[ad_1]

The two most distinguished cryptocurrencies Bitcoin (BTC) and Ethereum (ETH) are nonetheless sluggish, with the previous pivoting round $30,000. Trading at $29,950, the BTC worth stays unchanged during the last 24 hours, with the buying and selling quantity shrinking to $11 billion from $13 billion recorded on Wednesday.

Bitcoin boasts $582 billion in market capitalization, with the digital asset’s cumulative losses within the final seven days amounting to 1.2%.

Bitcoin Price Moves In Tandem With Momentum and Narrative Traders

Apart from a choose group of altcoins which have been rallying together with XRP, XLM, ADA, and SOL, the crypto market is quiet and torpid. These tokens are outperforming their friends as traders search publicity following Ripple’s partial win in the long-standing legal battle with the Securities and Exchange Commission (SEC).

“In short, we’re seeing a return of investors that had previously been spooked by recent regulatory measures,” Markus Levin, co-founder of XYO Network mentioned in a written assertion to CoinDesk.

According to the managing Partner of Web3 funding fund Generative Ventures, Lex Sokolin, the lethargy being witnessed is the cyclical nature of the biggest crypto. He argues that Bitcoin price often experiences ‘run-ups’ in anticipation and response to the information, after which a sell-off as soon as the optimistic information has been included into the value.”

“Bitcoin moves in cycles mainly due to momentum and narrative – “the market animal spirits,” as Sokolin describes them.

What’s Next As Bitcoin Price Lengthens Consolidation?

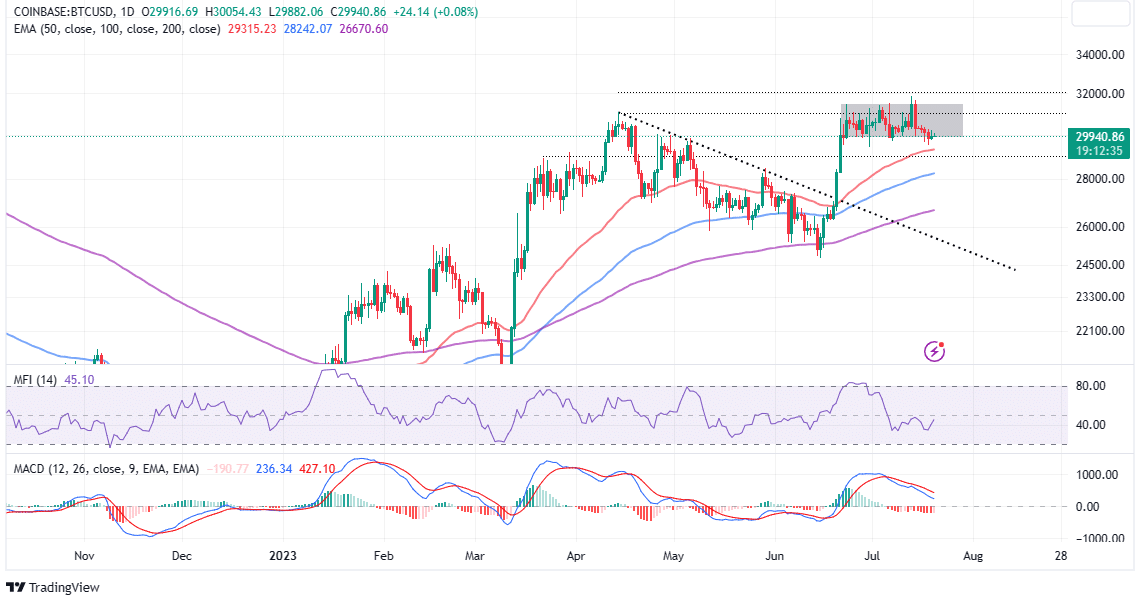

Bitcoin price continues to be doddering in the identical rectangle sample, with bulls presenting a legitimate case at $30,000. Although there have been dips under this stage, they haven’t been vital to trigger panic-selling amongst merchants and traders who’re nonetheless betting on a possible rally to $35,000 and $38,000.

If declines ensue under $30,000, the 50-day Exponential Moving Average (EMA) can be the primary help to confront the sellers. Some market watchers foresee a drop to $28,000, a help strengthened by the 100-day EMA (in blue), the place Bitcoin worth would sweep new liquidity for the much-awaited rally.

Bulls are doing all they’ll to maintain Bitcoin around $30,000 with minor dips in the upper $29,000 range, contemplating the Moving Average Convergence Divergence (MACD) has since July 5 been pushing a bearish narrative emphasised by a promote sign.

Holding above $30,000 is not possible for the resumption of the uptrend, Bitcoin should construct momentum to interrupt out from the bullish rectangle sample to maintain bears suppressed and with out a lot say within the path the coin takes subsequent.

That mentioned, the up and down actions might proceed till BTC blasts by means of resistance at $31,500 and purpose for the subsequent hurdle at $32,000.

Is This The Start of a New Macro Uptrend

The spike within the variety of corporations involved in providing a spot Bitcoin exchange-traded fund (ETF) in June fueled the sharp climb from lows barely under $25,000 in early June to highs round $31,500.

That uptrend might be attributed to momentum and narrative merchants who purchased the information however are nonetheless holding on to their BTC in anticipation of an prolonged rally. Subsequent information and occasions have been scarce in July, with Bitcoin markets witnessing a droop in actions.

However, the Money Flow Index (MFI) reveals that extra funds are beginning to circulate into the market. If the influx quantity continues to outpace the outflow quantity, Bitcoin worth will seemingly start a macro uptrend.

#BTC is now within the post-breakout Upward Acceleration Phase

The Macro Downtrend is over

And a brand new Macro Uptrend has begun$BTC #Crypto #Bitcoin pic.twitter.com/fOjjXQaHeM

— Rekt Capital (@rektcapital) July 15, 2023

Analysts at Rekt Capital are assured that “Bitcoin is now in the post-breakout upward acceleration phase.” This implies that the macro downtrend is lengthy gone and a brand new uptrend has began. In different phrases, traders might wish to critically contemplate stuffing their wallets forward of the subsequent bull run prone to start in 2023.

Related Articles

The introduced content material might embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.

[ad_2]

Source link