[ad_1]

Bitcoin value carries on with its consolidation, seemingly ‘muted,’ with little to no motion on the upside. However, bears are nonetheless beating exhausting on the decrease vary assist, barely under $30,000 – a state of affairs that’s worrisome amongst BTC bulls who’ve been eyeing a breakout to $35,000 and $35,000 following the climb from $25,000 to highs round $31,476 round mid-June.

Bitcoin Price Calm Before A Storm?

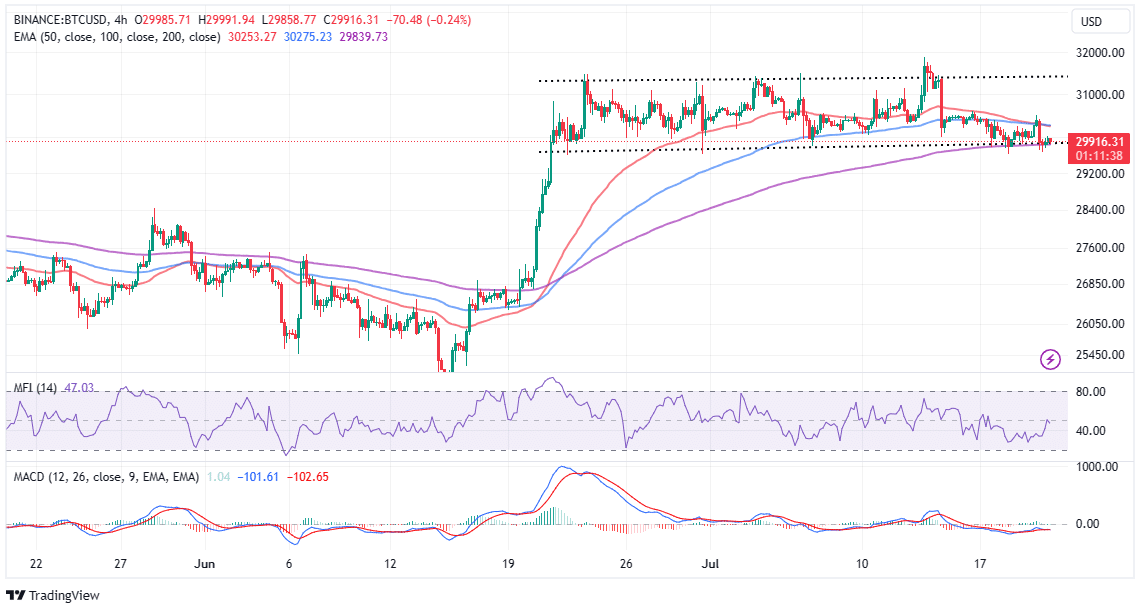

Bitcoin price has been caught in a variety channel since mid-June. Support on the decrease vary is now strengthened by the 200-day Exponential Moving Average (EMA) (in purple) at $29,839 whereas the cussed resistance sits at $31,400.

The Moving Average Convergence Divergence (MACD) indicator, shifting horizontally under the imply line (0.00) implies that Bitcoin price lacks momentum to maneuver both up or down. In different phrases, bearish and bullish forces are comparatively equal and canceling out, leaving Bitcoin in a quagmire state of affairs.

While different indicators like the Money Flow Index (MFI) look like leaning on the bullish aspect of issues, the shrinking volatility makes it tough to maintain an uptrend.

Bulls are slowly dropping grip contemplating Bitcoin price has been entwined with the range channel’s support since Monday. They should maintain onto the 200-day EMA assist in any respect prices, in any other case, they danger a sell-off to $28,000 the place extra patrons might create extra liquidity as they purchase the dip.

On the flip aspect, a minor push above $30,000 could possibly be the assurance patrons have to rally behind BTC for the anticipated breakout out of the channel. However, bulls have to be able to take care of the confluence resistance at $30,252 fashioned by the 50-day EMA (in crimson) and the 100-day EMA (in blue)—and subsequently the vendor congestion at $31,000.

According to on-chain analytics agency Glassnode, the sluggish value motion witnessed for a number of weeks now might quickly pave the approach for a volatility interval. Bitcoin’s 14-day value vary rose to six.38% in the final seven days and Glassnode underscores that with round 5.6% of all buying and selling hours staying in the decrease vary of this worth – BTC may see motion on both aspect in only a few days.

21k Bitcoin Options About to Expire – A Sell-Off On The Horizon?

Chinese crypto information reporter Colin Wu of Wu Blockchain highlighted on Friday throughout the Asian session that “1,000 BTC options are about to expire, the Put Call Ratio is 0.41, the biggest pain point is $30,250, and the nominal value is $630 million,” which could worsen the delicate the quagmire holding Bitcoin value suspended marginally under $30,000.

If Bitcoin value fails to recuperate above $30,250 by the time the choices expire, overhead stress could dampen the market even additional. Holding Bitcoin above the vary channel may not be viable, with declines to $28,000 prone to take form.

Related Articles

The offered content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link