[ad_1]

Bitcoin value continues to wrestle beneath $30,000 with declines seemingly within the offing. The largest cryptocurrency has within the final 24 hours rolled again 0.5%, and is buying and selling at $29,780.

Investors are cautiously navigating the market forward of a busy week, together with rate of interest choices from the United States Federal Reserve, the European Central Bank, and the Bank of Japan.

A 25-basis factors hike is anticipated within the US along with the discharge of the “actual GDP in the second quarter and the PCE price index in June,” Coin Wu of Wu Blockchain reported.

There are plenty of macro occasions this week. The US Federal Reserve, the European Central Bank, and the Bank of Japan will announce the most recent rate of interest resolutions. It is anticipated that the Fed will elevate rates of interest by 25bps with a excessive chance; as well as, the United…

— Wu Blockchain (@WuBlockchain) July 24, 2023

Bitcoin Price Breaks Out of The Range: Could Declines Soar

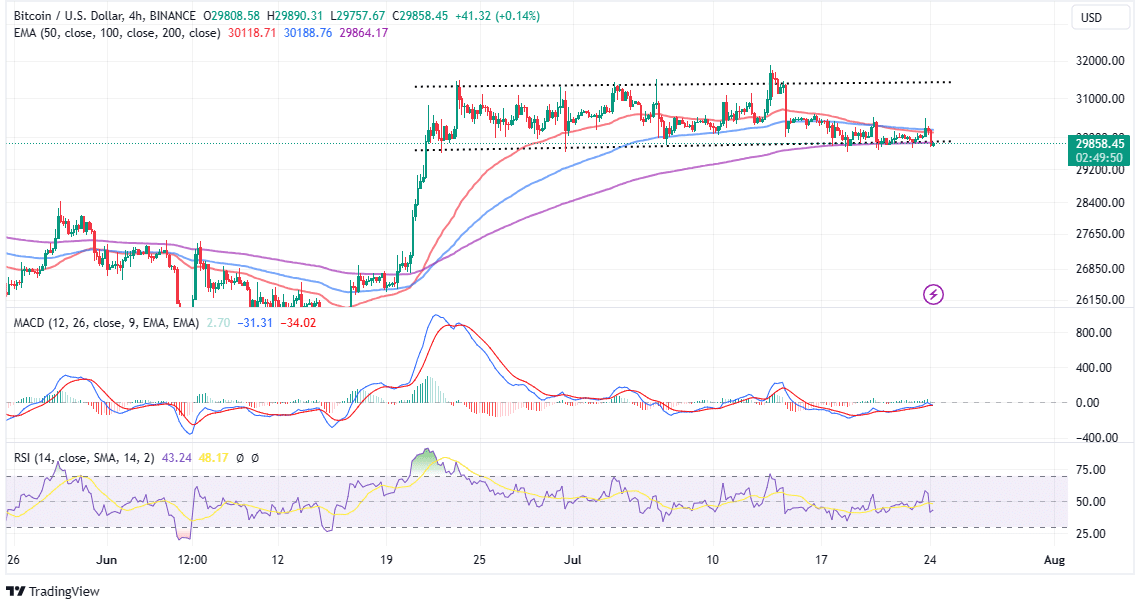

Bitcoin price is trading slightly below the range channel mentioned extensively over the previous few weeks.

With the help beforehand supplied by the 200-day Exponential Moving Average (EMA) now performing as resistance at $29,863, the trail with the least resistance may stay on the draw back, which may put extra strain on help areas at $28,000 and $25,000.

Meanwhile, the Moving Average Convergence Divergence (MACD) indicator will doubtless verify a promote sign on the four-hour chart. This name to promote BTC would manifest with a bearish cross, marked by the MACD line in blue flipping beneath the sign line in purple.

The Relative Strength Index (RSI) is again beneath the midline, nonetheless including downward strain. Two eventualities are more likely to happen this week. First, Bitcoin price bulls could arrest the bearish scenario beneath $30,000 earlier than it takes form and push for a considerable rebound towards $33,000 and $35,000, respectively.

Secondly, if the financial indicators set to be launched later within the week are unfavorable to threat property buyers, losses of $28,000 and $25,000 can be imminent. For now, merchants ought to be on the search for BTC to reclaim the vary channel help strengthened by the 200-day EMA.

Captain Faibik, a well-liked crypto analyst to his over 61k followers on Twitter that “the failure to interrupt above $31k stage may result in a retest of the weekly EMA200 ($25.5k).

However, buyers mustn’t fret, with Faibik reckoning that there’s a risk of “a profitable clearance of the $31k stage, which could pave the best way for a major bullish rally of round 30-35% in August/September.

$BTC (Weekly)

Bitcoin has been Experiencing a Critical section because it struggles to interrupt above the Major Trendline and 31k S/R stage.

5 Consecutive Candle Closes beneath this key stage, Signaling Possible Bearish Momentum.

The failure to Break above 31k stage Could result in a retest… pic.twitter.com/Y4FN3p4m9W

— Captain Faibik (@CryptoFaibik) July 24, 2023

Other market watchers just like the Senior Researcher at LBank Labs, Jonny Teng imagine developments surrounding the ruling within the case between Ripple and the Securities and Exchange Commission (SEC) proceed to negatively affect buying and selling throughout the crypto market, with Bitcoin investors choosing to stay cautious.

“The disappointment expressed by SEC chair Gary Gensler over the court’s ruling on the securitization of XRP token has added to uncertainty, with the possibility of an appeal by the SEC further complicating the situation,” Teng.

Related Articles

The offered content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.

[ad_2]

Source link