[ad_1]

Bitcoin worth is elevating questions amongst analysts and buyers for failing to transfer regardless of holding dearly to help at $30,000 whilst bears draw the road at $32,000 resistance.

The largest cryptocurrency has according to on-chain insights from CryptoQuant “been lodged within a narrow corridor for the past three months.” The on-chain analytics platform claims that the reply lies within the protocol’s basic elements akin to provide and miner exercise.

While we are going to explore Bitcoin’s fundamental position in a bit, BTC continues to be feeling the pinch of an aggressive bear camp – down 1% to $30,005. Trading quantity is up to $14 billion with its market capitalization holding at $582 billion.

The largest altcoin seems to be following in BTC’s footsteps, down 1.6% to $1,898. As mentioned within the earlier evaluation, Ethereum price must reclaim $1,900 support to maintain the resumption of the uptrend above $2,000 intact.

What’s Next if Bitcoin Price Loses $30,000 Support?

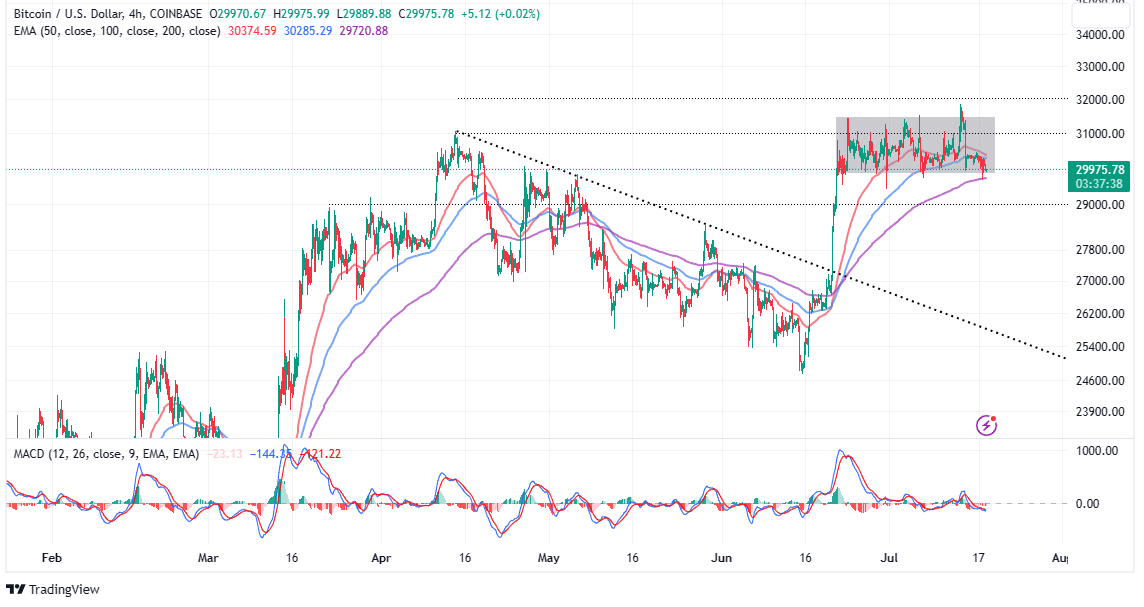

The Bitcoin worth consolidation in a slim rectangular sample, as proven on the day by day chart reveals that the tug of struggle between bulls and bear is shut to its tensile restrict. This implies that buyers ought to put together for 2 conflicting outcomes.

A break and maintain the $30,000 rapid help may validate declines to $28,000 and $25,000 in that order.

Short positions beneath $30,000 could intensify the promoting stress, thus creating instability at necessary however minor help areas as highlighted by the 200-day Exponential Moving Average (EMA) (in purple) and the following purchaser congestion at $29,000.

Adding credibility to the bearish outlook is a confirmed promote sign from the Moving Average Convergence Divergence (MACD) indicator.

Despite the promote sign, which manifested with the MACD line in blue crossing above the sign line in purple, shorts merchants shouldn’t underestimate the short-term help on the 200-day EMA as it could be the liquidity Bitcoin price sweeps for a bigger breakout above $32,000.

The different final result entails a breakout above the rectangle sample, in flip, with Bitcoin worth geared up with the proper circumstances for a rally, together with improved investor sentiment, a rising buying and selling quantity, and increasing liquidity.

Some of essentially the most essential ranges to watch going ahead embrace the help at $30,000 and one other on the 200-day EMA. On the upside, a break above the rectangle and resistance at $32,000 may mark the start of a rally to $35,000 and $38,000.

Why Bitcoin Is Failing To Move – CryptoQuant

On-chain knowledge as introduced by analytics platform CryptoQuant makes an attempt to clarify what’s holding Bitcoin worth from breaking out of the slim consolidation. Researchers on the agency discovered that “starting from April this year, the STH (Short-Term Holders) supply began to decrease.” This cohort continues to offload BTC wallets, thus making use of extra stress in the marketplace.

According to the Miner Exchange Inflow Realized Price, “miners are actively selling their Bitcoin reserves.” The researchers consider this isn’t a novel incidence because it mimics miners’ habits forward of the halving – anticipated in April 2024.

Miners usually promote months earlier than halving to purchase tools in a bid to improve their effectivity with mining actions changing into more and more troublesome with every four-year cycle.

Another issue that is likely to be hindering a Bitcoin price breakout may very well be attributed to the Volatility Index. After contemplating the influx and outflow of cash into and out of BTC markets, the volatility index reveals “a significant decrease in market activity” since April 2023.

4/ All these elements collectively kind the present image of the #Bitcoin market, the place the worth seems to be “stuck” in a slim vary. pic.twitter.com/OghS8zoxt8

— CryptoQuant.com (@cryptoquant_com) July 18, 2023

Some if not all not all these elements should change dynamically to help a sustainable breakout in Bitcoin worth to $35,000 and $38,000, respectively. Otherwise, declines to $28,000, and $25,000 may very well be within the offing.

Related Articles

The introduced content material could embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.

[ad_2]

Source link