[ad_1]

Ethereum value bulls are doing every little thing inside their energy to mitigate losses after help at $1,900 caved in. The token powering the most important good contracts token has within the final 24 hours, remained barely unchanged, and buying and selling at $1,870.

Despite the narrowing buying and selling vary, a $6.5 billion buying and selling quantity has been posted, with the market cap dropping barely to $224 billion.

How Ethereum Price Could Confirm 18% Bullish Move

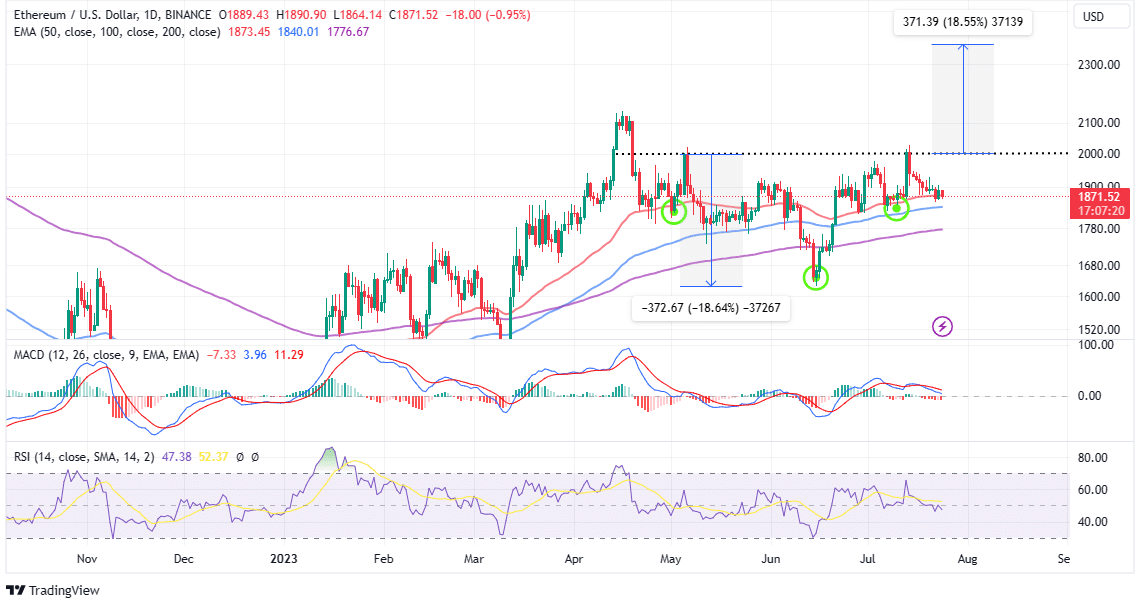

Ethereum price has shaped an inverse head-and-shoulders (H&S) on the every day chart, with the opportunity of an 18% breakout to $2,372.

As a technical chart sample, the inverse H&S presents a bullish sign to Ethereum merchants. It’s born by way of three troughs, with the center one deepest – the ‘head’, and the ‘shoulders’ flanking shallower.

A bullish transfer can be confirmed when this ‘neckline’ breaks, traders usually anticipate an upward value swing, equal to the peak of the sample extrapolated above the breakout level, $2,000 in Ethereum’s case.

The path with the least resistance is to the draw back for now with better danger lurking within the shadows if bulls lose the help supplied by the 50-day Exponential Moving Average (EMA) (in pink).

While these declines could bounce off the 100-day EMA (in blue), the present technical image means that overhead strain could soar within the coming days.

Notably, the Moving Average Convergence Divergence (MACD) provides credence to the bearish outlook after sending a promote sign. Ethereum’s drop below $1,900 may need accentuated the decision to promote, which manifested with the MACD line in blue crossing beneath the sign line in pink.

The Relative Strength Index (RSI) reinforces the bearish outlook because it slides beneath the midline.

With that in thoughts, shorts merchants can be wanting ahead to decrease revenue targets, as an example, the 200-day EMA (purple) and the first help between $1,630 and $1,700.

Ethereum Staking Stays Attractive

Investors have in current months wholesomely embraced Ethereum staking each on the first blockchain and liquid staking platforms. According to on-chain insights shared by Token Terminal Intern on Twitter, “total assets through liquid staking protocols are hitting ATH, despite Ethereum bringing -61% from the top.”

Ethereum staking finally began to achieve traction after the preliminary withdrawals which adopted the Shapella Upgrade. Liquid staking platforms like Lido proceed their dominance following the protocol improve that allowed traders to withdraw their staked Ether for the primary time because the transition to the PoS consensus algorithm.

The enhance in staking implies that traders are optimistic about the way forward for Ethereum and are willing to HODL the token with the hope of a rally again to the ATH. Staking additionally contributes to decreasing Ethereum’s provide on exchanges, which has been shrinking considerably. If demand for Ethereum rises, we’re more likely to witness a breakout above $30,000.

Related Articles

The offered content material could embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.

[ad_2]

Source link