[ad_1]

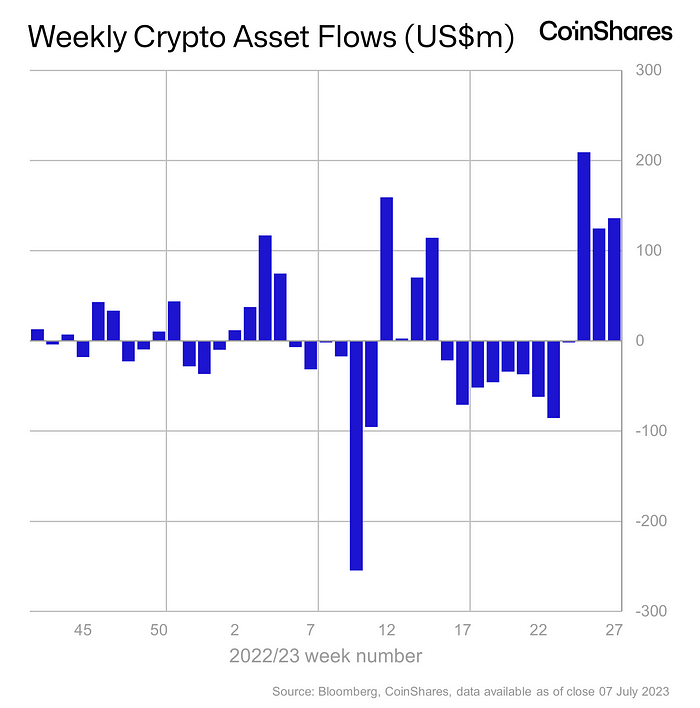

Crypto asset funding merchandise recorded the primary week of outflows after 4 consecutive weeks of inflows from establishments that totaled $742 million, in response to a report by CoinShares on July 24. Crypto asset funding merchandise noticed minor outflows totaling $6.5 million. Traders speculate whether or not the institutional shopping for is over as they offload some Bitcoin holdings.

Crypto Funds Record Outflows Amid Profit Booking in Bitcoin

Crypto asset funds noticed a complete of $742 million of inflow within the final 4 weeks. The inflows introduced year-to-date flows to a web constructive regardless of 9 weeks of outflows. Bitcoin recorded big inflows amid spot Bitcoin ETF filings by BlackRock, Fidelity Investments, and different monetary giants.

However, $6.5 million in crypto asset outflows final week raised hypothesis of correction within the crypto market. Investors offered Bitcoin price $13 million and switched to Ethereum, which noticed $6.6 million inflows. Also, brief Bitcoin funding merchandise recorded the thirteenth consecutive week of outflows totaling $5.5 million.

After Ethereum, XRP recorded essentially the most inflows of $2.6 attributable to Ripple’s partial win towards the US SEC. Other altcoins Solana, Uniswap, and Polygon (MATIC) noticed inflows totaling $1.1 million, $0.7 million, and $0.7 million, respectively. Trading volumes decreased considerably final week.

ProShares ETFs, ETC Issuance GmbH, and Purpose Investments recorded essentially the most outflows final week. Negative sentiment was primarily centered on the North American market, which noticed 99% of outflows ($21 million). This was offset by $12 million in inflows into Switzerland and $1.9 million into Germany.

Also Read: Binance And Other Crypto Exchanges Announce Worldcoin (WLD) Listing

Bitcoin, Ethereum, and Altcoins Saw Sudden Fall

A broader selloff throughout the crypto market noticed over $90 million price of crypto belongings liquidated in an hour and $150 million liquidated prior to now 24 hours. BTC price fell sharply to the $29,000 stage, with the worth at the moment buying and selling close to $29,200. Meanwhile, ETH price trades close to $1850, falling comparatively lower than Bitcoin.

Government bond yields all over the world retreated, with the US 10-year Treasury notice yield falling to three.81%. Traders additionally bracing for key occasions akin to rate of interest choices from the US Federal Reserve, the ECB, and the Bank of Japan.

Read More: Crypto Market Selloff – Bitcoin, ETH, XRP Price Falling Sharply; What Happened?

The introduced content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.

[ad_2]

Source link