[ad_1]

Bitcoin worth threatens to comb new lows earlier than the following substantial restoration above $30,000, particularly with the financial occasions traders are anticipating this week. The most distinguished crypto continues to battle with mounting bearish strain however with the bulls’ adamance about promoting, its draw back has been restricted to assist round $29,000.

How To Prepare Amid A Glaring Bitcoin Price Sell-Off

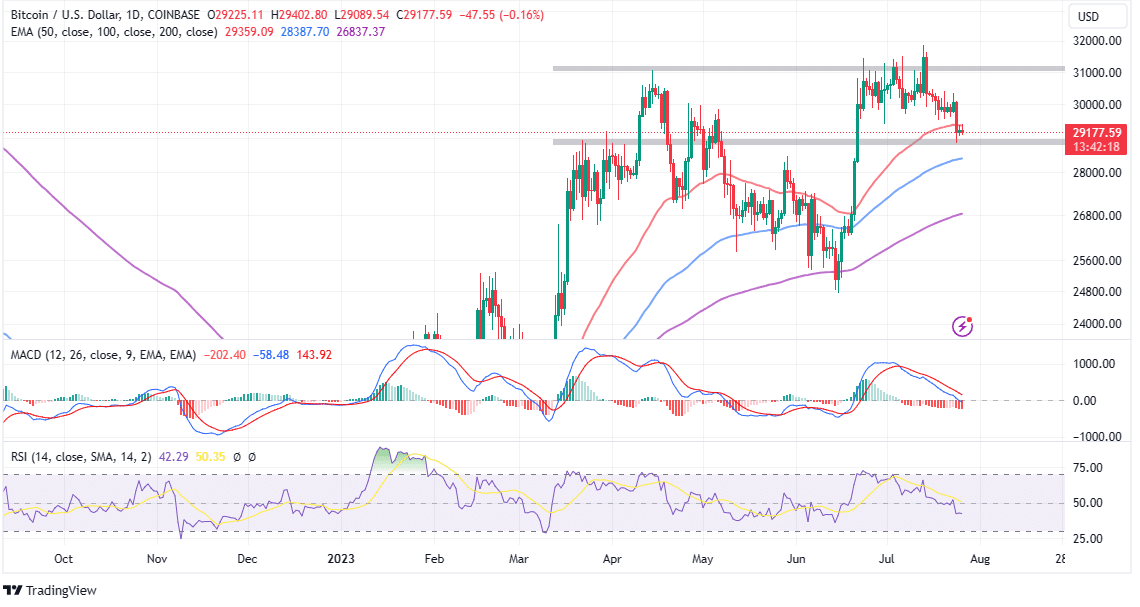

Bitcoin price holds barely above $29,200 with the 50-day Exponential Moving Average (EMA) (purple) performing as resistance at $29,360. Although assist at $29,000 is holding steadily, the technical image is leaning closely towards the bearish aspect.

A promote sign from the Moving Average Convergence Divergence (MACD) implies that sellers have the higher hand and that the trail with the least resistance is southbound. If losses are sustained under the speedy assist, quick positions in BTC might flip worthwhile towards $28,000 with an additional drop to $25,000 turning into obvious.

Most analysts anticipated declines to dominate the Bitcoin market toward the end of the week, particularly with the United States Federal Open Market Committee (FOMC) deliberating on a attainable rate of interest hike on Wednesday.

“With all the upcoming events, I wouldn’t be surprised we’ll sweep the lows on #Bitcoin first before we’ll reverse back up,” Michaël van de Poppe advised his over 661k followers on Twitter.

In addition to the FOMC deliberation of a attainable 25 foundation level hike, stories on the true GDP and Personal Consumption Expenditure (PCE) are simply as essential occasions to stay up for on Friday.

With all of the upcoming occasions, I would not be stunned we’ll sweep the lows on #Bitcoin first earlier than we’ll reverse again up.

Tonight won’t be an important factor, GDP and PCE are simply as essential. pic.twitter.com/1zYSdhXhy5

— Michaël van de Poppe (@CryptoMichNL) July 26, 2023

Captain Faibik, one other analyst believes Bitcoin price may continue to move above a long-term trendline on the day by day chart. Meanwhile, the Bollinger Bands on the weekly timeframe “shows all-time low-price volatility.”

Investors must be cautious as main breakouts are likely to happen following “deep silence” within the crypto market.

$BTC Still Moving above the Major Trendline on the 1D TF Chart.

Bollinger Bands (Weekly) Shows All time low Price Volatility.

Deep Silence 💤😶#Crypto #Bitcoin #BTC pic.twitter.com/tbBFsnbLuP

— Captain Faibik (@CryptoFaibik) July 26, 2023

A break under the trendline as introduced by Faibik implies the opportunity of an enormous sell-off to $28,000 and $25,000, respectively.

Is An Uptrend in Bitcoin Price Viable?

For now, the trail with the least resistance is to the draw back. Moreover, this example seems to be worsening with on a regular basis BTC holds under $30,000. The Relative Strength Index (RSI) on the day by day chart reinforces the bearish grip because it slides under down within the impartial zone, and closes in on the oversold area.

Watching the conduct of Bitcoin whales is one other technique each skilled and novice merchants can apply to remain worthwhile in a tradable situation such because the ranging channel between $28,000 and $32,000.

According to Glassnode, an on-chain analytics platform addresses with between 1,000 and 10,000 BTC have been capitalizing on the gradual retracement in Bitcoin worth to up their steadiness by roughly 33,800 BTC.

The same pattern was noticeable with whales with greater than 100,000 BTC, whose holdings ticked by 6,600 BTC. Despite these efforts, Glassnode talked about a “net reduction of -8.7k BTC,” brought on by holders of between 10k and 100k BTC lowering their steadiness by 49,000 BTC.

Overall, the online promoting strain is marginal with Bitcoin price likely to keep trading in the range, until the FOMC or different financial occasions talked about earlier set off a selloff.

Related Articles

The introduced content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link