[ad_1]

Fidelity, a number one monetary providers supplier, has just lately launched a report on Ethereum (ETH) that sheds mild on some key metrics to look at for the cryptocurrency within the coming months.

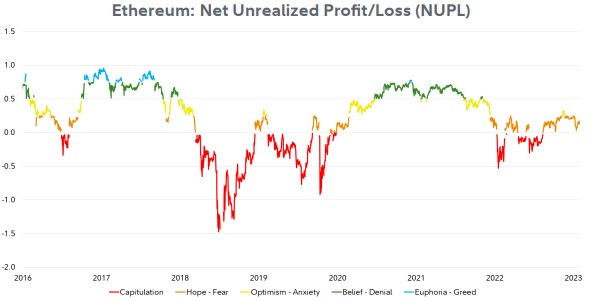

The report highlights a number of necessary indicators, together with the 50-day and 200-day shifting averages (MA), the realized worth, the Net Unrealized Profit/Loss (NUPL) ratio, Market Value to Realized Value (MVRV) Z-Score, % in revenue, and the Pi Cycle indicators, all of which might present helpful insights into market sentiment and potential worth actions.

Ethereum Holds Strong Above Key Support Levels

Per the report, Ethereum has remained above key assist ranges, with the realized worth serving as a robust assist stage since January tenth.

Additionally, the NUPL ratio means that Ethereum is presently in a impartial zone, whereas the MVRV Z-Score signifies that the cryptocurrency’s market worth is estimated to be simply over the “fair” zone, doubtlessly setting the stage for a bull run or no less than sideways worth motion, in keeping with Fidelity.

Another attention-grabbing metric highlighted within the report is the % of distinctive addresses in revenue, which presently sits at almost 66%. While this metric has not touched the inexperienced zone since January 2020, it means that Ethereum homeowners could also be utilizing the cryptocurrency for buying and selling, DeFi, staking, or shopping for different digital property.

Furthermore, the Pi Cycle indicators, which have traditionally been a superb cycle prime indicator, are displaying that Ethereum is presently in a impartial zone. As the long-term shifting common continues to observe the sunken worth downward, it could be setting the stage for extra volatility shortly.

However, whether or not this volatility shall be to the upside or draw back stays to be seen and will rely upon a wide range of macro components.

ETH Adoption On The Rise

On the opposite hand, Fidelity’s report highlights that whereas month-to-month lively addresses and the month-to-month transaction rely have fallen by 1%, the variety of month-to-month new Ethereum addresses has slowly elevated by 9% in Q2 2023.

New addresses are outlined as distinctive addresses that appeared for the primary time in a transaction. This metric for momentum could not present direct community utilization, but it surely does point out a clearer image of Ethereum adoption.

The short-term shifting common of recent addresses is proven to be rising again above that of the longer-term shifting common, indicating that the speed of recent customers becoming a member of the community is rising. New and current initiatives are doubtless incentivizing new customers and serving to to drive this improve.

Another important metric highlighted within the report is the web issuance of recent provide issued by the community minus burned provide from transactions since The Merge.

This has pushed a provide lower for over 5 months now, with internet issuance surpassing -700,000 Ether. The report notes that that is necessary as a result of, in principle, as Ethereum’s provide is destroyed, it raises the relative possession stage of all remaining token holders.

As of writing, ETH’s worth is at $1,849, which has decreased by 2% inside the final 24 hours. Similar to Bitcoin’s state of affairs, Ethereum has additionally misplaced its 50-day MA, which is presently positioned at $1,869.

If the market continues to say no, ETH can anticipate a number of key assist ranges that will assist forestall an additional bearish pattern.

The closest assist stage is located at $1,840, adopted by one other assist stage of $1,792. However, essentially the most essential assist flooring is the 200-day MA, which is situated at $1,780. This shall be a big consider figuring out who will dominate within the upcoming months.

Featured picture from Unsplash, chart from TradingView.com

[ad_2]

Source link