[ad_1]

Bitcoin value sell-off under $30,000 appears to be gaining momentum such that the most important crypto briefly misplaced floor at $29,000 and traded lows of $28,897 earlier than rebounding to change fingers at $29,115.

Bitcoin Price Reclaims $29k Support – What’s Next?

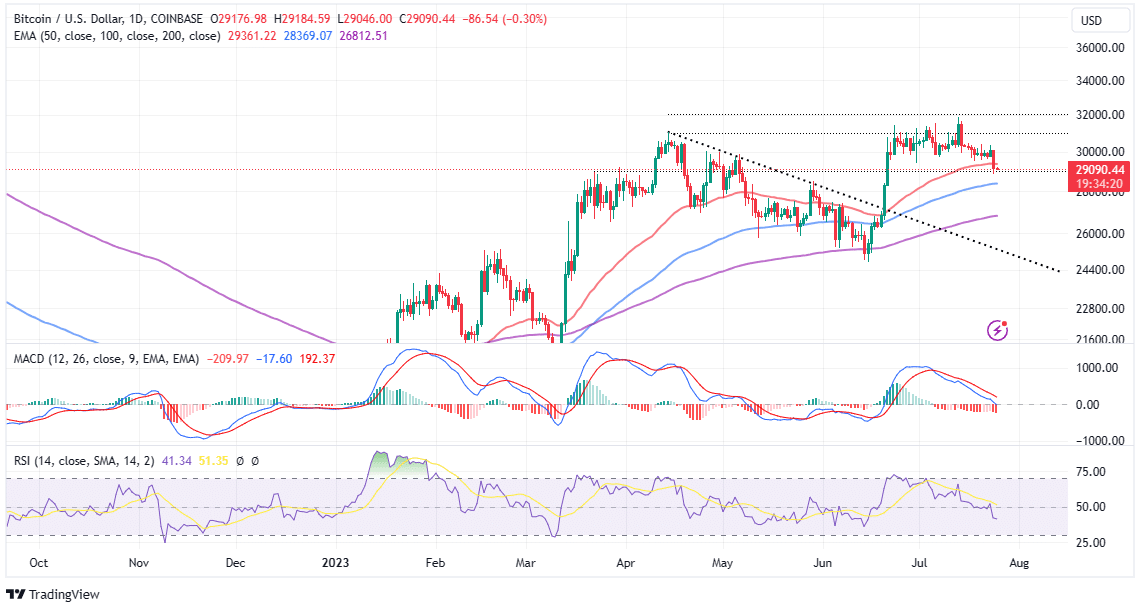

Bitcoin value has reclaimed assist at $29,000 however there isn’t any assure an uptrend will keep it up, particularly with the resistance anticipated on the 50-day Exponential Moving Average (EMA) (crimson) holding at $29,362.

Based on the Moving Average Convergence Divergence (MACD) indicator’s outlook, the trail with the least resistance is mostly to the upside. Shorts merchants look out for bearish crosses, characterised by the MACD line in blue crossing under the sign line in crimson.

It is perhaps pointless to hope for an instantaneous restoration from Bitcoin price ranging momentum between the realm round $29,000 and $30,000. Adding credence to the bearish outlook is the Relative Strength Index (RSI), which is dropping quick within the impartial area towards the oversold area.

If declines are sustained under $29,000 within the coming classes, merchants could need to capitalize on the potential worthwhile shorts place to $28,000 and $25,000. Depending on how traders react to the choice on rate of interest hikes this week, Bitcoin price might continue with the breakdown, or begin gaining floor above $30,000.

In addition to assist at $29,000, $28,000, and $25,000 merchants could need to carefully watch the 100-day EMA (blue), as it could assist arrest the bearish scenario earlier than it intensifies.

Bitcoin Price Technical Outlook Ahead of FOMC Meeting

Investors have continued to tread cautiously, with the buying and selling vary narrowing, presumably because of the impending price hike by the US Federal Reserve. As earlier reported, the Federal Open Market Committee (FOMC), which deliberates the regulator’s financial coverage is anticipated to satisfy Tuesday amid a excessive likelihood of a 25 foundation level price hike in addition to the fact of inflation risking financial stability.

In a associated report, CoinDesk cited the CME Rate Watch at the moment foresees a 98% probability of a 0.25% improve in rate of interest. Such a call would push the fed funds price within the vary between 525 to 550 foundation factors – that is the best degree in roughly 17 years.

Although the Fed paused rate of interest hikes in June, investor sentiment shortly light because of the remarks that adopted insinuating additional price hikes.

Another price hike would squash investor sentiment even additional, worsening an already dilapidated scenario within the crypto market.

For Bitcoin merchants to regain enthusiasm, a brand new driving issue is required, Edward Moya, a senior market analyst on the overseas change market creator, Oanda, stated in a word revealed on Monday.

In addition to the FOMC assembly, traders are wanting ahead Consumer Confidence Index (CCI), which might be launched by the Conference Board on Tuesday. The week is about to get busier with the discharge of experiences on jobless claims on Thursday along with the private Consumption Expenditures (PCE) on Friday.

Away from financial indicators, on-chain analytics agency CryptoQuant reveals that the Bitcoin mining hashrate is experiencing stagnation, although this is perhaps momentary.

It is price mentioning that “a higher hashrate means that the Bitcoin network is more secure, which in turn means that the intrinsic value of BTC has increased.”

1/ On July 8, #Bitcoin hashrate reached an all-time excessive after which stagnated. Additionally, as the worth improve stalled and the potential for a correction elevated, miners expressed issues a couple of value drop as they cashed out their mined Bitcoin. pic.twitter.com/I1V4Prlsci

— CryptoQuant.com (@cryptoquant_com) July 25, 2023

CryptoQuant provides that traders shouldn’t be alarmed by miners cashing out as this occurs regularly “and the price has often recovered as the buying pressure increases during price adjustments.”

Related Articles

The introduced content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.

[ad_2]

Source link