[ad_1]

XRP has turn into the discuss of the crypto area since Ripple’s partial win in the long-standing legal battle with the United States Securities and Exchange Commission (SEC) final week.

As investors, index funds, and crypto exchanges like Coinbase and Kraken rushed to hunt publicity to the world’s four-largest digital asset, momentum constructed catalyzing a rally to $0.94 – a value stage not seen since December 2021.

The token powering the worldwide Ripple cost system noticed its market cap bounce considerably to $43.5 billion as buyers snatched XRP bolstered by improved sentiment and mind-boggling predictions.

At some level, the XRP trading volume triumphed over Bitcoin, though it had shrunk barely to $3.3 billion on the time of writing.

XRP Price Homerun to $1 Gains Momentum

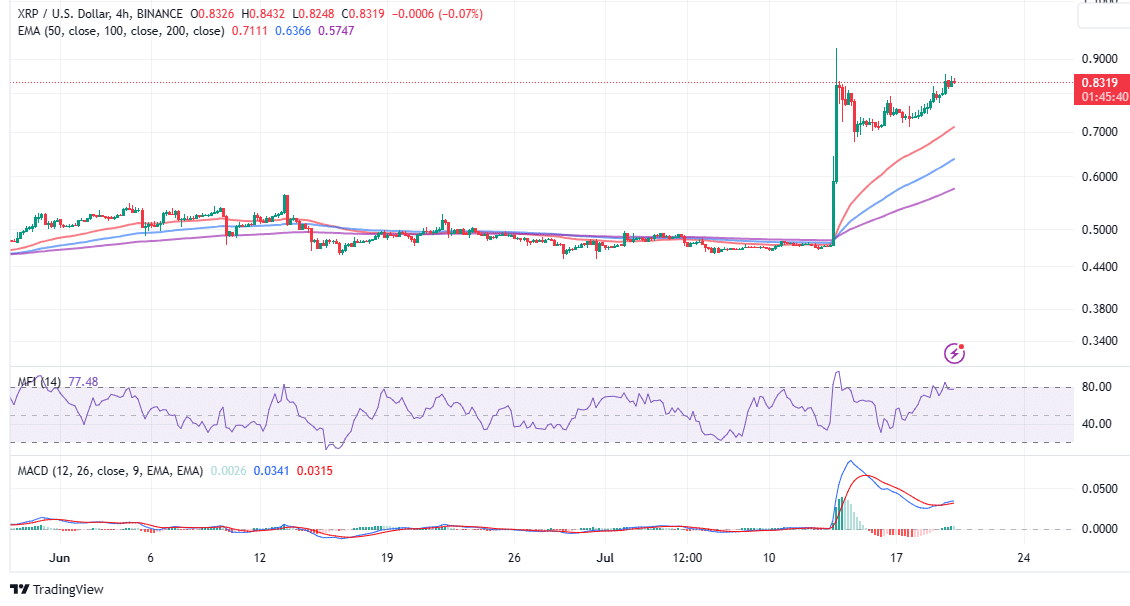

Following the climb from a prolonged consolidation within the area between $0.45 and $0.5, XRP value trimmed the features to $0.7 – presumably on account of profit-taking amongst merchants who had been caught in the identical place for weeks and even months.

A restoration ensued quickly after, with extra consumers benefiting from the stoop to $0.7 to stack up XRP tokens forward of an anticipated bounce above $1. A sustained breakout above this psychological resistance would pave the best way to a momentum of euphoria, ushering in retail and small buyers as a result of concern of lacking out (FOMO).

XRP price trades at $0.8391 on Thursday, up 5.2% within the final 24 hours. The confirmed larger help at $0.8 is an assurance that market sentiment is constructive towards the cross-border cash remittance token, and the climb to above $1 is within the offing.

The ongoing uptrend has backing from each micro and macro views with the Moving Average Convergence Divergence (MACD) indicator flashing a purchase sign. Traders look out for bullish crosses on this momentum oscillator, characterised by the MACD line in blue flipping above the sign line in crimson.

Inflow quantity into XRP markets additionally considerably surpasses outflow quantity, which helps to maintain the uptrend intact, based on the Money Flow Index (MFI).

Notably, two value ranges could decide the place XRP heads subsequent, beginning with resistance at $0.9. If bulls push previous this stage, they are going to entice extra buyers to hunt publicity to XRP, thus building enough momentum for a breakout to $1.

However, shedding the instant help at $0.8 would imply that the token rolls again to comb by new liquidity at $0.7. Sideways buying and selling could take over with XRP locked between $0.7 and $0.8 earlier than a major breakout happens.

Can XRP Explode to $15?

Renowned crypto influencer and YouTuber Ben “BitBoy,” Armstrong says that XRP may escape to $15 within the subsequent 18 months and nonetheless be open to an prolonged rally to $35 if the issuing firm Ripple fastidiously occasions its IPO.

Such a transfer would imply XRP surges 1,729% from the prevailing market worth. “Make no mistake… it may not go that high… but $XRP IS breaking an all-time high this cycle save some sort of pointless, vindictive SEC appeal,” BitBoy argued.

$15 is cheap I imagine over 18 months or so.

If they IPO and time it appropriately, might be as much as $35 imo.

Make no mistake… it could not go that prime… however $XRP IS breaking an all time excessive this cycle avoid wasting form of pointless, vindictive SEC enchantment. (Low probability) https://t.co/rrMCuOacrE

— Ben Armstrong (@Bitboy_Crypto) July 19, 2023

The YouTuber’s conviction of a parabolic rise to $15 reveals how optimistic buyers are within the long-term progress of XRP, which many imagine will quickly reclaim its third spot out there, toppling stablecoin USDT.

A Ripple IPO may expose XRP to a brand new wave of buyers and mainstream adoption, thus offering a useful catalyst to the anticipated upward trajectory.

Related Articles

The offered content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link