Bands are squeezing & Volume is Decreasing too, Silence earlier than the Storm..🌪

I Think Both early Shorts and Late Longs REKT quickly.#Crypto #Bitcoin #BTC pic.twitter.com/wGgVcSzmQh

— Captain Faibik (@CryptoFaibik) July 17, 2023

Based on the each day chart, the Money Flow Index (IMF) exhibits that odds might proceed to favor bears now that the outflow quantity at the moment surpasses the influx quantity. If bulls lose the quick assist at $30,000 it’s extremely possible to expertise a sell-off to $28,000.

Traders should maintain the 50-day Exponential Moving Average (EMA) at $29,230 in thoughts as it might support within the absorption of the overhead strain. Nonetheless, potential losses to $28,000 and $25,000 can’t be dominated out till Bitcoin price reclaims resistance at $30,200 and $32,000, respectively.

Bitcoin Lightning Network Debuts On Binance

In different information, Binance is weathering the storms by maintaining with its growth wants regardless of the continuing lawsuit towards the Securities and Exchange Commission (SEC) and a raft of FUD surrounding the trade.

The largest crypto trade introduced that might be integrating the Bitcoin Lightning network into its protocol to enhance transaction pace whereas successfully decreasing the price of BTC transactions.

As a Layer 2 answer for Bitcoin, the lightning community makes use of extremely specialised channels that improve the person expertise by supporting sooner and cheaper transactions. Experts consider this growth may very well be geared towards bettering investor sentiment towards Binance, which has lately confronted regulatory scrutiny and associated FUD surrounding the lawsuit.

Related Articles

The introduced content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.

[ad_2]

Source link